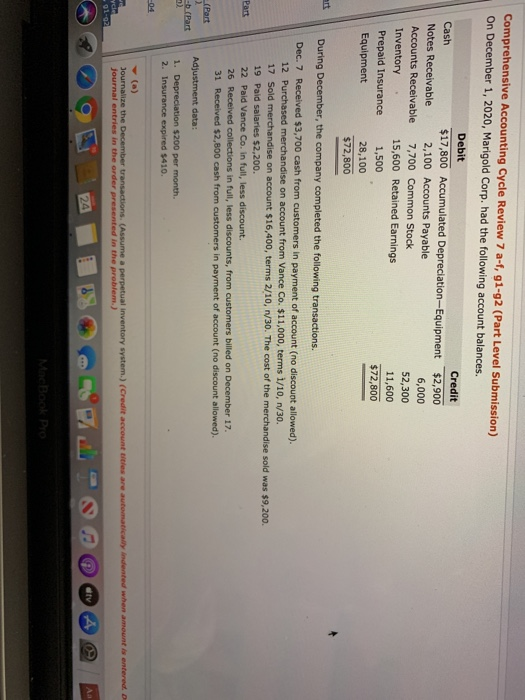

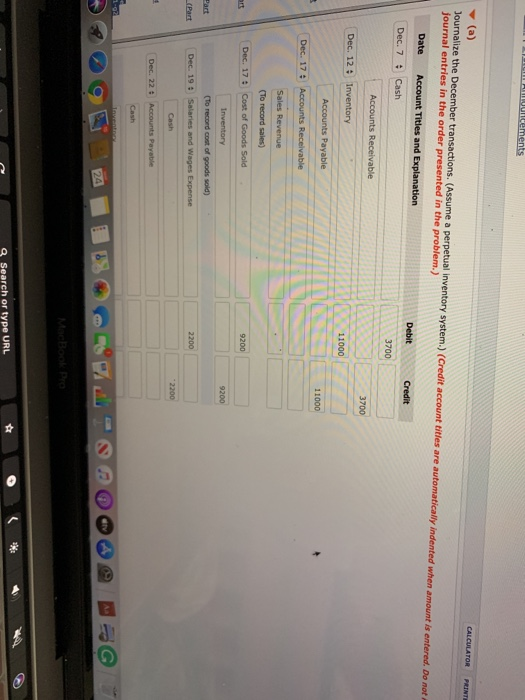

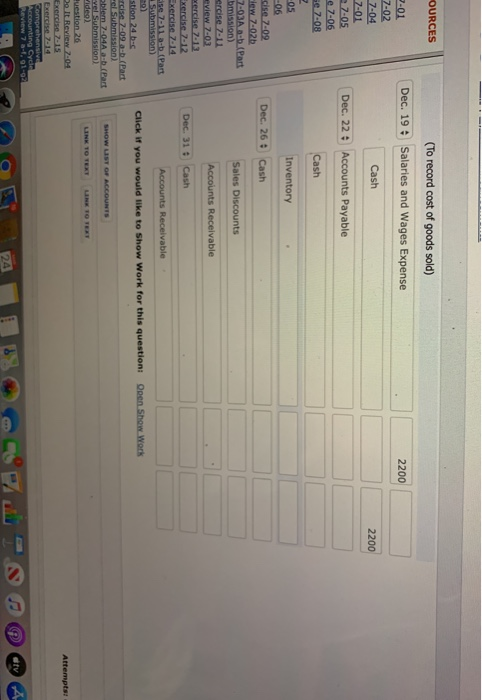

Comprehensive Accounting Cycle Review 7 a-f, 91-92 (Part Level Submission) On December 1, 2020, Marigold Corp. had the following account balances. Cash Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Debit $17,800 Accumulated Depreciation-Equipment 2,100 Accounts Payable 7,700 Common Stock 15,600 Retained Earnings 1,500 28,100 $72,800 Credit $2,900 6,000 52,300 11,600 $72,800 During December, the company completed the following transactions. Dec. 7 Received $3,700 cash from customers in payment of account (no discount allowed). 12 Purchased merchandise on account from Vance Co. $11,000, terms 1/10, 1/30. 17 Sold merchandise on account $16,400, terms 2/10, 1/30. The cost of the merchandise sold was $9,200. 19 Paid salaries $2,200. 22 Paid Vance Co. in full, less discount. 26 Received collections in full, less discounts, from customers billed on December 17. 31 Received $2,800 cash from customers in payment of account (no discount allowed). Part (Part Adjustment data: -b (Part 1. Depreciation $200 per month 2. Insurance expired $410. 28 Journalize the December transactions. (Assume a perpetual inventory system.) (Credit account titles are automatically journal entries in the order presented in the problem.) dented when amount is entered a - 01-02 A llements CALCULATOR PRINT (a) Journalize the December transactions. (Assume a perpetual inventory system.) (Credit account titles are automatically indented when amount is entered. Do not journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Dec. 7 : Cash 3700 Accounts Receivable 3700 Dec. 12 : Inventory Accounts Payable 11000 Dec. 17. Accounts Receivable Sales Revenue (To record sales) Dec. 17. Cost of Goods Sold Inventory (to record cost of goods sold) Dec. 19 Salaries and Wages Expense Dec. 22. Accounts Payable Tavanti MacBook Pro 9 Search or type URL OURCES (To record cost of goods sold) Dec. 19 : Salaries and Wages Expense 2200 Cash 2200 -01 7-02 7-04 7-01 7-05 e 7-06 se 7:08 Dec. 22 Accounts Payable Cash 05 Inventory Dec. 26 : Cash Sales Discounts cise 7:09 lew.7-02 7-03A 0-b_(Part mission) ercise 7-11 eview 7-03 exercise 7-13 Exercise 7-12 Exercise 7.14 se 7 .b (Part Accounts Receivable Dec. 31. Cash Accounts Receivable Click if you would like to Show Work for this questioni Open Show Work stion 24 b-C ise 7:09.a-b(Part wel submission blem 7.04A (Part vel Submission SHOW UST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Puestion 26 Do It Review 7:04 Exercise 2015 Exercise 2.14 Attempts! Accounting Cydel Review 7 -1.91-92