Question

Comprehensive Analysis for Deer and Co (One question with separate portions which need to be answered for the entire inferential analysis) What were dividends declared

Comprehensive Analysis for Deer and Co (One question with separate portions which need to be answered for the entire inferential analysis)

What were dividends declared by Deer and Co for the year ended December 31, 2021?

2. In December 2021, Deer and Co declared a bonus for its executives. This amount is an expense in 2021, even though it will not be paid until 2022. For tax purposes, however, the bonus will not be a tax deduction until it is paid. All deferred tax items at Deer and Co are recorded net, as part of deferred income taxes on the balance sheet. Taken in isolation, did the 2021 bonus increase, decrease, or have no impact on the deferred income taxes account on Deer and Cos December 31, 2021 balance sheet. Select the correct choice (can only be one choice).

Increase OR Neither OR Decrease

3. During the year ended December 31, 2021, Deer and Co repurchased treasury stock and then reissued some of those shares. Assume that Deer and Co reissued 3.6 million shares for a total of $223 in cash and recorded an economic loss of $68 on the issuance of these shares. [Note that both the $223 and the $68 are totals, in millions, NOT per share amounts].

a) How many shares of treasury stock did Deer and Co repurchase during the year ended December 31, 2021? [round your answer to the nearest hundred thousand shares]

b) What was the average price paid by Deer and Co for the shares repurchased during the year ended December 31, 2021? [give your answer to the nearest hundredth decimal place (nearest penny in USD) i.e., $4.86 per share, rather than $5 per share]

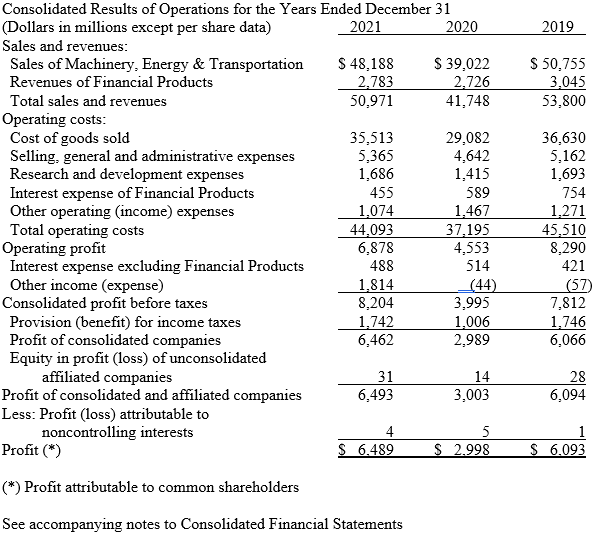

Income Statement

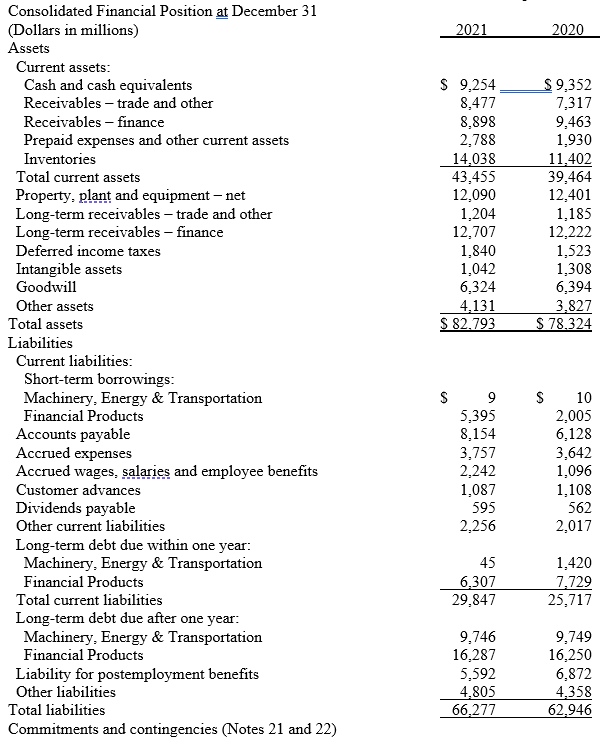

Balance Sheet

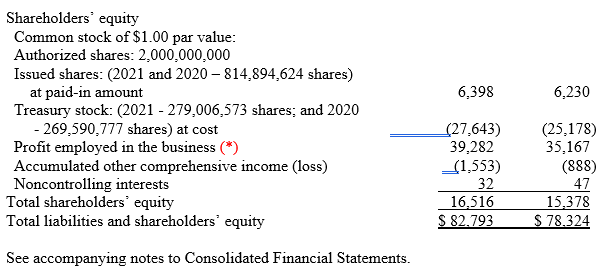

SE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started