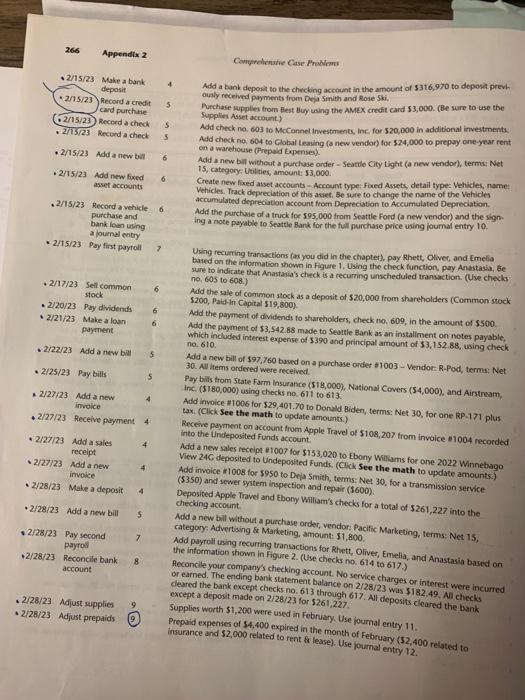

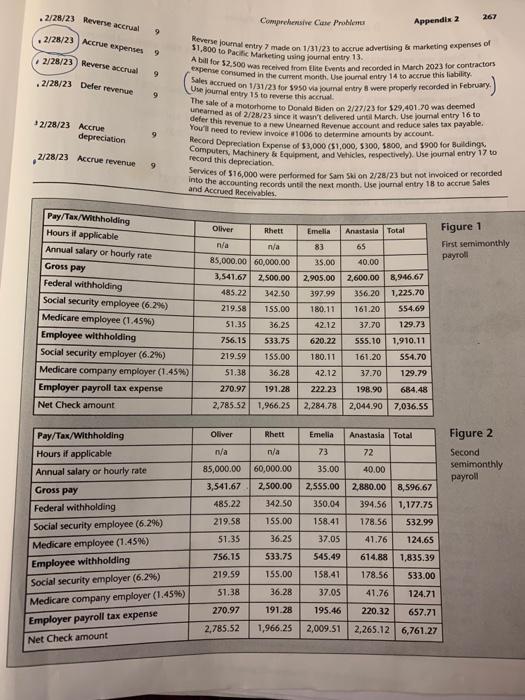

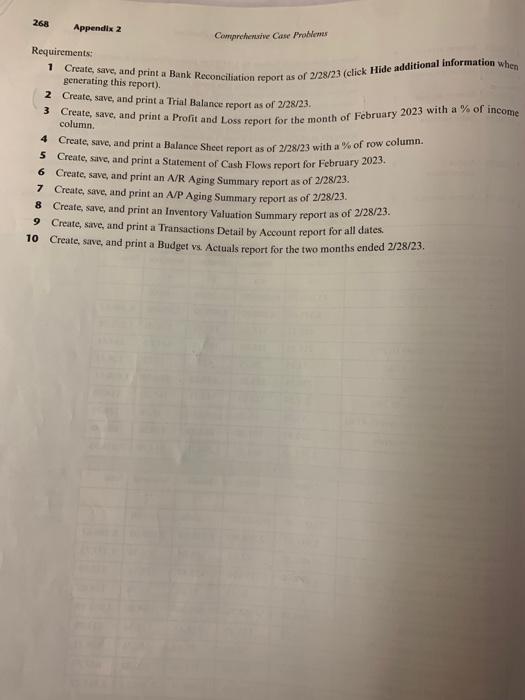

Comprehensive Case Problems Appendix 2267 - 2/28/23 Reverse accrual 9 Reverse journal entry 7 made on 1/31/23 to accrue advertising & marketing expenses of Case 6 Comprehensive prop cuse 6, which begins in Chapter 3, roblem sell new RVs and related accessories to is is ational Vehicle (RV) dealership in the state of Washington. They Business events in Case 6 occurred from to individuals and businesses. In addition, they repair and service RVs. description of business events that oceurred in the 1/31/23 when presented in Chapters 3 to 10 . The following is a Description of .2/2/23 Add new product 4 Add a new product - Name Description/hurchaing intormation: RP 171, intial quantity on hand; 0 , as of date: 2/2/23, inventory arset account: hivertory, 5017 , inicial 420,900 , cost \$21, 520, income account: Sales of Product licome, expense account Cost of .2/2/23 Change the Coods Sold, Sales lax category: Taxable - standard rate, Preferred vendor: R-Pod. name of a Productic product service. .2/2/23 Add a new 4 Add a new product-Name/Description/Punchacing informution: RP. 179, initial quantity on tand: 0, as of date: 2212123 , inventory asset account timentontory, Sales price: $22,800, Coods Sold, Sales tax category: Taxable - standard rate, Preferred vendor: R.Pod. .2/3/23 Add a new service , 2/3/23 Modify budget 8 Modity the following monthly bodgeted amounts (budget 1 ) for February 2023 as fol-, lowis sales of product income, 5400,000 , sales: 515,000 , cost of goods sold 5320,000 , advertising 8 marketing: $18,000, contractors: $3,000, insurance: $4,000, interest expense: 5600 , payrolt: $22,000, repairs: 1700 , utatities: $5,000, and depreciation: 51,200. Leave budgets for March through December as is. .2/3/23 Add a new 7 Add a new employee - Ansoassu Cuinn, 507N169 - St, Shoreline, WA 98133 , Social employee 2/3/23 Add a bill this month. W/4/23 Add a new 4 Add a new customer - Apple Trave, terms: Net 30. 2/6/23 Add a sales Add a new sales receiph 81003 - New cuatomer: Rose Ski, 241 St., Andrews Way, Santa receipt Maria, CA 93454, payment method; Check, relerence no.i 355, deporit to: Undepos receved: 5163,950 . - 5 2/7/23 Add a new Add a new purchuse order 11003 to purchase two RP- 171 and three RP- 179 trailes from - 2i7/23 Add a new 5 vendor R-Pod for a total cost of 597,760. , 2/8/23 Purchase order Add a new 5 Add a new purchase order 11004 to purchase fwo 2023 Thor Motor Cosch Palarro 33.2 ,2/8/23 Add a new s motoriomes from vendor Thor Motor Coakh for a total cost of 5288,000. purchase order Add a new invoice $1004 for 5108,207 - Customer: Apple Travel, terms: Net 30, prod, 2/8/23 Add a new 4 uct one 2023 Airstream flying Cloud 27FB TWIN. (Click See the math to update invoice almounts) 2 4 Add a new imwoice 31005 for 5700 - Customen Rose 5W, terms Net 30, service one . 2/10/23 Add a new 4 Basic 8,000 -mile service and five hours of Detailing. invoice Receve payment - Customer. Deja Smith, pyment method: Check, deposit to: Undepos- 2/13/23 Receive payment 4 ited funds, amount recehed 5153,020 (reated to invoice: 11002 ). , 2/14/23 Pay bills 5 Pay 5322,000 in bilis from Winnebago, Inc, and Pacific Marketing, using checks no. 601 Campirelenade Case Problems + 2/15/23 Add a new bill 6 . 6 on a warehouse (Prepaid Expenser). Adi a new ball witheut a purchase order - Seartle City Light (a new vendor), termis, Net 15, category: Utilities, amount: 53,000 . Create new fixed asset accounts - Account type: Fixed Assets, detail type: Vehicles, name: Vehicles. Track depreciation of this asiet, Se sure to change the name of the Vehicles accumulated depreciation account from Depreciation to Accumulated Depreciation. Add the purchuse of a truck for 595,000 from Seattle Ford (a new vendor) and the sign. ing a note payable to Seattle Bark for the full purchase price using joumal entry 10 . purchase and bank lown uning a jouenal entry - 2/15/23 Pay first payroll 7 Ushing recuring trancuctions (as you did in the chapter). pay Rhett, Oliver, and Emelia based on the information shown in figure 1. Uxing the check function, pary Anastasia, be rure to indirate that Anastania's check is a recuring unscheduled transaction. (Uve checks no, 605 to 608 .) - 2/17/23 Seil common stock - 2220/23 Pay dividends 6 \$5200, Paid-In Capital 519,800 ). - 2/21/23 Male a loun 6 Add the payment of dividends to shareholders, check no. 609 , in the arnount of 5500 . payment Add the payment of 53,542.88 made to Sealtle Blank as an instaliment on notes payable, which included interest experise of 5390 and principal amount of 53,152.88, using check no. 610. Add a new bill of 597,760 buned on a purchase order $1003 - Vendor R-Pod, terma; Net 30. All items ordered were received. Pay bifis trom 5 tate Farm Insurance (518,000), National Covers (54,000), and Airatream, Inc. ( ($180,000) using checks no. 611 to 613 . Add invoice 11006 for $29,401.70 to Donald Biden, terms: Net 30 , for one RP.171 plus tax. (Click See the math to update amounts.) Receive payment on account from Apple Travel of 5108,207 from invoice 81004 recorded into the Undeposited Funds account. Add a new sales receipe 81007 for 5153,020 to Ebony Willams for one 2022 Winnebago View 24C deposited to Undeposited Funds, (Click 5 ee the math to update amounts.) Add invoice in 1008 for 5950 to Deia Smith, tems: Net 30 , for a transmission service: ($350) and sewer system inspection and repair (5600). Deposited Apple Travel and fbony William's checks for a total of $261,227 into the checking account. Add a new bill without a purchase order, vendor: Pacific Marketing, terms: Net 15, category: Advertising of Marketing, amount: $1,800. Add payroll using recurning transactions for Rhett, Oliver, Emelia, and Anastasia based on the information shown in Figure 2. (Use checks no. 614 to 617. ) Aeconcile your company's checking account. No service charges or interest were incurred or earned. The ending bank statement balance on 2/28/23 was $182,49. Al checks ceered the bank except checks no. 613 through 617 . All deposits cleared the bank Prepaid expenses of $4,400 expired in the month of February ($2,400 related to Comprehensive Cane Prokieru Appendix 2.267 . 2/28/23. Accrue expenses 9 \$ 9 , 800 to Pacific Marheting using fournal entry 13. unearned as of 2/28/23 aince if wasn? delivered unsil March, Use joumal entry 16 to defer this fevenue to a new. Unearned Revenue account and reduce sales tax payable. 12/28/23 Accrue depreciation. Pecord Depreciation Expense of $3,000(51,000,5300,5800, and $900 for Buldingr, Computers, Machinery Er Equipment, and Vehicles, respectively). Use journal entry 17 to 2/28/23 Accrue revente 9 record this depreciation. Services of 516,000 were performed for 5am5ki an 2/28/23 but not irrvoiced or recorded into the accounting records unt the next month. Use journal entry 18 to accrue Sales and Accrucd Receivables. Appendix 2 Comprehenvive Case Problews Requirements: 1 Create, save, and print a Bank Reconciliation report as of 2/28/23(clickHideadditionalinformationw generating this report). 2 Create, save, and print a Trial Balance report as of 2/28/23. 4 Create, save, and print a Balance Sheet report as of 2/28/23 with a % of row column. 5 Create, save, and print a Statement of Cash Flows report for February 2023. 6 Create, save, and print an A/R Aging Summary report as of 2/28/23. 7 Create, sive, and print an A/P Aging Summary report as of 2/28/23. 8 Create, save, and print an Inventory Valuation Summary report as of 2/28/23. 9 Create, sitve, and print a Transactions Detail by Account report for all dates. 10 Create, sive, and print a Budget vs Actuals report for the two months ended 2/28/23. Comprehensive Case Problems Appendix 2267 - 2/28/23 Reverse accrual 9 Reverse journal entry 7 made on 1/31/23 to accrue advertising & marketing expenses of Case 6 Comprehensive prop cuse 6, which begins in Chapter 3, roblem sell new RVs and related accessories to is is ational Vehicle (RV) dealership in the state of Washington. They Business events in Case 6 occurred from to individuals and businesses. In addition, they repair and service RVs. description of business events that oceurred in the 1/31/23 when presented in Chapters 3 to 10 . The following is a Description of .2/2/23 Add new product 4 Add a new product - Name Description/hurchaing intormation: RP 171, intial quantity on hand; 0 , as of date: 2/2/23, inventory arset account: hivertory, 5017 , inicial 420,900 , cost \$21, 520, income account: Sales of Product licome, expense account Cost of .2/2/23 Change the Coods Sold, Sales lax category: Taxable - standard rate, Preferred vendor: R-Pod. name of a Productic product service. .2/2/23 Add a new 4 Add a new product-Name/Description/Punchacing informution: RP. 179, initial quantity on tand: 0, as of date: 2212123 , inventory asset account timentontory, Sales price: $22,800, Coods Sold, Sales tax category: Taxable - standard rate, Preferred vendor: R.Pod. .2/3/23 Add a new service , 2/3/23 Modify budget 8 Modity the following monthly bodgeted amounts (budget 1 ) for February 2023 as fol-, lowis sales of product income, 5400,000 , sales: 515,000 , cost of goods sold 5320,000 , advertising 8 marketing: $18,000, contractors: $3,000, insurance: $4,000, interest expense: 5600 , payrolt: $22,000, repairs: 1700 , utatities: $5,000, and depreciation: 51,200. Leave budgets for March through December as is. .2/3/23 Add a new 7 Add a new employee - Ansoassu Cuinn, 507N169 - St, Shoreline, WA 98133 , Social employee 2/3/23 Add a bill this month. W/4/23 Add a new 4 Add a new customer - Apple Trave, terms: Net 30. 2/6/23 Add a sales Add a new sales receiph 81003 - New cuatomer: Rose Ski, 241 St., Andrews Way, Santa receipt Maria, CA 93454, payment method; Check, relerence no.i 355, deporit to: Undepos receved: 5163,950 . - 5 2/7/23 Add a new Add a new purchuse order 11003 to purchase two RP- 171 and three RP- 179 trailes from - 2i7/23 Add a new 5 vendor R-Pod for a total cost of 597,760. , 2/8/23 Purchase order Add a new 5 Add a new purchase order 11004 to purchase fwo 2023 Thor Motor Cosch Palarro 33.2 ,2/8/23 Add a new s motoriomes from vendor Thor Motor Coakh for a total cost of 5288,000. purchase order Add a new invoice $1004 for 5108,207 - Customer: Apple Travel, terms: Net 30, prod, 2/8/23 Add a new 4 uct one 2023 Airstream flying Cloud 27FB TWIN. (Click See the math to update invoice almounts) 2 4 Add a new imwoice 31005 for 5700 - Customen Rose 5W, terms Net 30, service one . 2/10/23 Add a new 4 Basic 8,000 -mile service and five hours of Detailing. invoice Receve payment - Customer. Deja Smith, pyment method: Check, deposit to: Undepos- 2/13/23 Receive payment 4 ited funds, amount recehed 5153,020 (reated to invoice: 11002 ). , 2/14/23 Pay bills 5 Pay 5322,000 in bilis from Winnebago, Inc, and Pacific Marketing, using checks no. 601 Campirelenade Case Problems + 2/15/23 Add a new bill 6 . 6 on a warehouse (Prepaid Expenser). Adi a new ball witheut a purchase order - Seartle City Light (a new vendor), termis, Net 15, category: Utilities, amount: 53,000 . Create new fixed asset accounts - Account type: Fixed Assets, detail type: Vehicles, name: Vehicles. Track depreciation of this asiet, Se sure to change the name of the Vehicles accumulated depreciation account from Depreciation to Accumulated Depreciation. Add the purchuse of a truck for 595,000 from Seattle Ford (a new vendor) and the sign. ing a note payable to Seattle Bark for the full purchase price using joumal entry 10 . purchase and bank lown uning a jouenal entry - 2/15/23 Pay first payroll 7 Ushing recuring trancuctions (as you did in the chapter). pay Rhett, Oliver, and Emelia based on the information shown in figure 1. Uxing the check function, pary Anastasia, be rure to indirate that Anastania's check is a recuring unscheduled transaction. (Uve checks no, 605 to 608 .) - 2/17/23 Seil common stock - 2220/23 Pay dividends 6 \$5200, Paid-In Capital 519,800 ). - 2/21/23 Male a loun 6 Add the payment of dividends to shareholders, check no. 609 , in the arnount of 5500 . payment Add the payment of 53,542.88 made to Sealtle Blank as an instaliment on notes payable, which included interest experise of 5390 and principal amount of 53,152.88, using check no. 610. Add a new bill of 597,760 buned on a purchase order $1003 - Vendor R-Pod, terma; Net 30. All items ordered were received. Pay bifis trom 5 tate Farm Insurance (518,000), National Covers (54,000), and Airatream, Inc. ( ($180,000) using checks no. 611 to 613 . Add invoice 11006 for $29,401.70 to Donald Biden, terms: Net 30 , for one RP.171 plus tax. (Click See the math to update amounts.) Receive payment on account from Apple Travel of 5108,207 from invoice 81004 recorded into the Undeposited Funds account. Add a new sales receipe 81007 for 5153,020 to Ebony Willams for one 2022 Winnebago View 24C deposited to Undeposited Funds, (Click 5 ee the math to update amounts.) Add invoice in 1008 for 5950 to Deia Smith, tems: Net 30 , for a transmission service: ($350) and sewer system inspection and repair (5600). Deposited Apple Travel and fbony William's checks for a total of $261,227 into the checking account. Add a new bill without a purchase order, vendor: Pacific Marketing, terms: Net 15, category: Advertising of Marketing, amount: $1,800. Add payroll using recurning transactions for Rhett, Oliver, Emelia, and Anastasia based on the information shown in Figure 2. (Use checks no. 614 to 617. ) Aeconcile your company's checking account. No service charges or interest were incurred or earned. The ending bank statement balance on 2/28/23 was $182,49. Al checks ceered the bank except checks no. 613 through 617 . All deposits cleared the bank Prepaid expenses of $4,400 expired in the month of February ($2,400 related to Comprehensive Cane Prokieru Appendix 2.267 . 2/28/23. Accrue expenses 9 \$ 9 , 800 to Pacific Marheting using fournal entry 13. unearned as of 2/28/23 aince if wasn? delivered unsil March, Use joumal entry 16 to defer this fevenue to a new. Unearned Revenue account and reduce sales tax payable. 12/28/23 Accrue depreciation. Pecord Depreciation Expense of $3,000(51,000,5300,5800, and $900 for Buldingr, Computers, Machinery Er Equipment, and Vehicles, respectively). Use journal entry 17 to 2/28/23 Accrue revente 9 record this depreciation. Services of 516,000 were performed for 5am5ki an 2/28/23 but not irrvoiced or recorded into the accounting records unt the next month. Use journal entry 18 to accrue Sales and Accrucd Receivables. Appendix 2 Comprehenvive Case Problews Requirements: 1 Create, save, and print a Bank Reconciliation report as of 2/28/23(clickHideadditionalinformationw generating this report). 2 Create, save, and print a Trial Balance report as of 2/28/23. 4 Create, save, and print a Balance Sheet report as of 2/28/23 with a % of row column. 5 Create, save, and print a Statement of Cash Flows report for February 2023. 6 Create, save, and print an A/R Aging Summary report as of 2/28/23. 7 Create, sive, and print an A/P Aging Summary report as of 2/28/23. 8 Create, save, and print an Inventory Valuation Summary report as of 2/28/23. 9 Create, sitve, and print a Transactions Detail by Account report for all dates. 10 Create, sive, and print a Budget vs Actuals report for the two months ended 2/28/23