Question: COMPREHENSIVE CASE STUDY - 2021-2022 You are required to prepare personal income tax returns using a tax software as part of the evaluation components for

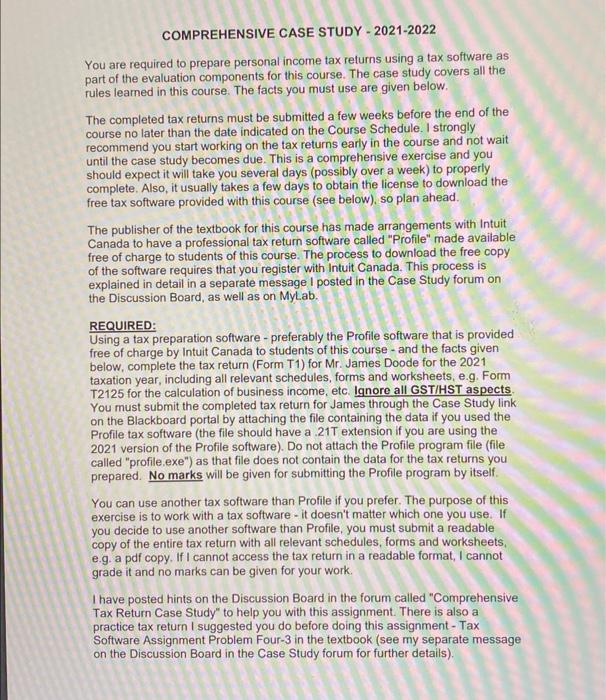

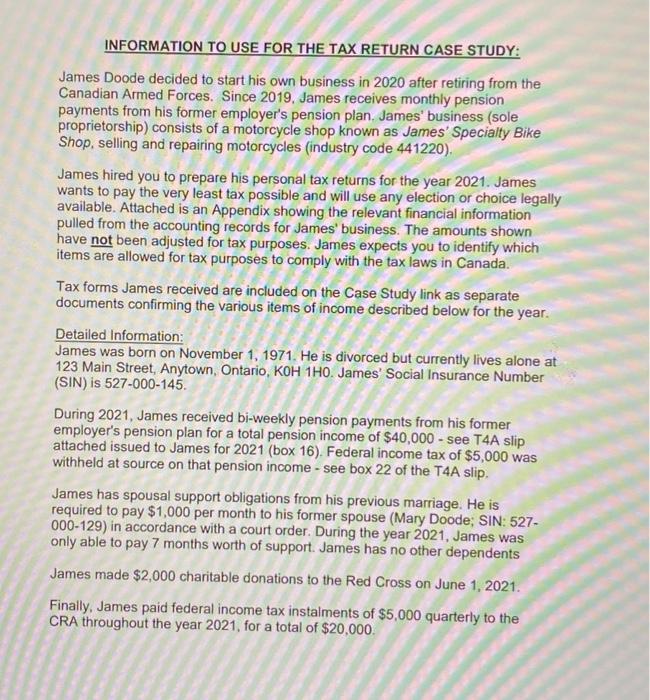

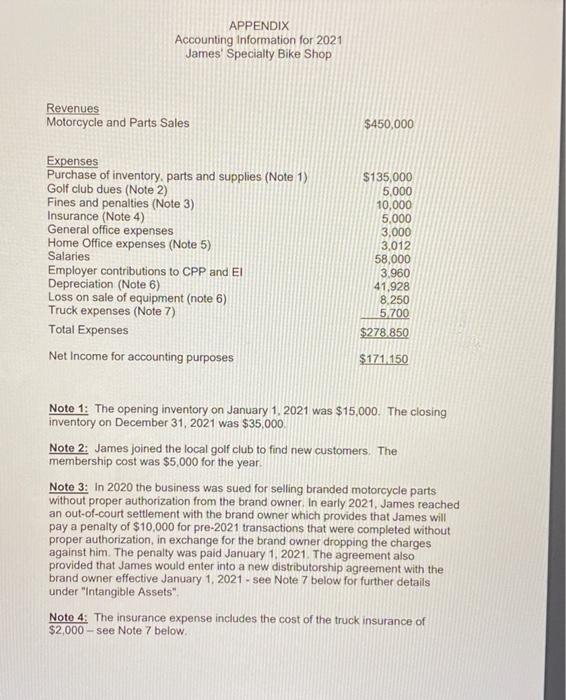

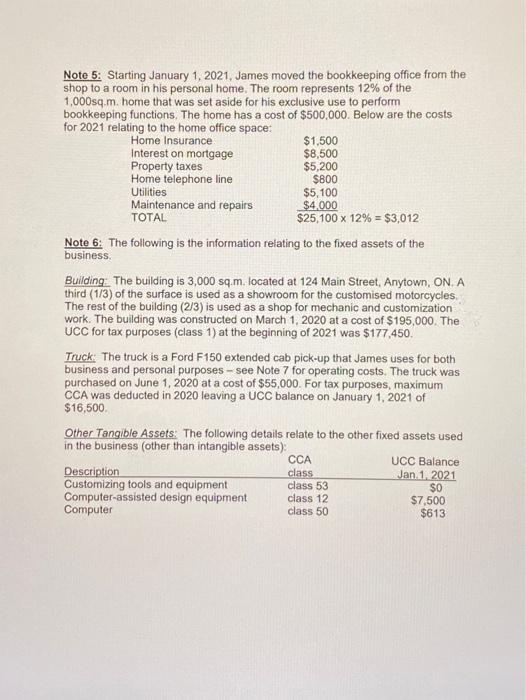

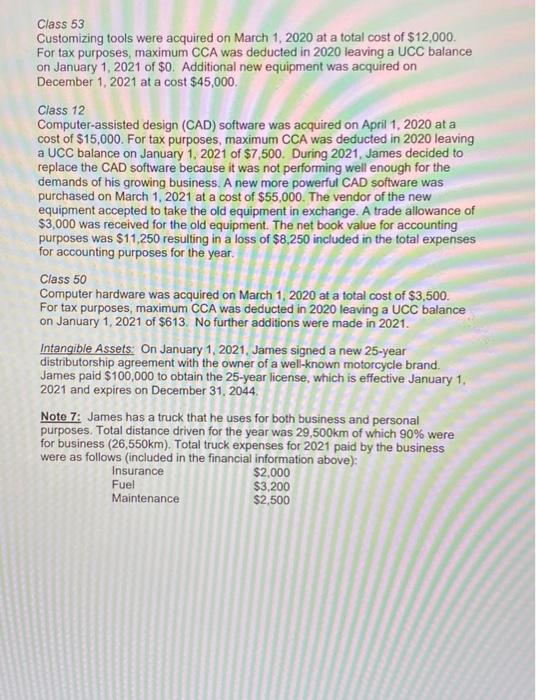

COMPREHENSIVE CASE STUDY - 2021-2022 You are required to prepare personal income tax returns using a tax software as part of the evaluation components for this course. The case study covers all the rules learned in this course. The facts you must use are given below. The completed tax returns must be submitted a few weeks before the end of the course no later than the date indicated on the Course Schedule. I strongly recommend you start working on the tax returns early in the course and not wait until the case study becomes due. This is a comprehensive exercise and you should expect it will take you several days (possibly over a week) to properly complete. Also, it usually takes a few days to obtain the license to downioad the free tax software provided with this course (see below), so plan ahead. The publisher of the textbook for this course has made arrangements with Intuit Canada to have a professional tax return software called "Profile" made available free of charge to students of this course. The process to download the free copy of the software requires that you register with Intuit Canada. This process is explained in detail in a separate message I posted in the Case Study forum on the Discussion Board, as well as on MyLab. REQUIRED: Using a tax preparation software - preferably the Profile software that is provided free of charge by Intuit Canada to students of this course - and the facts given below, complete the tax return (Form T1) for Mr. James Doode for the 2021 taxation year, including all relevant schedules, forms and worksheets, e.g. Form T2125 for the calculation of business income, etc. Ignore all GST/HST aspects. You must submit the completed tax return for James through the Case Study link on the Blackboard portal by attaching the file containing the data if you used the Profile tax software (the file should have a .21T extension if you are using the 2021 version of the Profile software). Do not attach the Profile program file (file called "profile.exe") as that file does not contain the data for the tax returns you prepared. No marks will be given for submitting the Profile program by itself. You can use another tax software than Profile if you prefer. The purpose of this exercise is to work with a tax software - it doesn't matter which one you use. If you decide to use another software than Profile, you must submit a readable copy of the entire tax return with all relevant schedules, forms and worksheets, e.g. a pdf copy. If I cannot access the tax return in a readable format, I cannot grade it and no marks can be given for your work. I have posted hints on the Discussion Board in the forum called "Comprehensive Tax Return Case Study" to help you with this assignment. There is also a practice tax return I suggested you do before doing this assignment - Tax Software Assignment Problem Four-3 in the textbook (see my separate message on the Discussion Board in the Case Study forum for further details). INFORMATION TO USE FOR THE TAX RETURN CASE STUDY: James Doode decided to start his own business in 2020 after retiring from the Canadian Armed Forces. Since 2019, James receives monthly pension payments from his former employer's pension plan. James' business (sole proprietorship) consists of a motorcycle shop known as James' Specialty Bike Shop, selling and repairing motorcycles (industry code 441220). James hired you to prepare his personal tax returns for the year 2021. James wants to pay the very least tax possible and will use any election or choice legally available. Attached is an Appendix showing the relevant financial information pulled from the accounting records for James' business. The amounts shown have not been adjusted for tax purposes. James expects you to identify which items are allowed for tax purposes to comply with the tax laws in Canada. Tax forms James received are included on the Case Study link as separate documents confirming the various items of income described below for the year. Detailed Information: James was born on November 1, 1971. He is divorced but currently lives alone at 123 Main Street, Anytown, Ontario, KOH1HO. James' Social Insurance Number (SIN) is 527-000-145. During 2021, James received bi-weekly pension payments from his former employer's pension plan for a total pension income of $40,000 - see T4A slip attached issued to James for 2021 (box 16). Federal income tax of $5,000 was withheld at source on that pension income - see box 22 of the T4A slip. James has spousal support obligations from his previous marriage. He is required to pay $1,000 per month to his former spouse (Mary Doode; SIN: 527000-129) in accordance with a court order. During the year 2021, James was only able to pay 7 months worth of support. James has no other dependents James made $2,000 charitable donations to the Red Cross on June 1, 2021. Finally, James paid federal income tax instalments of $5,000 quarterly to the CRA throughout the year 2021 , for a total of $20,000. APPENDIX Accounting information for 2021 James' Specialty Bike Shop Note 1: The opening inventory on January 1,2021 was $15,000. The ciosing inventory on December 31,2021 was $35,000. Note 2: James joined the local golf club to find new customers. The membership cost was $5,000 for the year. Note 3: In 2020 the business was sued for selling branded motorcycle parts without proper authorization from the brand owner. In early 2021, James reached an out-of-court settlement with the brand owner which provides that James will pay a penalty of $10,000 for pre-2021 transactions that were completed without proper authorization, in exchange for the brand owner dropping the charges against him. The penalty was paid January 1. 2021. The agreement also provided that James would enter into a new distributorship agreement with the brand owner effective January 1, 2021 - see Note 7 below for further details under "intangible Assets" Note 4: The insurance expense includes the cost of the truck insurance of $2,000 - see Note 7 below. Note 5: Starting January 1, 2021, James moved the bookkeeping office from the shop to a room in his personal home. The room represents 12% of the 1,000 sq.m. home that was set aside for his exclusive use to perform bookkeeping functions. The home has a cost of $500,000. Below are the costs for 2021 relating to the home office space: Note 6: The following is the information relating to the fixed assets of the business. Building: The building is 3,000sq.m. located at 124 Main Street, Anytown, ON, A third (1/3) of the surface is used as a showroom for the customised motorcycles. The rest of the building (2/3) is used as a shop for mechanic and customization work. The building was constructed on March 1, 2020 at a cost of $195,000. The UCC for tax purposes (class 1) at the beginning of 2021 was $177,450. Truck: The truck is a Ford F150 extended cab pick-up that James uses for both business and personal purposes - see Note 7 for operating costs. The truck was purchased on June 1, 2020 at a cost of $55,000. For tax purposes, maximum CCA was deducted in 2020 leaving a UCC balance on January 1, 2021 of $16,500. Other Tangible Assets: The following details relate to the other fixed assets used in the business (other than intangible assets): Class 53 Customizing tools were acquired on March 1, 2020 at a total cost of $12,000. For tax purposes, maximum CCA was deducted in 2020 leaving a UCC balance on January 1,2021 of $0. Additional new equipment was acquired on December 1,2021 at a cost $45,000. Class 12 Computer-assisted design (CAD) software was acquired on April 1, 2020 at a cost of $15,000. For tax purposes, maximum CCA was deducted in 2020 leaving a UCC balance on January 1, 2021 of $7,500. During 2021, James decided to replace the CAD software because it was not performing well enough for the demands of his growing business. A new more powerful CAD software was purchased on March 1, 2021 at a cost of $55,000. The vendor of the new equipment accepted to take the old equipment in exchange. A trade allowance of $3,000 was received for the old equipment. The net book value for accounting purposes was $11,250 resulting in a loss of $8,250 included in the total expenses for accounting purposes for the year. Class 50 Computer hardware was acquired on March 1,2020 at a total cost of $3,500. For tax purposes, maximum CCA was deducted in 2020 leaving a UCC balance on January 1, 2021 of $613. No further additions were made in 2021. Intangible Assets: On January 1, 2021, James signed a new 25-year distributorship agreement with the owner of a well-known motorcycle brand. James paid $100,000 to obtain the 25-year license, which is effective January 1 . 2021 and expires on December 31,2044. Note 7: James has a truck that he uses for both business and personal purposes. Total distance driven for the year was 29,500km of which 90% were for business (26,550km). Total truck expenses for 2021 paid by the business were as follows (included in the financial information above): COMPREHENSIVE CASE STUDY - 2021-2022 You are required to prepare personal income tax returns using a tax software as part of the evaluation components for this course. The case study covers all the rules learned in this course. The facts you must use are given below. The completed tax returns must be submitted a few weeks before the end of the course no later than the date indicated on the Course Schedule. I strongly recommend you start working on the tax returns early in the course and not wait until the case study becomes due. This is a comprehensive exercise and you should expect it will take you several days (possibly over a week) to properly complete. Also, it usually takes a few days to obtain the license to downioad the free tax software provided with this course (see below), so plan ahead. The publisher of the textbook for this course has made arrangements with Intuit Canada to have a professional tax return software called "Profile" made available free of charge to students of this course. The process to download the free copy of the software requires that you register with Intuit Canada. This process is explained in detail in a separate message I posted in the Case Study forum on the Discussion Board, as well as on MyLab. REQUIRED: Using a tax preparation software - preferably the Profile software that is provided free of charge by Intuit Canada to students of this course - and the facts given below, complete the tax return (Form T1) for Mr. James Doode for the 2021 taxation year, including all relevant schedules, forms and worksheets, e.g. Form T2125 for the calculation of business income, etc. Ignore all GST/HST aspects. You must submit the completed tax return for James through the Case Study link on the Blackboard portal by attaching the file containing the data if you used the Profile tax software (the file should have a .21T extension if you are using the 2021 version of the Profile software). Do not attach the Profile program file (file called "profile.exe") as that file does not contain the data for the tax returns you prepared. No marks will be given for submitting the Profile program by itself. You can use another tax software than Profile if you prefer. The purpose of this exercise is to work with a tax software - it doesn't matter which one you use. If you decide to use another software than Profile, you must submit a readable copy of the entire tax return with all relevant schedules, forms and worksheets, e.g. a pdf copy. If I cannot access the tax return in a readable format, I cannot grade it and no marks can be given for your work. I have posted hints on the Discussion Board in the forum called "Comprehensive Tax Return Case Study" to help you with this assignment. There is also a practice tax return I suggested you do before doing this assignment - Tax Software Assignment Problem Four-3 in the textbook (see my separate message on the Discussion Board in the Case Study forum for further details). INFORMATION TO USE FOR THE TAX RETURN CASE STUDY: James Doode decided to start his own business in 2020 after retiring from the Canadian Armed Forces. Since 2019, James receives monthly pension payments from his former employer's pension plan. James' business (sole proprietorship) consists of a motorcycle shop known as James' Specialty Bike Shop, selling and repairing motorcycles (industry code 441220). James hired you to prepare his personal tax returns for the year 2021. James wants to pay the very least tax possible and will use any election or choice legally available. Attached is an Appendix showing the relevant financial information pulled from the accounting records for James' business. The amounts shown have not been adjusted for tax purposes. James expects you to identify which items are allowed for tax purposes to comply with the tax laws in Canada. Tax forms James received are included on the Case Study link as separate documents confirming the various items of income described below for the year. Detailed Information: James was born on November 1, 1971. He is divorced but currently lives alone at 123 Main Street, Anytown, Ontario, KOH1HO. James' Social Insurance Number (SIN) is 527-000-145. During 2021, James received bi-weekly pension payments from his former employer's pension plan for a total pension income of $40,000 - see T4A slip attached issued to James for 2021 (box 16). Federal income tax of $5,000 was withheld at source on that pension income - see box 22 of the T4A slip. James has spousal support obligations from his previous marriage. He is required to pay $1,000 per month to his former spouse (Mary Doode; SIN: 527000-129) in accordance with a court order. During the year 2021, James was only able to pay 7 months worth of support. James has no other dependents James made $2,000 charitable donations to the Red Cross on June 1, 2021. Finally, James paid federal income tax instalments of $5,000 quarterly to the CRA throughout the year 2021 , for a total of $20,000. APPENDIX Accounting information for 2021 James' Specialty Bike Shop Note 1: The opening inventory on January 1,2021 was $15,000. The ciosing inventory on December 31,2021 was $35,000. Note 2: James joined the local golf club to find new customers. The membership cost was $5,000 for the year. Note 3: In 2020 the business was sued for selling branded motorcycle parts without proper authorization from the brand owner. In early 2021, James reached an out-of-court settlement with the brand owner which provides that James will pay a penalty of $10,000 for pre-2021 transactions that were completed without proper authorization, in exchange for the brand owner dropping the charges against him. The penalty was paid January 1. 2021. The agreement also provided that James would enter into a new distributorship agreement with the brand owner effective January 1, 2021 - see Note 7 below for further details under "intangible Assets" Note 4: The insurance expense includes the cost of the truck insurance of $2,000 - see Note 7 below. Note 5: Starting January 1, 2021, James moved the bookkeeping office from the shop to a room in his personal home. The room represents 12% of the 1,000 sq.m. home that was set aside for his exclusive use to perform bookkeeping functions. The home has a cost of $500,000. Below are the costs for 2021 relating to the home office space: Note 6: The following is the information relating to the fixed assets of the business. Building: The building is 3,000sq.m. located at 124 Main Street, Anytown, ON, A third (1/3) of the surface is used as a showroom for the customised motorcycles. The rest of the building (2/3) is used as a shop for mechanic and customization work. The building was constructed on March 1, 2020 at a cost of $195,000. The UCC for tax purposes (class 1) at the beginning of 2021 was $177,450. Truck: The truck is a Ford F150 extended cab pick-up that James uses for both business and personal purposes - see Note 7 for operating costs. The truck was purchased on June 1, 2020 at a cost of $55,000. For tax purposes, maximum CCA was deducted in 2020 leaving a UCC balance on January 1, 2021 of $16,500. Other Tangible Assets: The following details relate to the other fixed assets used in the business (other than intangible assets): Class 53 Customizing tools were acquired on March 1, 2020 at a total cost of $12,000. For tax purposes, maximum CCA was deducted in 2020 leaving a UCC balance on January 1,2021 of $0. Additional new equipment was acquired on December 1,2021 at a cost $45,000. Class 12 Computer-assisted design (CAD) software was acquired on April 1, 2020 at a cost of $15,000. For tax purposes, maximum CCA was deducted in 2020 leaving a UCC balance on January 1, 2021 of $7,500. During 2021, James decided to replace the CAD software because it was not performing well enough for the demands of his growing business. A new more powerful CAD software was purchased on March 1, 2021 at a cost of $55,000. The vendor of the new equipment accepted to take the old equipment in exchange. A trade allowance of $3,000 was received for the old equipment. The net book value for accounting purposes was $11,250 resulting in a loss of $8,250 included in the total expenses for accounting purposes for the year. Class 50 Computer hardware was acquired on March 1,2020 at a total cost of $3,500. For tax purposes, maximum CCA was deducted in 2020 leaving a UCC balance on January 1, 2021 of $613. No further additions were made in 2021. Intangible Assets: On January 1, 2021, James signed a new 25-year distributorship agreement with the owner of a well-known motorcycle brand. James paid $100,000 to obtain the 25-year license, which is effective January 1 . 2021 and expires on December 31,2044. Note 7: James has a truck that he uses for both business and personal purposes. Total distance driven for the year was 29,500km of which 90% were for business (26,550km). Total truck expenses for 2021 paid by the business were as follows (included in the financial information above)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts