Question

Comprehensive income for the fiscal year ended May 26, 2019, includes a loss of $82.8 million related to foreign currency translation. Explain what this loss

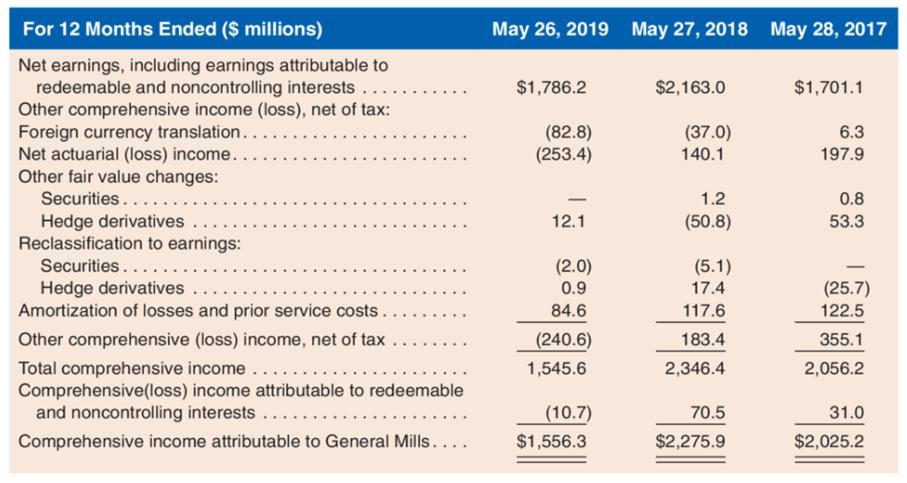

Comprehensive income for the fiscal year ended May 26, 2019, includes a loss of $82.8 million related to foreign currency translation. Explain what this loss means.

On average, did the U.S. dollar weaken or strengthen vis-à-vis the currencies of the companies’ foreign subsidiaries?

What was the cash portion of the foreign currency translation loss in the fiscal year 2019?

Comprehensive income for the fiscal year ended May 26, 2019, includes a gain of $12.1 million related to hedge derivatives. Is this a fair value or a cash flow hedge?

Provide four examples of hedging transactions General Mills might engage in.

How did the cash flow hedges affect net income during the fiscal year ended May 26, 2019?

For 12 Months Ended ($ millions) Net earnings, including earnings attributable to redeemable and noncontrolling interests ... Other comprehensive income (loss), net of tax: Foreign currency translation.... Net actuarial (loss) income.. Other fair value changes: Securities .... Hedge derivatives... Reclassification to earnings: Securities .... Hedge derivatives... Amortization of losses and prior service costs... Other comprehensive (loss) income, net of tax... Total comprehensive income .... Comprehensive(loss) income attributable to redeemable and noncontrolling interests .... Comprehensive income attributable to General Mills.... ..... May 26, 2019 May 27, 2018 May 28, 2017 $1,786.2 (82.8) (253.4) 12.1 (2.0) 0.9 84.6 (240.6) 1,545.6 (10.7) $1,556.3 $2,163.0 (37.0) 140.1 1.2 (50.8) (5.1) 17.4 117.6 183.4 2,346.4 70.5 $2,275.9 $1,701.1 6.3 197.9 0.8 53.3 (25.7) 122.5 355.1 2,056.2 31.0 $2,025.2

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started