Question

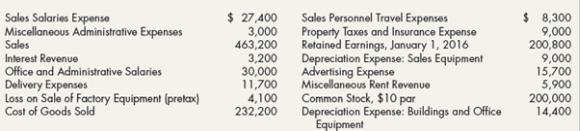

Comprehensive: Income Statement and Retained Earnings Milwaukee Manufacturing Company presents the following partial list of account balances, after adjustments, as of December 31, 2019: The

Comprehensive: Income Statement and Retained Earnings Milwaukee Manufacturing Company presents the following partial list of account balances, after adjustments, as of December 31, 2019:

The following information is also available but is not reflected in the preceding accounts:

a. The company sold Division E (a major component of the company) on August 2, 2019. During 2019, Division E had incurred a pretax loss from operations of $16,000. However, because the acquiring company could vertically integrate Division E into its facilities, Milwaukee Manufacturing was able to recognize a $42,000 pretax gain on the sale.

b. On January 2, 2019, without warning, a foreign country expropriated a factory of Milwaukee Manufacturing which had been operating in that country. As a result of that expropriation, the company has incurred a pretax loss of $30,000.

c. The common stock was outstanding for the entire year. A cash dividend of $1.20 per share was declared and paid in 2019.

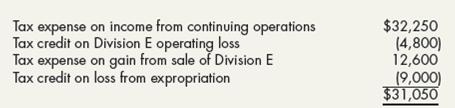

d. The 2019 income tax expense totals $31,050 and consists of the following:

Required:

1. As supporting documents for Requirement 2, prepare separate supporting schedules for selling expenses and for general and administrative expenses (include depreciation expense where applicable in these schedules).

2. Prepare a 2019 multiple-step income statement for Milwaukee Manufacturing.

3. Prepare a 2019 retained earnings statement.

4. Next Level What was Milwaukee Manufacturing’s return on common equity for 2019 if its average shareholders’ equity during 2019 was $500,000? What is your evaluation of this return on common equity if its “target” for 2019 was 15%?

5. Next Level Discuss how Milwaukee Manufacturing’s income statement in Requirement 2 might be different if it used IFRS.

Salos Salaries Expense Miscellaneous Administrative Expenses Sales Interest Revenue Office and Administrative Salaries Delivery Expenses Loss on Sale of Factory Equipment (pretax) Cost of Goods Sold $ 27,400 3,000 463,200 3,200 30,000 11,700 4,100 232,200 Sales Personnel Travel Expenses Property Taxes and Insurance Expense Retained Earnings, January 1, 2016 Depreciation Expense: Sales Equipment Advertising Expense Miscellaneous Rent Revenue $ ,300 9,000 200,800 9,000 15,700 5,900 200,000 14,400 Common Stock, $10 par Depreciation Expense: Buildings and Office Equipment

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 11 1 Make schedules showing selling expenses general and administrative expenses including depreciation expenses Selling expenses administrative expenses and depreciation expenses are calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started