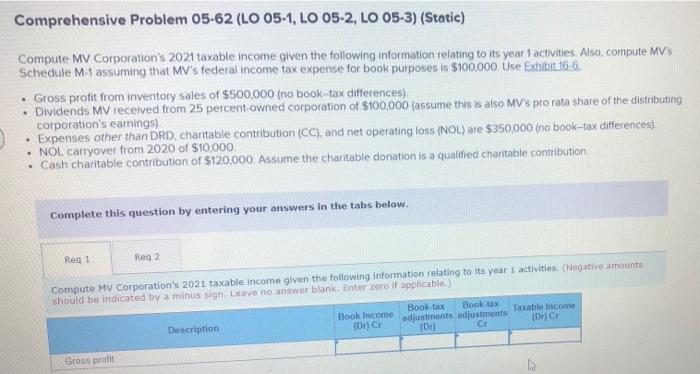

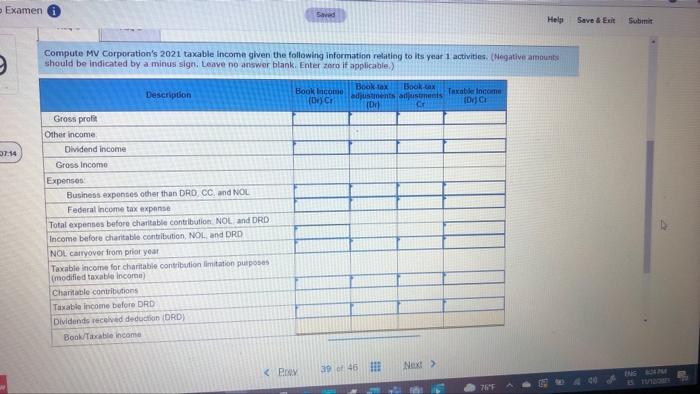

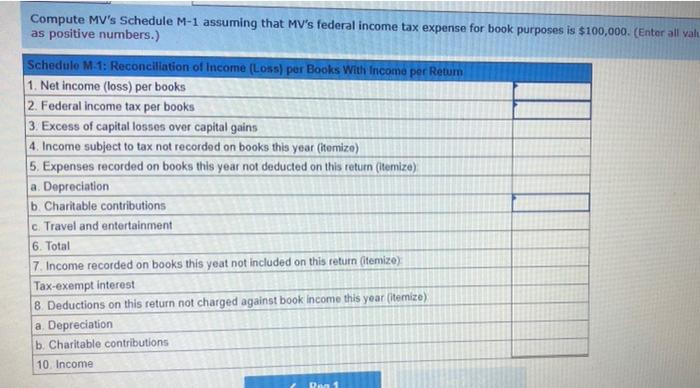

Comprehensive Problem 05-62 (LO 05-1, LO 05-2, LO 05-3) (Static) Compute MV Corporation's 2021 taxable income given the following information relating to its year 1 activities. Also, compute MV'S Schedule M 1 assuming that MV's federal income tax expense for book purposes is $100,000 Use Exhibit.166. Gross profit from inventory sales of $500,000 (no book-tax differences) Dividends MV received from 25 percent-owned corporation of S100,000 (assume this is also MV's pro rata share of the distributing corporation's earings) Expenses other than DRD, charitable contribution (CC), and net operating loss (NOL) are $350,000 (no book-tax differences) NOL carryover from 2020 of $10,000, Cash charitable contribution of $120,000. Assume the charitable donation is a qualified charitable contribution Complete this question by entering your answers in the tabs below. Reg 1 Red 2 Compute MV Corporation's 2021 taxable income given the following information relating to its year I activities (Negative amounts should be indicated by a minus sign: Leave no answer blank: Enter zero if applicable) Book Income (DICE Book Book tax adjustments adjustments (D) CF Taxable income D C Description Gross profit Examen Saved Help Save & Exit Submit 37:14 Compute MV Corporation's 2021 taxable income given the following information relating to its year 1 activities (Negative amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable) Book tax Book tax Book com Description Taxable income ( DCI adjustments adjustments (Dil DC Gross pros Other income Dividend Income Gross Income Expenses Business expenses other than DRD CC and NOL Federal income tax expense Total expenses before charitable contribution NOL and DRD Income before charitable contribution, NOL and DRD NOL carryover from prior year Taxable income for charitable contribution limitation purposes (modified taxable income) Charitable contributions Taxable income before DRD Dividends received deduction (DRD) Book/Tatable income 39 46 INS TI 76" Compute MV's Schedule M-1 assuming that MV's federal income tax expense for book purposes is $100,000. (Enter all val. as positive numbers.) Schedulo M.1: Reconciliation of Income (Loss) per Books With Income per Return 1. Net Income (loss) per books 2. Federal income tax per books 3. Excess of capital losses over capital gains 4. Income subject to tax not recorded on books this year (itemize) 5. Expenses recorded on books this year not deducted on this return (itemize) a Depreciation b. Charitable contributions c. Travel and entertainment 6. Total 7. Income recorded on books this yeat not included on this return (itemize) Tax-exempt interest 8. Deductions on this return not charged against book income this year (itemize) a Depreciation b. Charitable contributions 10. Income Doa 1 Comprehensive Problem 05-62 (LO 05-1, LO 05-2, LO 05-3) (Static) Compute MV Corporation's 2021 taxable income given the following information relating to its year 1 activities. Also, compute MV'S Schedule M 1 assuming that MV's federal income tax expense for book purposes is $100,000 Use Exhibit.166. Gross profit from inventory sales of $500,000 (no book-tax differences) Dividends MV received from 25 percent-owned corporation of S100,000 (assume this is also MV's pro rata share of the distributing corporation's earings) Expenses other than DRD, charitable contribution (CC), and net operating loss (NOL) are $350,000 (no book-tax differences) NOL carryover from 2020 of $10,000, Cash charitable contribution of $120,000. Assume the charitable donation is a qualified charitable contribution Complete this question by entering your answers in the tabs below. Reg 1 Red 2 Compute MV Corporation's 2021 taxable income given the following information relating to its year I activities (Negative amounts should be indicated by a minus sign: Leave no answer blank: Enter zero if applicable) Book Income (DICE Book Book tax adjustments adjustments (D) CF Taxable income D C Description Gross profit Examen Saved Help Save & Exit Submit 37:14 Compute MV Corporation's 2021 taxable income given the following information relating to its year 1 activities (Negative amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable) Book tax Book tax Book com Description Taxable income ( DCI adjustments adjustments (Dil DC Gross pros Other income Dividend Income Gross Income Expenses Business expenses other than DRD CC and NOL Federal income tax expense Total expenses before charitable contribution NOL and DRD Income before charitable contribution, NOL and DRD NOL carryover from prior year Taxable income for charitable contribution limitation purposes (modified taxable income) Charitable contributions Taxable income before DRD Dividends received deduction (DRD) Book/Tatable income 39 46 INS TI 76" Compute MV's Schedule M-1 assuming that MV's federal income tax expense for book purposes is $100,000. (Enter all val. as positive numbers.) Schedulo M.1: Reconciliation of Income (Loss) per Books With Income per Return 1. Net Income (loss) per books 2. Federal income tax per books 3. Excess of capital losses over capital gains 4. Income subject to tax not recorded on books this year (itemize) 5. Expenses recorded on books this year not deducted on this return (itemize) a Depreciation b. Charitable contributions c. Travel and entertainment 6. Total 7. Income recorded on books this yeat not included on this return (itemize) Tax-exempt interest 8. Deductions on this return not charged against book income this year (itemize) a Depreciation b. Charitable contributions 10. Income Doa 1