Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comprehensive Problem 1 2017 Noah and Joan Arcs Tax Return Noah and Joan Are live with their family in Dayton, OH. Noah's Social Security number

Comprehensive Problem 1 2017

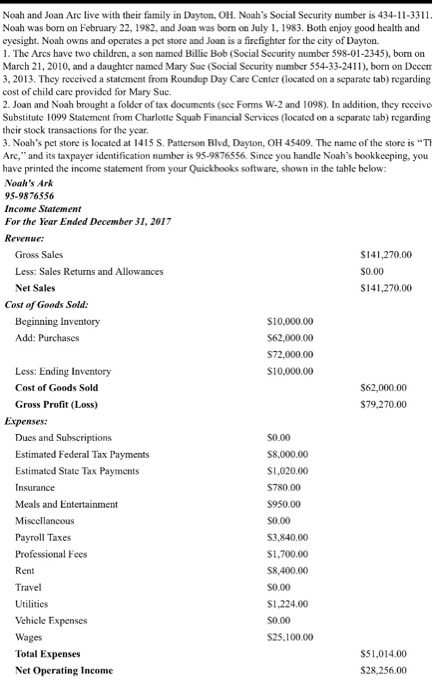

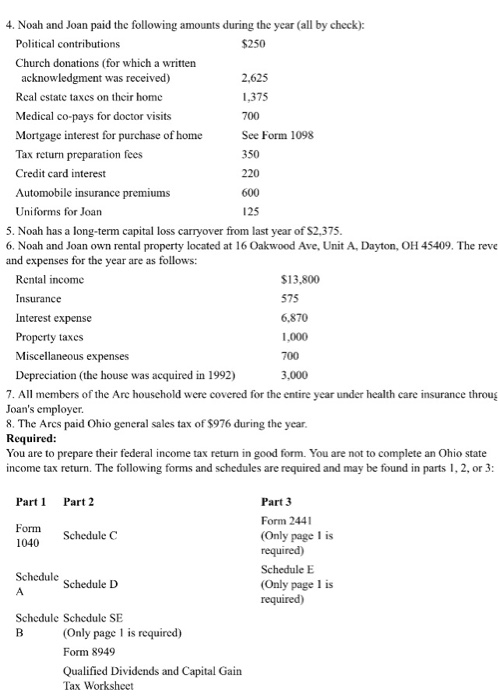

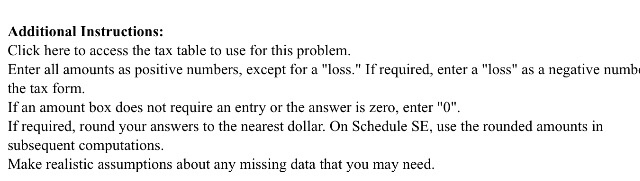

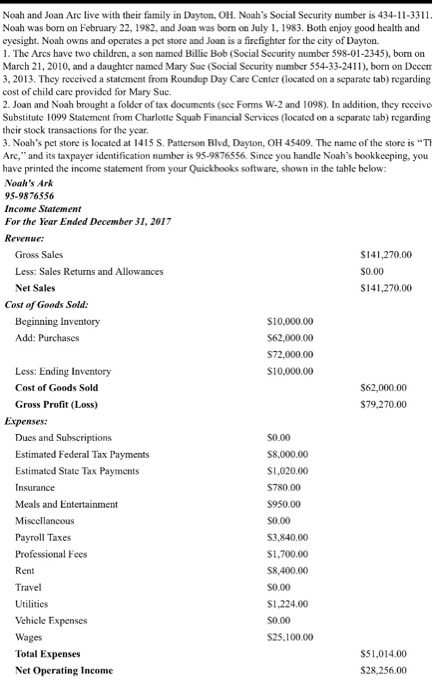

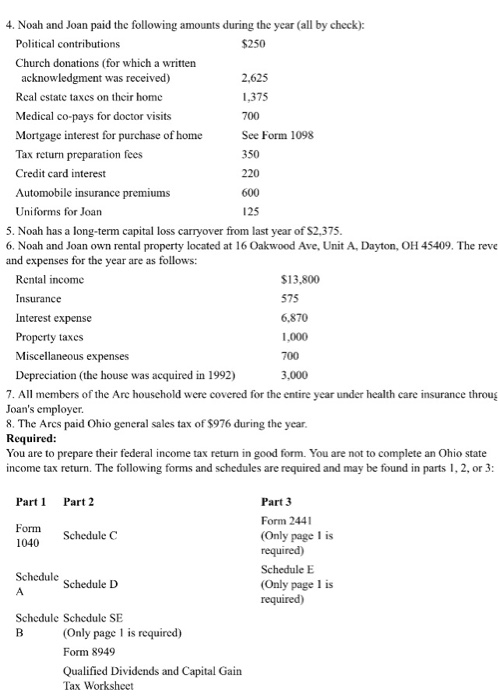

Noah and Joan Are live with their family in Dayton, OH. Noah's Social Security number is 434-11-3311 Noah was bom on February 22, 1982, and Joan was born on July 1, 1983. Both enjoy good health and cycsight. Noah owns and operates a pet store and Joan is a firefighter for the city of Dayton. 1. The Ares have two children, a son named Billie Bob (Social Security number 598-01-2345), bom on March 21, 2010, and a daughter named Mary Sue (Social Security number 554-33-2411), born on Decem 3, 2013. They received a statement from Roundup Day Care Center (located on a separate tab) regarding cost of child care provided for Mary Sue. 2. Joan and Noah brought a folder of tax documents (see Forms W-2 and 1098). In addition, thcy reccive Substitute 1099 Statement from Charlotte Squab Financial Services (located on a separate tab) regarding their stock transactions for the year 3. Noah's pet store is located at 1415 S. Patterson Blvd, Dayton, OH 454091e name of the store is T Are," and its taxpayer identification number is 95-9876556. Since you handle Noah's bookkeeping, you have printed the income statement from your Quickbooks software, shown in the table below: Noah's Ark 95-9876556 Income Statement For the Year Ended December 31, 2017 Revenue: Gross Sales Less: Sales Returns and Allowances Net Sales $141,270.00 S0.00 $141,270.00 Cost of Goods Sold Beginning Inventory Add: Purchases S10,000.0 $62,000.00 $72.000.00 S10,000.00 Less: Ending Inventory Cost of Goods Sold Gross Profit (Loss) $62,000.00 $79,270.00 Expenses: 50.00 $8,000.00 S1,020.00 $780.00 $950.00 $0.00 $3,840.00 $1,700.00 $8,400.00 S0.00 S1,224.00 50.00 S25,100.00 Dues and Subscriptions Estimated Federal Tax Payments Estimated State Tax Payments Meals and Entertainment Miscellancous Payroll Taxes Professional Fees Rent Travel Utilities Vehicle Expenses Wages Total Expenses Net Operating Income S51,014.00 $28,256.00 4. Noah and Joan paid the following amounts during the year (all by check) Political contributions $250 Church donations (for which a written acknowledgment was received) Rcal cstate taxcs on their homc Medical co-pays Mortgage interest for purchase of home Tax return preparation fees Credit card interest Automobile insurance premiums Uniforms for Joarn 2,625 1,375 700 See Form 1098 350 220 600 125 for doctor visits 5. Noah has a long-term capital loss carryover from last year of S2375 6. Noah and Joan own rental property located at 16 Oakwood Ave, Unit A, Dayton, OH 45409. The reve and expenses for the year are as follows: Rental income Insurance Interest expense Property taxes Miscellaneous expenses Depreciation (the house was acquired in 1992) $13,800 575 6,870 1,000 700 3,000 7. All members of the Are household were covered for the entire year under health care insurance throug Joan's employer. 8. The Ares paid Ohio general sales tax of $976 during the year Required: You are to prepare their federal income tax return in good form. You are not to complete an Ohio state income tax return. The following forms and schedules are required and may be found in parts 1, 2, or 3: Part 1 Part 2 Part 3 Form 2441 (Only page is required) Schedule E (Only page 1 is required) 1040 Schedule C Schedule schedule D Schedule Schedule SE Only page is required) Form 8949 Qualified Dividends and Capital Gain Tax Worksheet Additional Instructions: Click here to access the tax table to use for this problem. Enter all amounts as positive numbers, except for a "loss." If required, enter a "loss" as a negative numb the tax form. If required, round your answers to the nearest dollar. On Schedule SE, use the rounded amounts in subsequent computations Make realistic assumptions about any missing data that you may need Noah and Joan Are live with their family in Dayton, OH. Noah's Social Security number is 434-11-3311 Noah was bom on February 22, 1982, and Joan was born on July 1, 1983. Both enjoy good health and cycsight. Noah owns and operates a pet store and Joan is a firefighter for the city of Dayton. 1. The Ares have two children, a son named Billie Bob (Social Security number 598-01-2345), bom on March 21, 2010, and a daughter named Mary Sue (Social Security number 554-33-2411), born on Decem 3, 2013. They received a statement from Roundup Day Care Center (located on a separate tab) regarding cost of child care provided for Mary Sue. 2. Joan and Noah brought a folder of tax documents (see Forms W-2 and 1098). In addition, thcy reccive Substitute 1099 Statement from Charlotte Squab Financial Services (located on a separate tab) regarding their stock transactions for the year 3. Noah's pet store is located at 1415 S. Patterson Blvd, Dayton, OH 454091e name of the store is T Are," and its taxpayer identification number is 95-9876556. Since you handle Noah's bookkeeping, you have printed the income statement from your Quickbooks software, shown in the table below: Noah's Ark 95-9876556 Income Statement For the Year Ended December 31, 2017 Revenue: Gross Sales Less: Sales Returns and Allowances Net Sales $141,270.00 S0.00 $141,270.00 Cost of Goods Sold Beginning Inventory Add: Purchases S10,000.0 $62,000.00 $72.000.00 S10,000.00 Less: Ending Inventory Cost of Goods Sold Gross Profit (Loss) $62,000.00 $79,270.00 Expenses: 50.00 $8,000.00 S1,020.00 $780.00 $950.00 $0.00 $3,840.00 $1,700.00 $8,400.00 S0.00 S1,224.00 50.00 S25,100.00 Dues and Subscriptions Estimated Federal Tax Payments Estimated State Tax Payments Meals and Entertainment Miscellancous Payroll Taxes Professional Fees Rent Travel Utilities Vehicle Expenses Wages Total Expenses Net Operating Income S51,014.00 $28,256.00 4. Noah and Joan paid the following amounts during the year (all by check) Political contributions $250 Church donations (for which a written acknowledgment was received) Rcal cstate taxcs on their homc Medical co-pays Mortgage interest for purchase of home Tax return preparation fees Credit card interest Automobile insurance premiums Uniforms for Joarn 2,625 1,375 700 See Form 1098 350 220 600 125 for doctor visits 5. Noah has a long-term capital loss carryover from last year of S2375 6. Noah and Joan own rental property located at 16 Oakwood Ave, Unit A, Dayton, OH 45409. The reve and expenses for the year are as follows: Rental income Insurance Interest expense Property taxes Miscellaneous expenses Depreciation (the house was acquired in 1992) $13,800 575 6,870 1,000 700 3,000 7. All members of the Are household were covered for the entire year under health care insurance throug Joan's employer. 8. The Ares paid Ohio general sales tax of $976 during the year Required: You are to prepare their federal income tax return in good form. You are not to complete an Ohio state income tax return. The following forms and schedules are required and may be found in parts 1, 2, or 3: Part 1 Part 2 Part 3 Form 2441 (Only page is required) Schedule E (Only page 1 is required) 1040 Schedule C Schedule schedule D Schedule Schedule SE Only page is required) Form 8949 Qualified Dividends and Capital Gain Tax Worksheet Additional Instructions: Click here to access the tax table to use for this problem. Enter all amounts as positive numbers, except for a "loss." If required, enter a "loss" as a negative numb the tax form. If required, round your answers to the nearest dollar. On Schedule SE, use the rounded amounts in subsequent computations Make realistic assumptions about any missing data that you may need Noah and Joan Arcs Tax Return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started