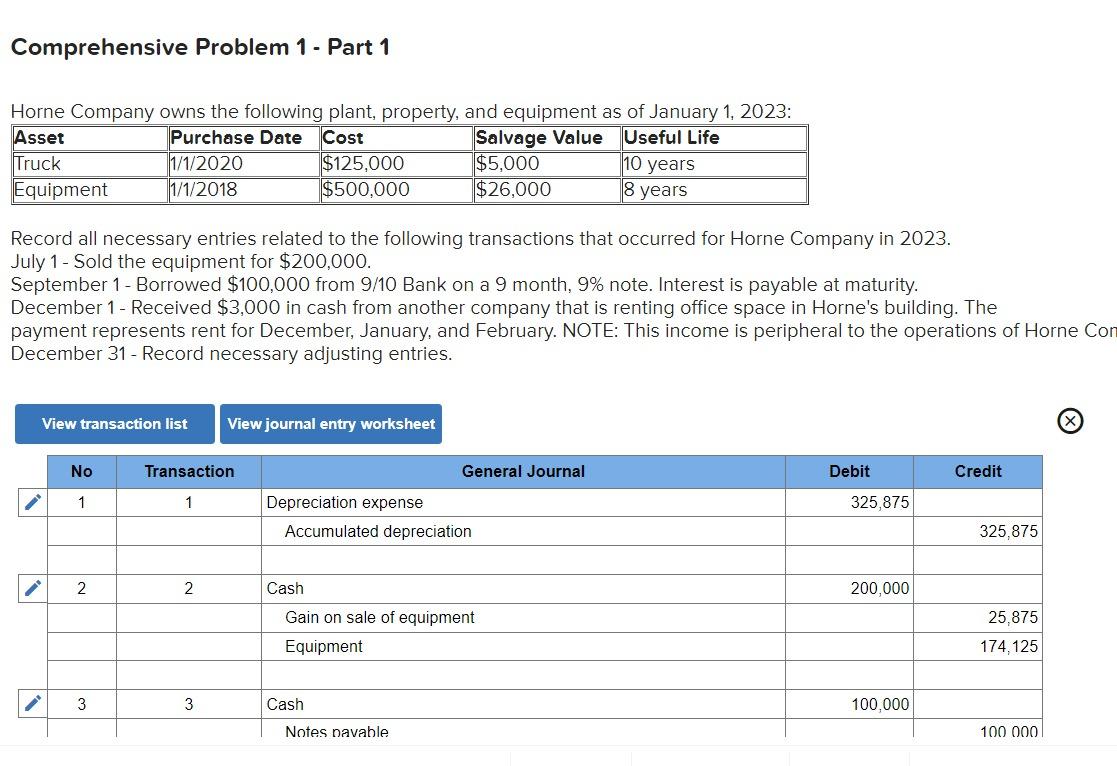

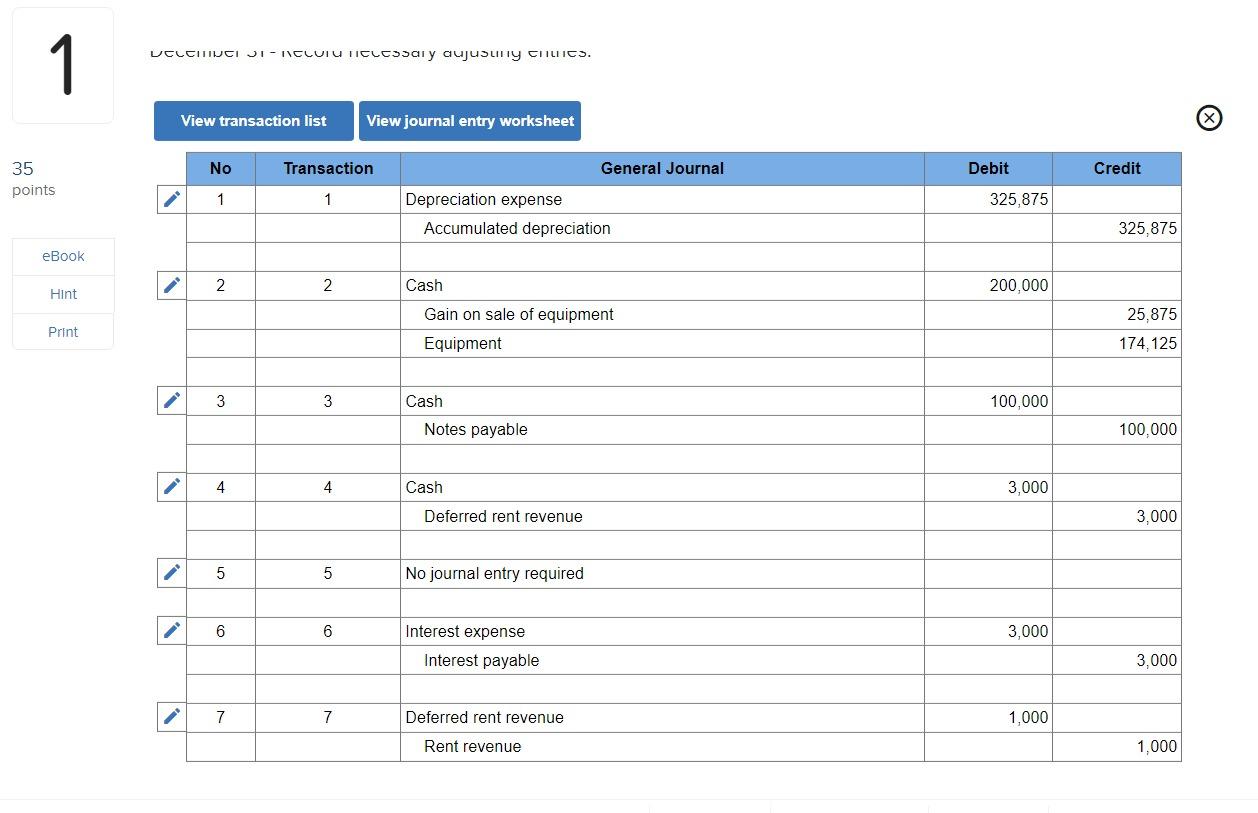

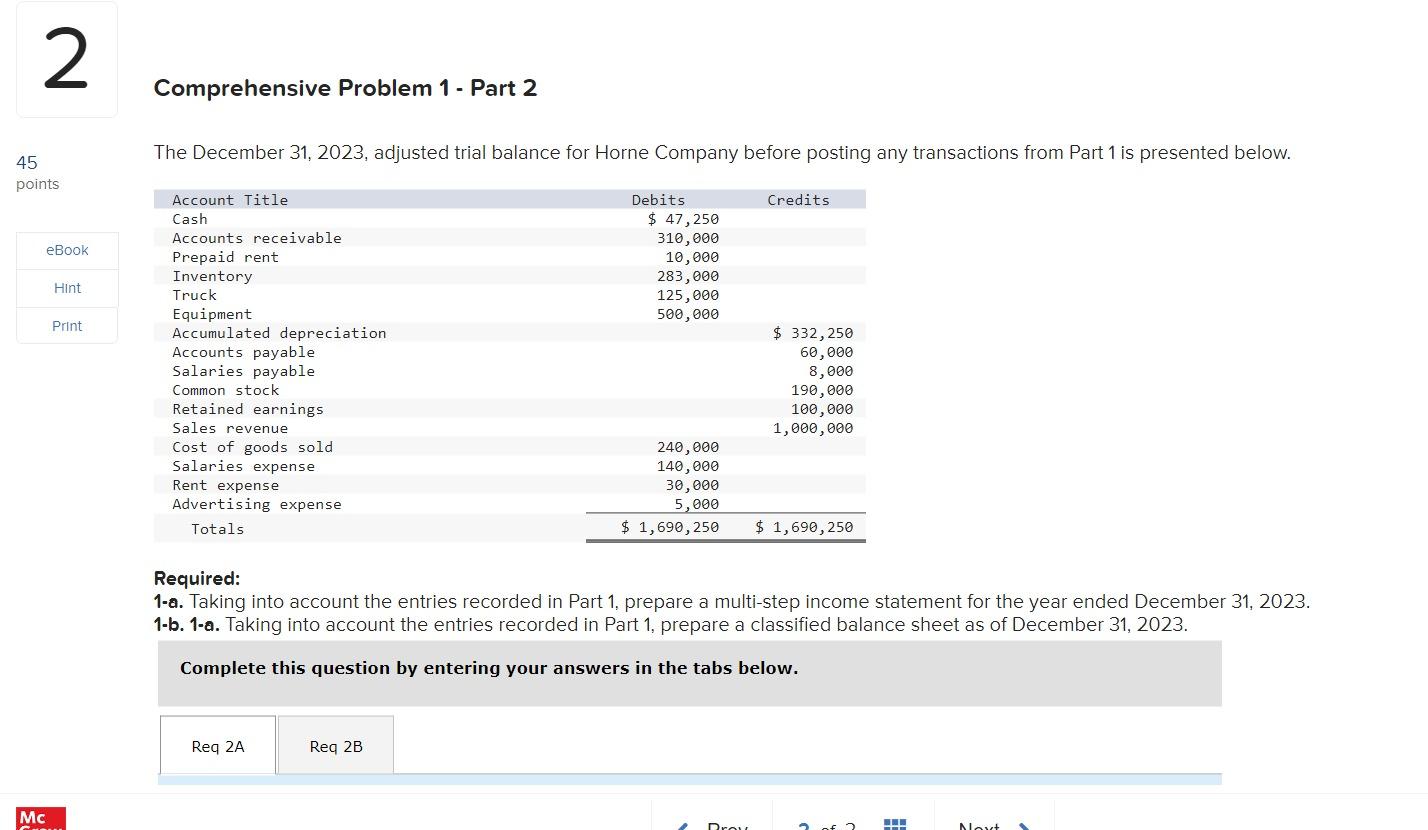

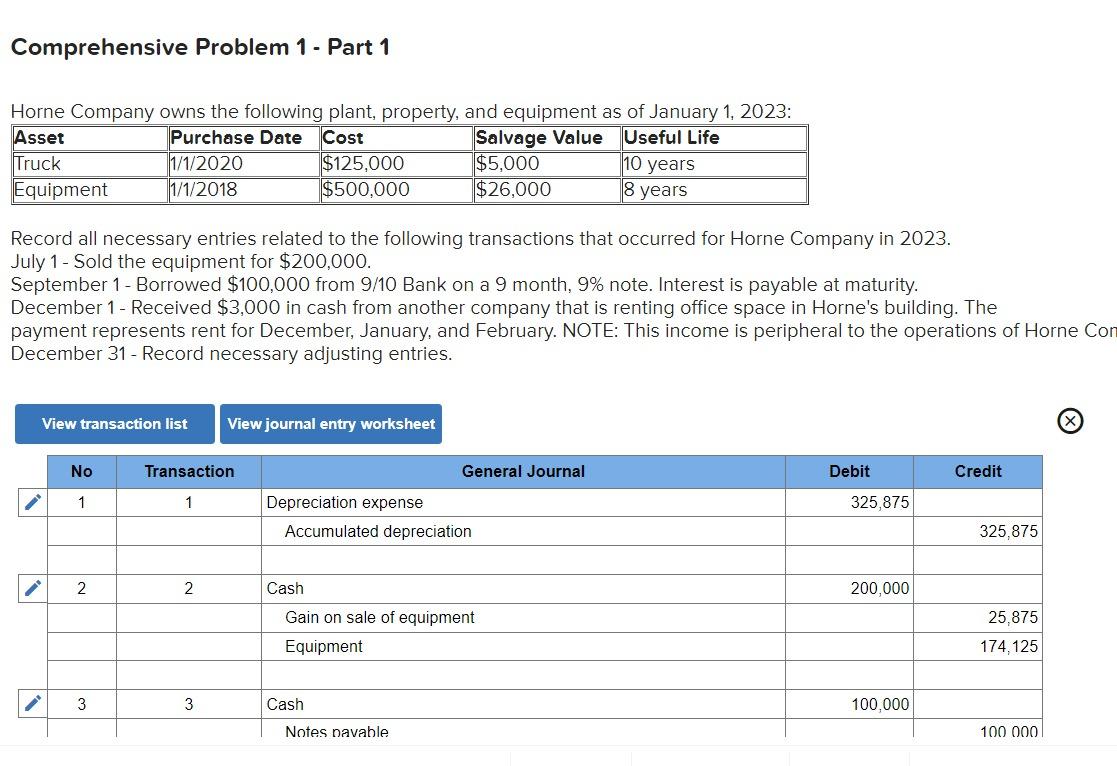

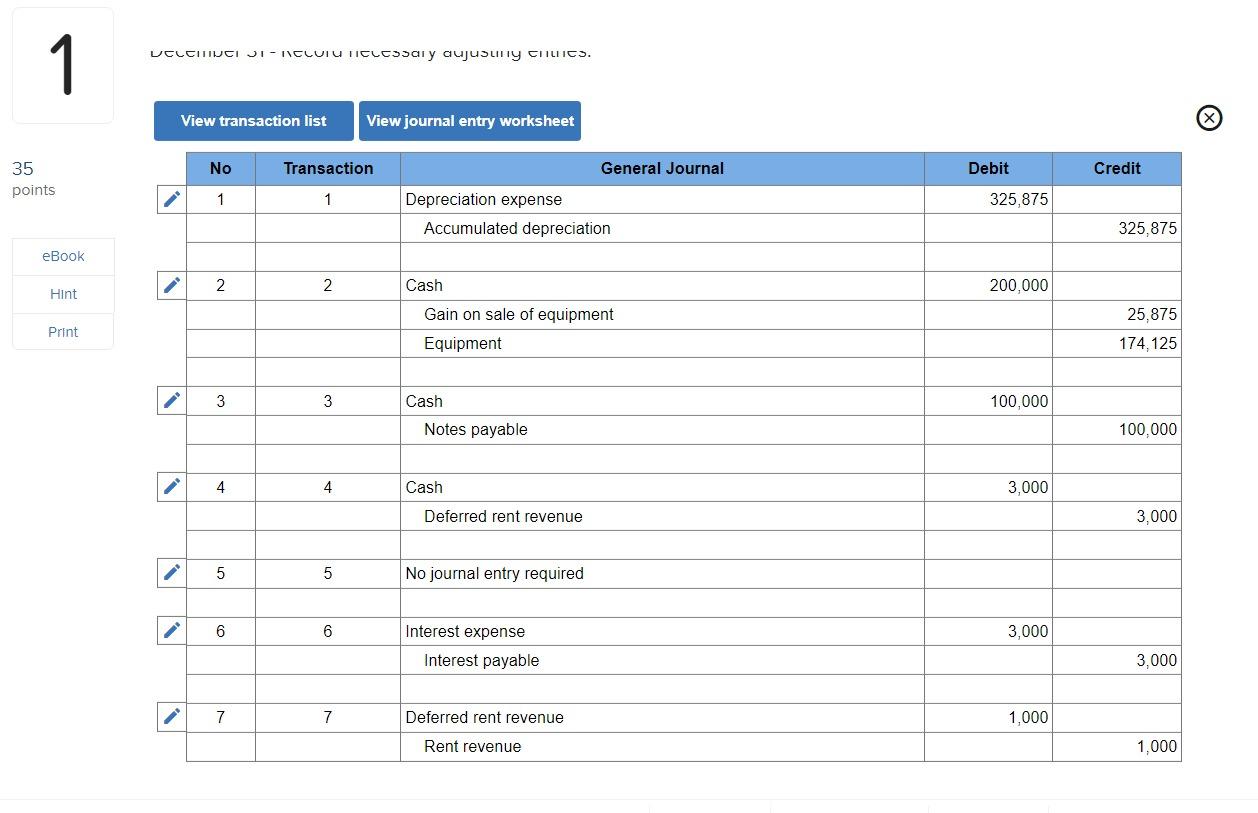

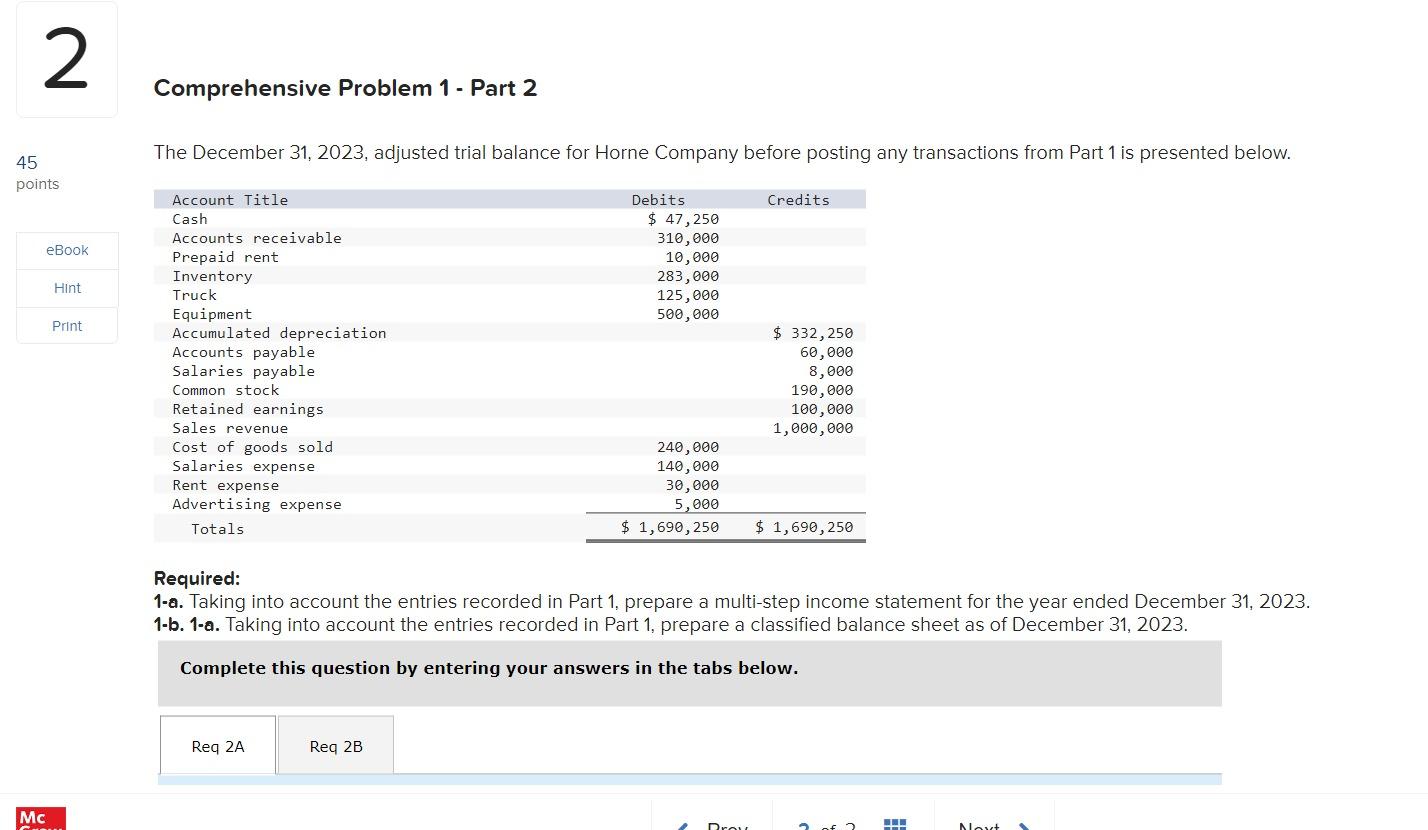

Comprehensive Problem 1 - Part 1 Horne Company owns the following plant, property, and equipment as of January 1, 2023: Record all necessary entries related to the following transactions that occurred for Horne Company in 2023. July 1 - Sold the equipment for $200,000. September 1 - Borrowed $100,000 from 9/10 Bank on a 9 month, 9% note. Interest is payable at maturity. December 1 - Received $3,000 in cash from another company that is renting office space in Horne's building. The payment represents rent for December, January, and February. NOTE: This income is peripheral to the operations of Horne December 31 - Record necessary adjusting entries. View transaction list View journal entry worksheet \begin{tabular}{l} 35 \\ points \\ eBook \\ Hint \\ \hline Print \\ \hline \end{tabular} Comprehensive Problem 1 - Part 2 The December 31, 2023, adjusted trial balance for Horne Company before posting any transactions from Part 1 is presented below. Required: 1-a. Taking into account the entries recorded in Part 1, prepare a multi-step income statement for the year ended December 31,2023. 1-b. 1-a. Taking into account the entries recorded in Part 1, prepare a classified balance sheet as of December 31, 2023. Complete this question by entering your answers in the tabs below. Prepare an income statement for the year ended December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sign. 45 points Comprehensive Problem 1 - Part 1 Horne Company owns the following plant, property, and equipment as of January 1, 2023: Record all necessary entries related to the following transactions that occurred for Horne Company in 2023. July 1 - Sold the equipment for $200,000. September 1 - Borrowed $100,000 from 9/10 Bank on a 9 month, 9% note. Interest is payable at maturity. December 1 - Received $3,000 in cash from another company that is renting office space in Horne's building. The payment represents rent for December, January, and February. NOTE: This income is peripheral to the operations of Horne December 31 - Record necessary adjusting entries. View transaction list View journal entry worksheet \begin{tabular}{l} 35 \\ points \\ eBook \\ Hint \\ \hline Print \\ \hline \end{tabular} Comprehensive Problem 1 - Part 2 The December 31, 2023, adjusted trial balance for Horne Company before posting any transactions from Part 1 is presented below. Required: 1-a. Taking into account the entries recorded in Part 1, prepare a multi-step income statement for the year ended December 31,2023. 1-b. 1-a. Taking into account the entries recorded in Part 1, prepare a classified balance sheet as of December 31, 2023. Complete this question by entering your answers in the tabs below. Prepare an income statement for the year ended December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sign. 45 points