Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comprehensive Problem 11-69 (LO 11-1, LO 11-2, LO 11-3, LO 11-4, LO 11-5, LO 11-6) (Algo) Hauswirth Corporation sold (or exchanged) a warehouse in

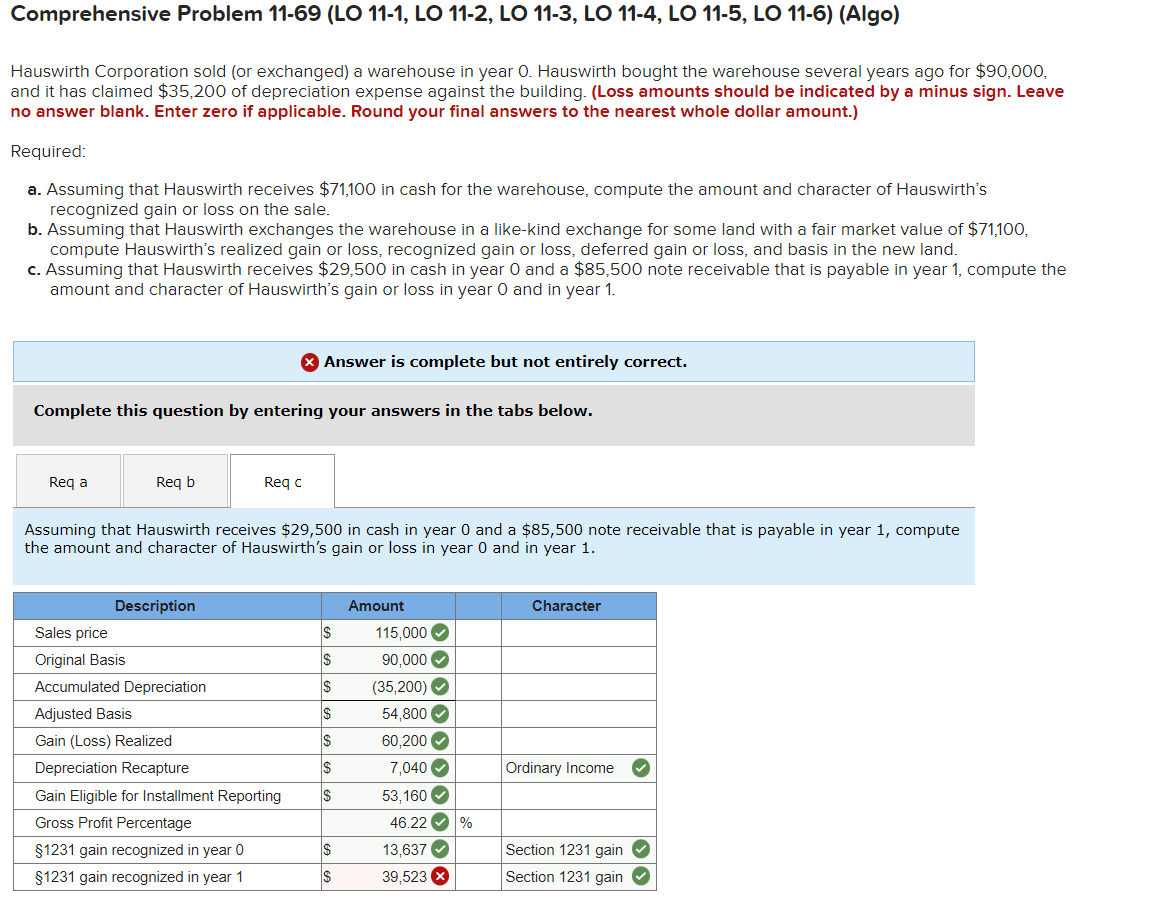

Comprehensive Problem 11-69 (LO 11-1, LO 11-2, LO 11-3, LO 11-4, LO 11-5, LO 11-6) (Algo) Hauswirth Corporation sold (or exchanged) a warehouse in year O. Hauswirth bought the warehouse several years ago for $90,000, and it has claimed $35,200 of depreciation expense against the building. (Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Round your final answers to the nearest whole dollar amount.) Required: a. Assuming that Hauswirth receives $71,100 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. b. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $71,100, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. c. Assuming that Hauswirth receives $29,500 in cash in year 0 and a $85,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year O and in year 1. > Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req a Req b Req c Assuming that Hauswirth receives $29,500 in cash in year 0 and a $85,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1. Description Amount Character Sales price $ 115,000 Original Basis $ 90,000 Accumulated Depreciation $ (35,200) Adjusted Basis $ 54,800 Gain (Loss) Realized $ 60,200 Depreciation Recapture $ 7,040 Ordinary Income Gain Eligible for Installment Reporting $ 53,160 Gross Profit Percentage 46.22 % 1231 gain recognized in year 0 $ 13,637 Section 1231 gain $1231 gain recognized in year 1 $ 39,523 x Section 1231 gain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started