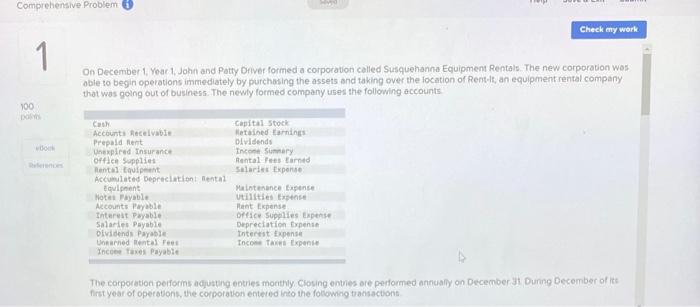

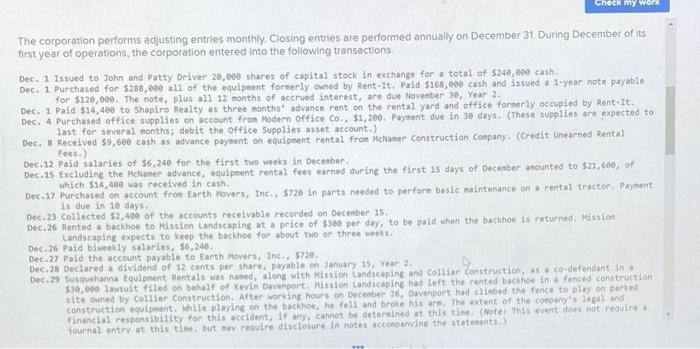

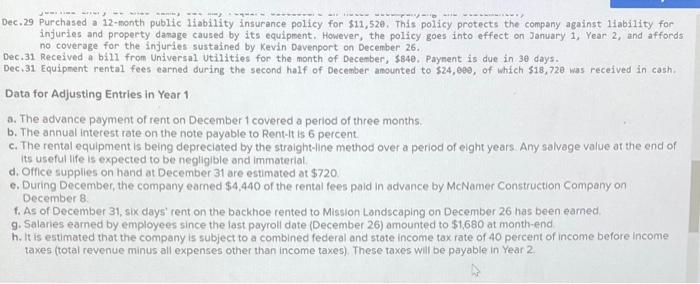

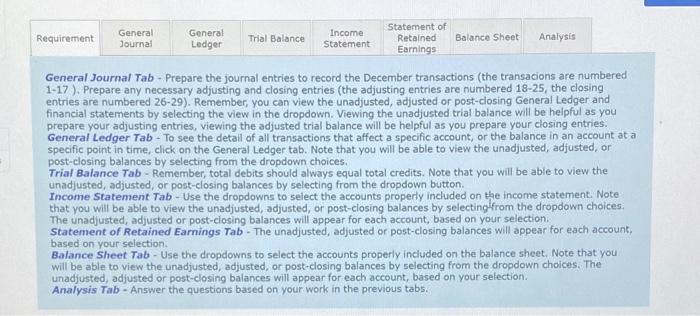

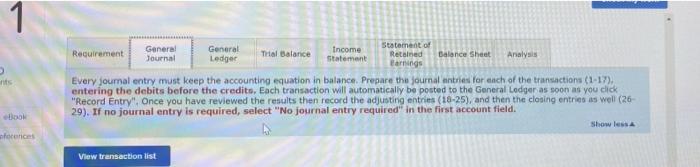

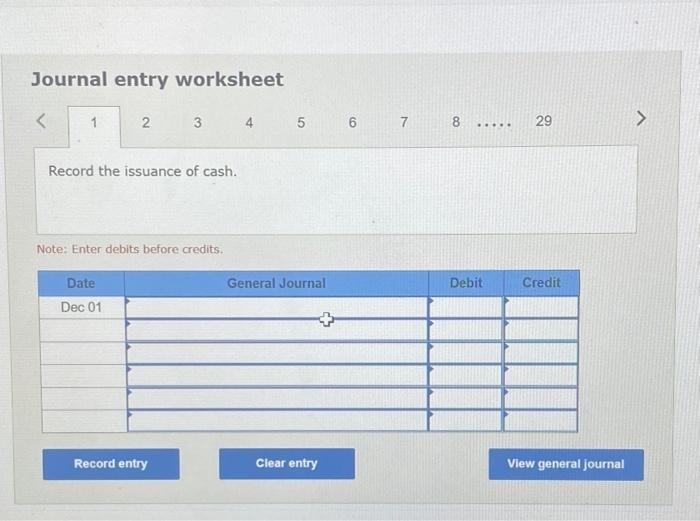

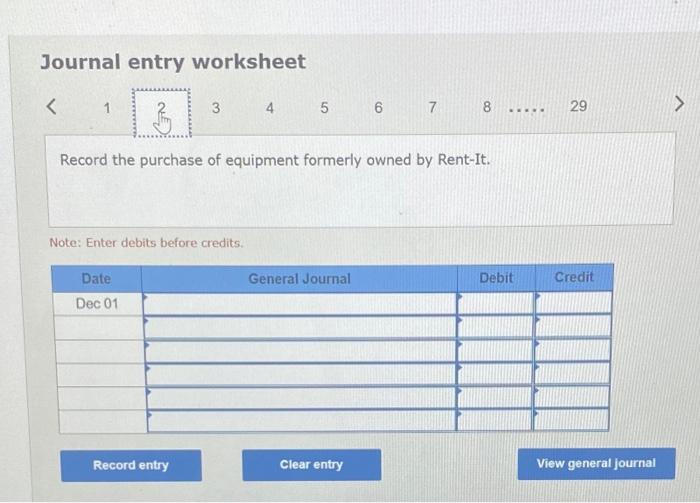

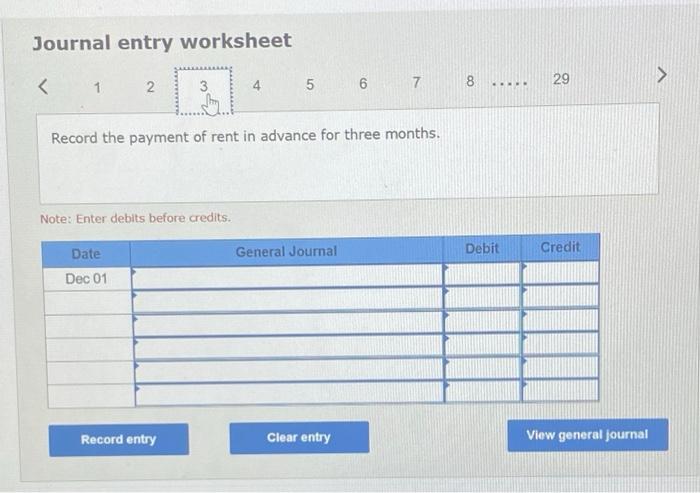

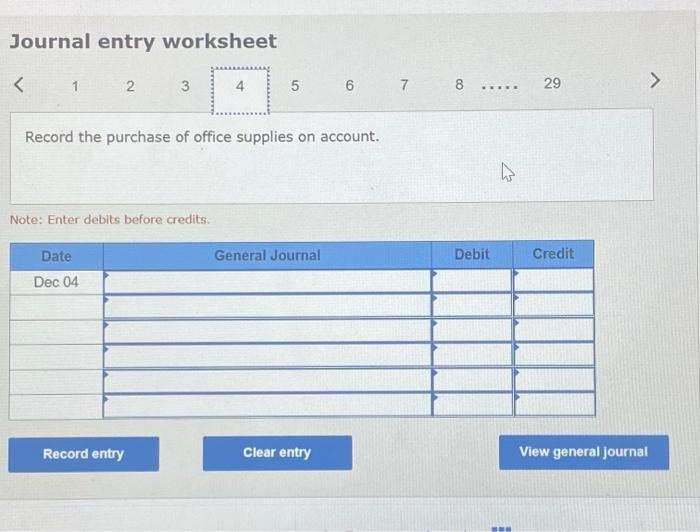

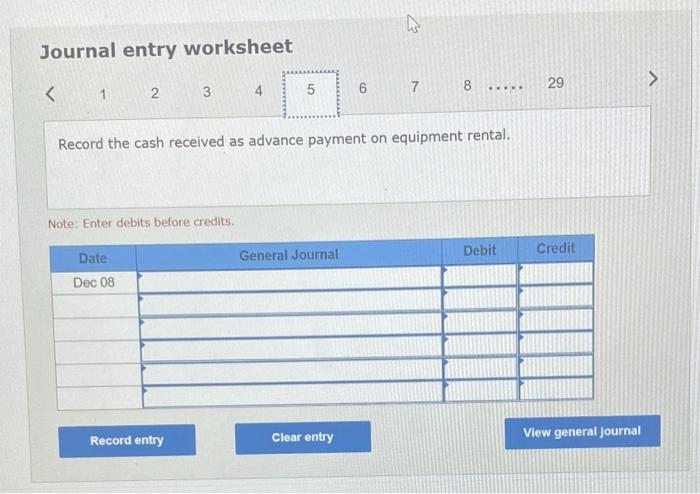

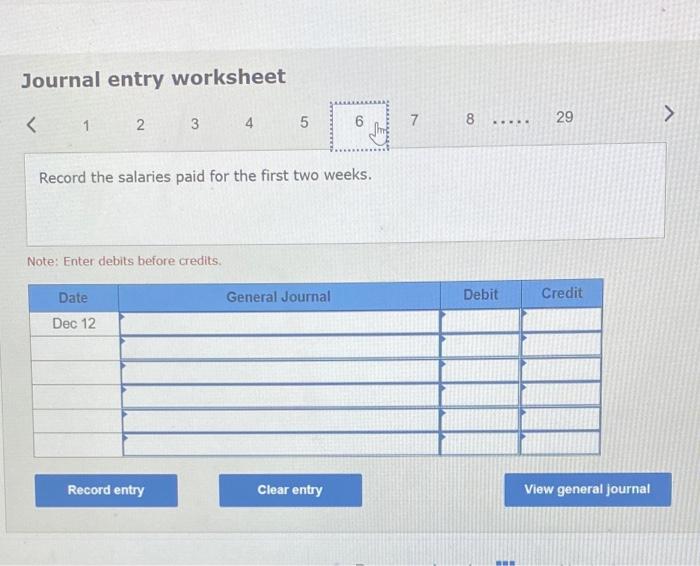

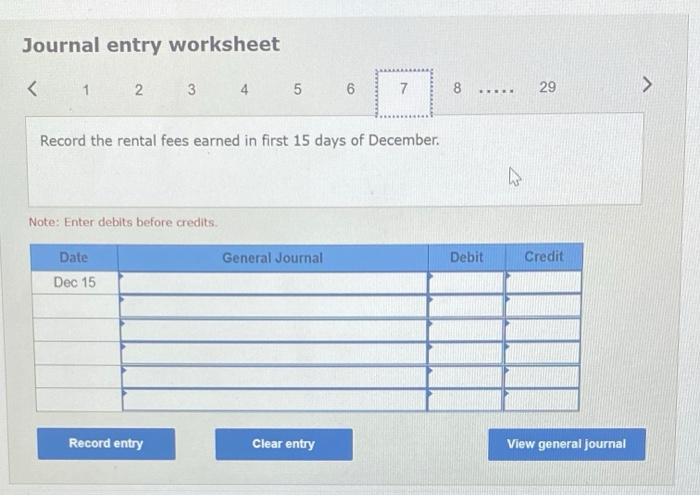

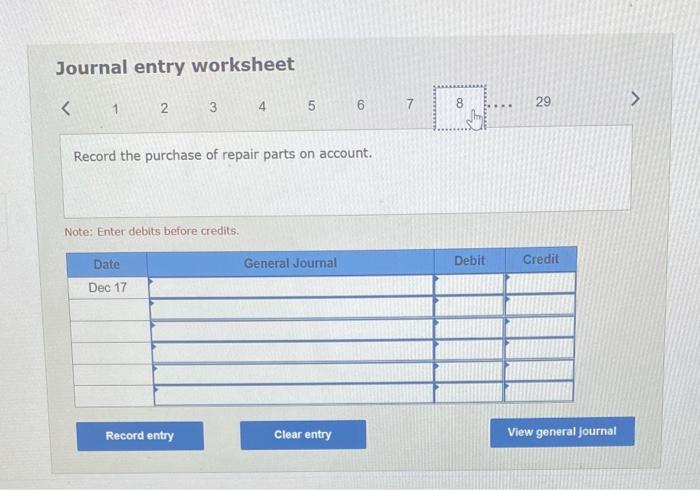

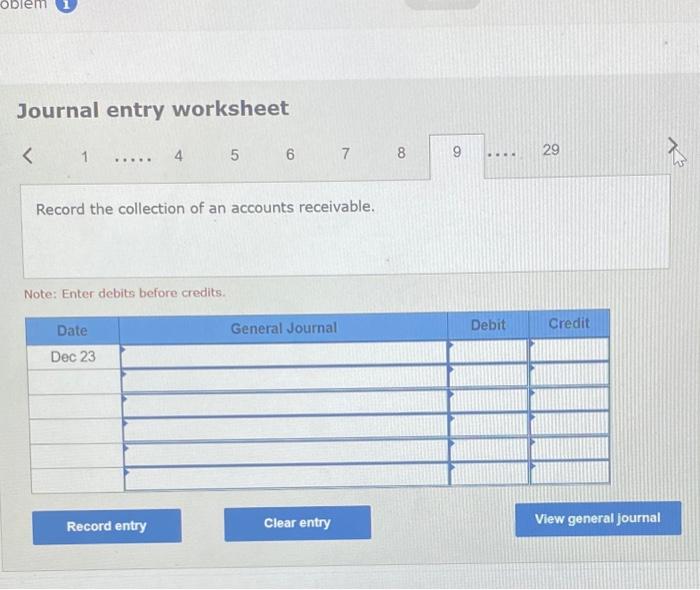

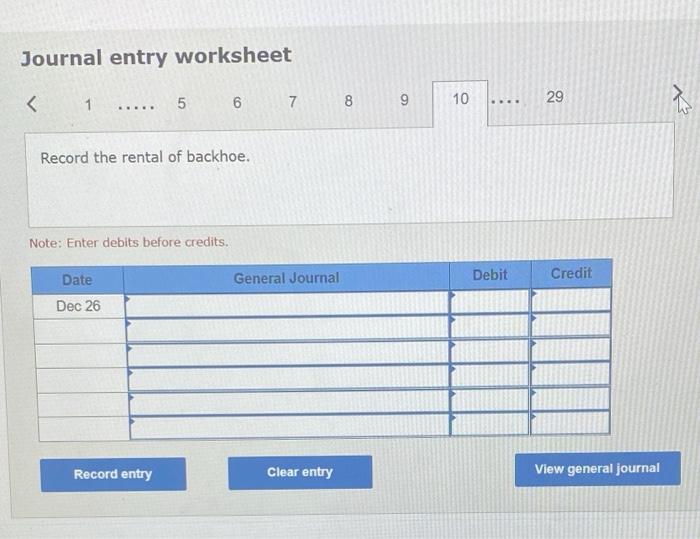

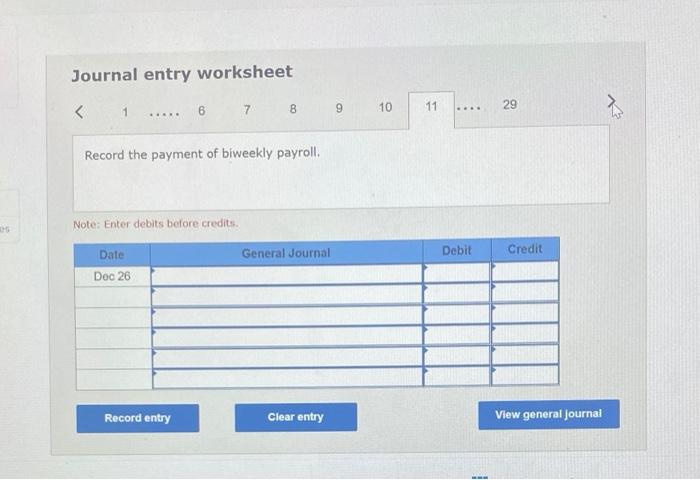

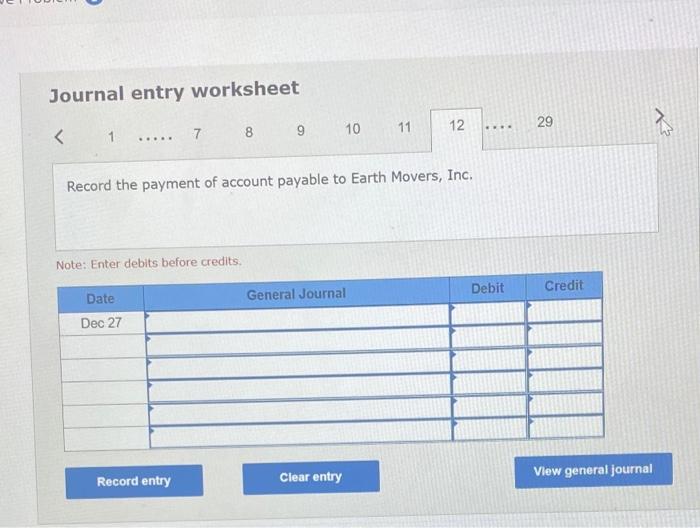

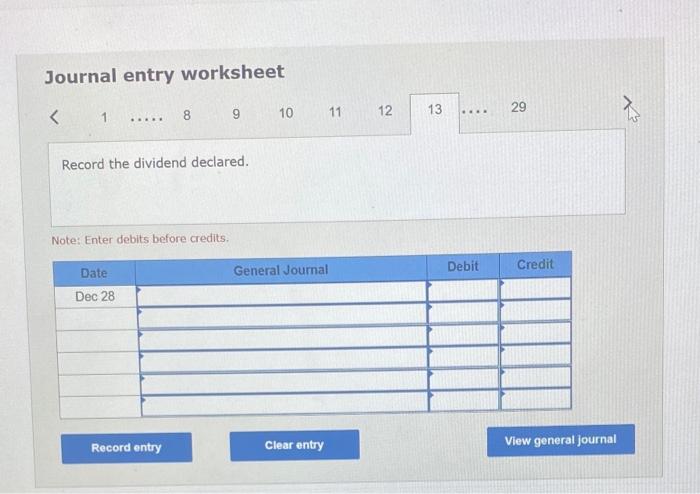

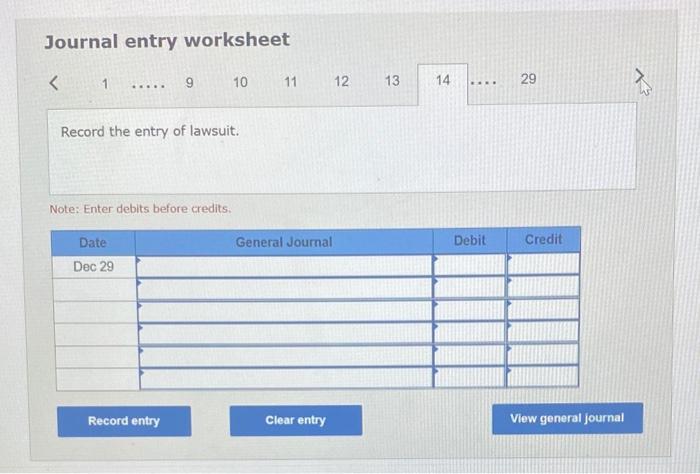

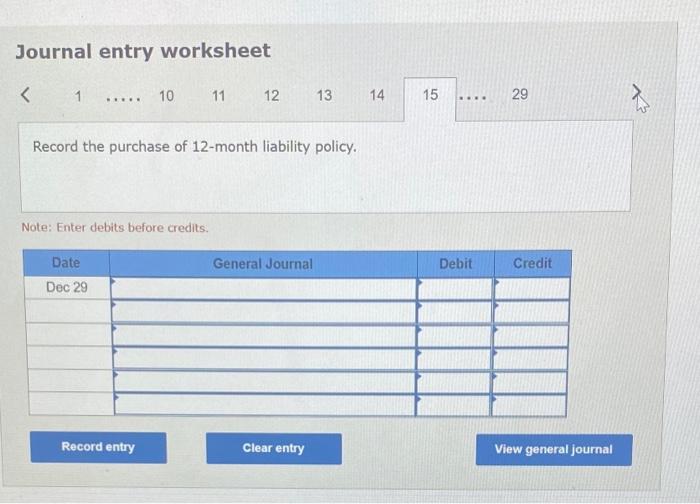

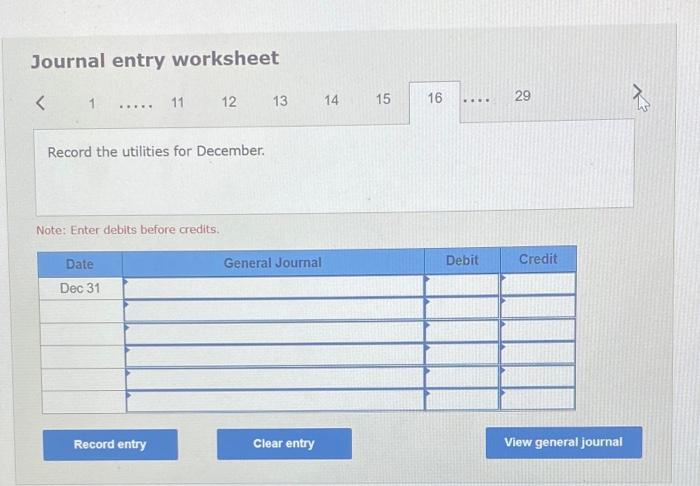

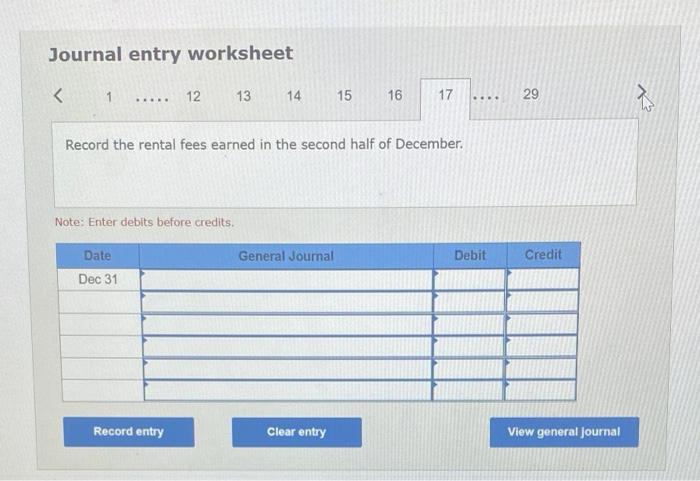

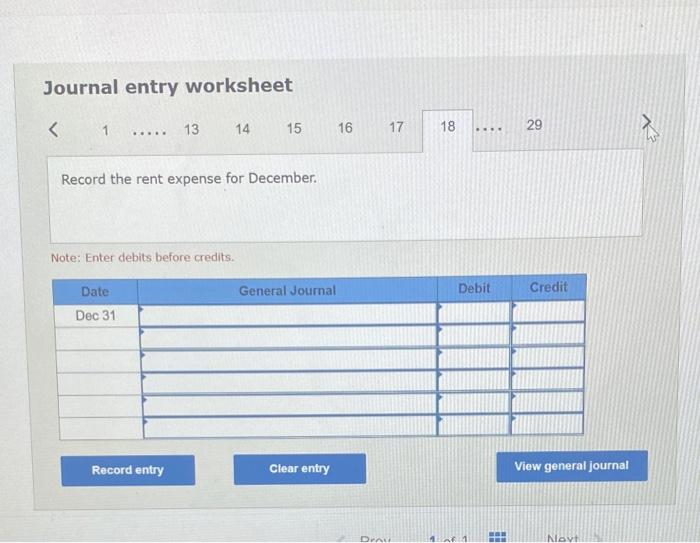

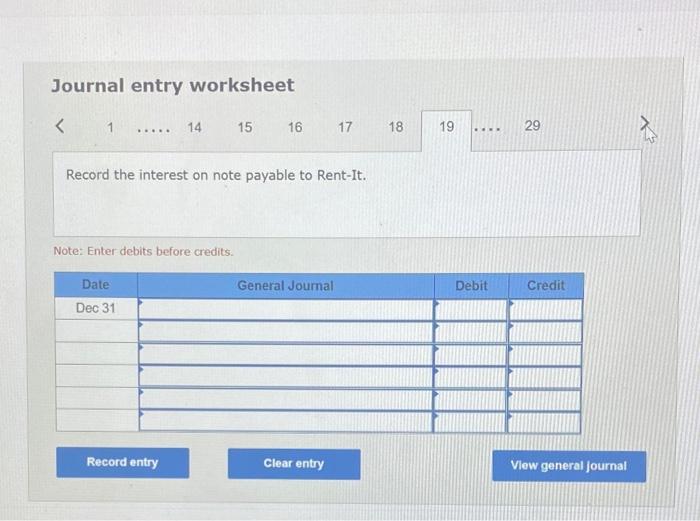

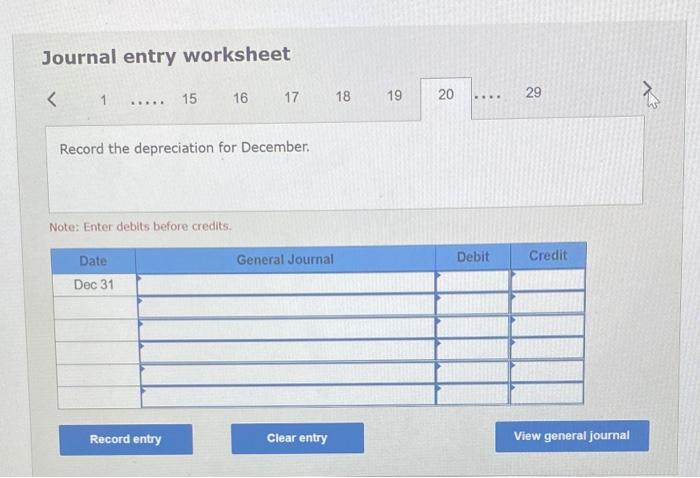

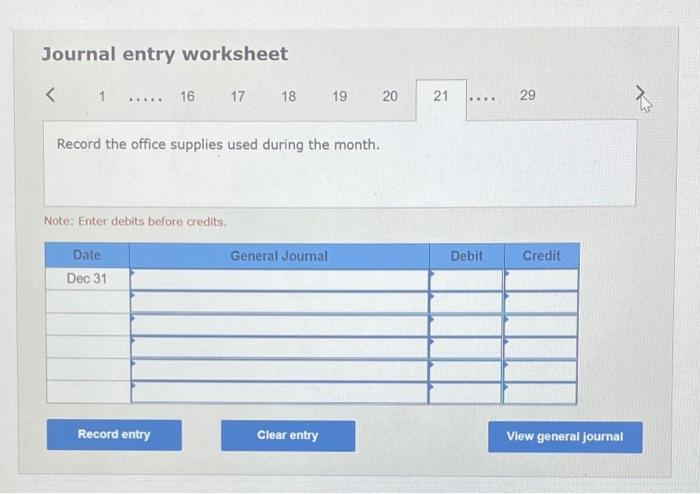

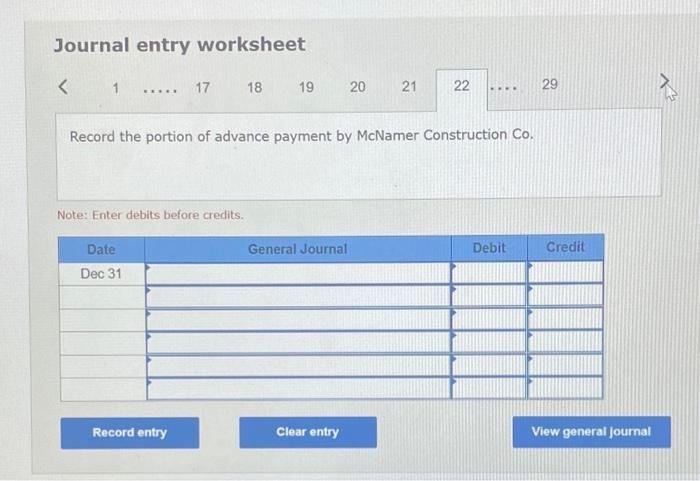

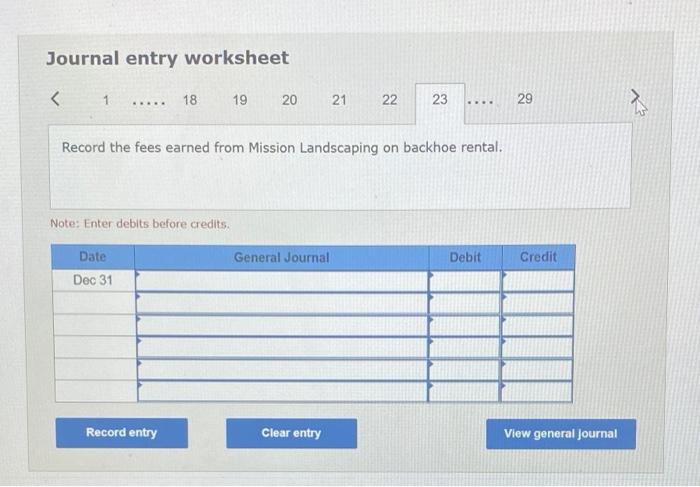

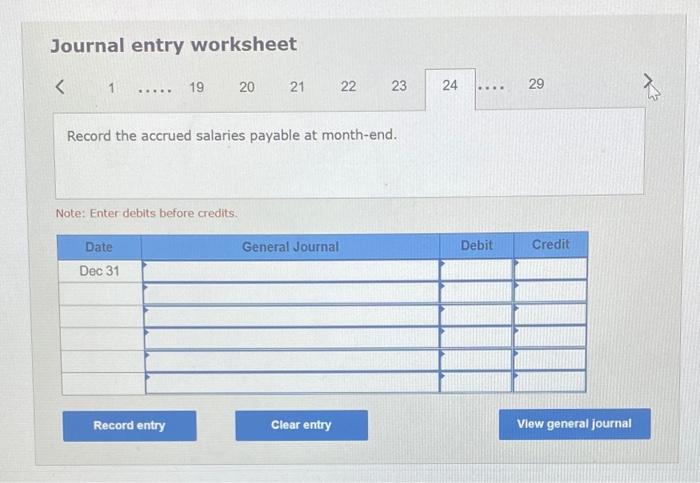

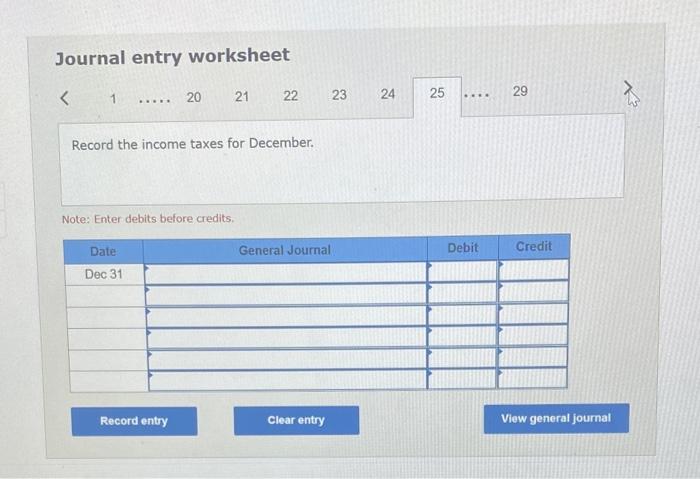

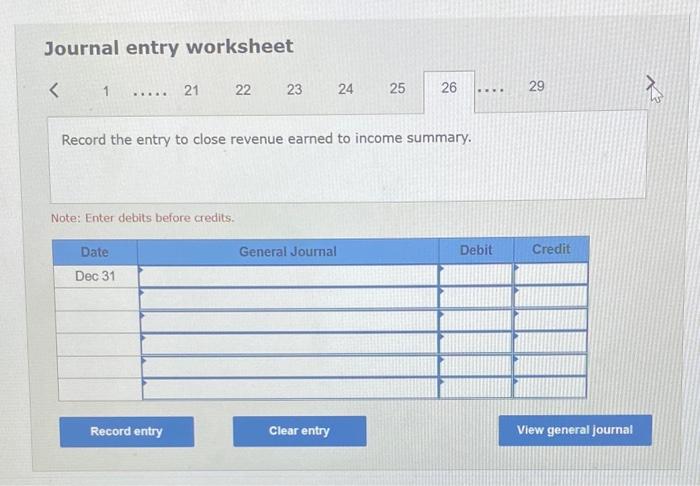

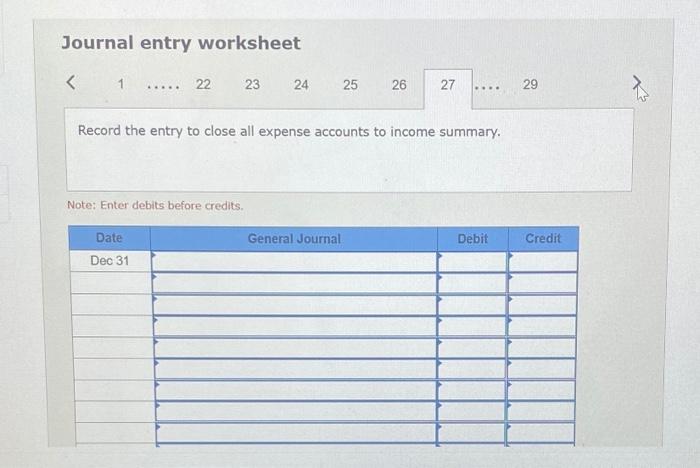

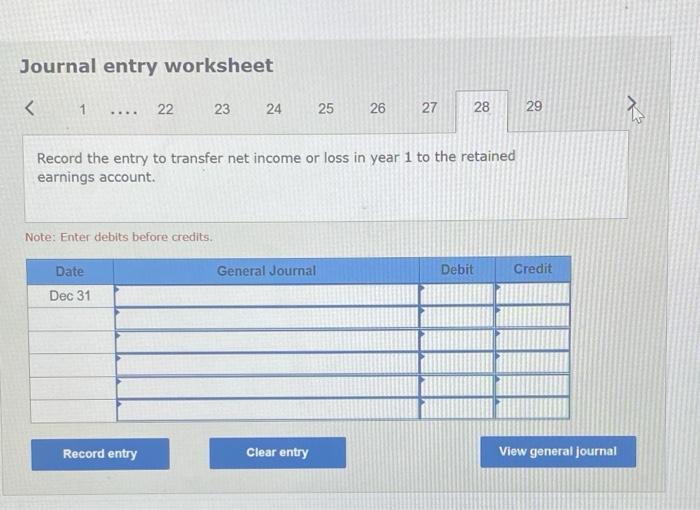

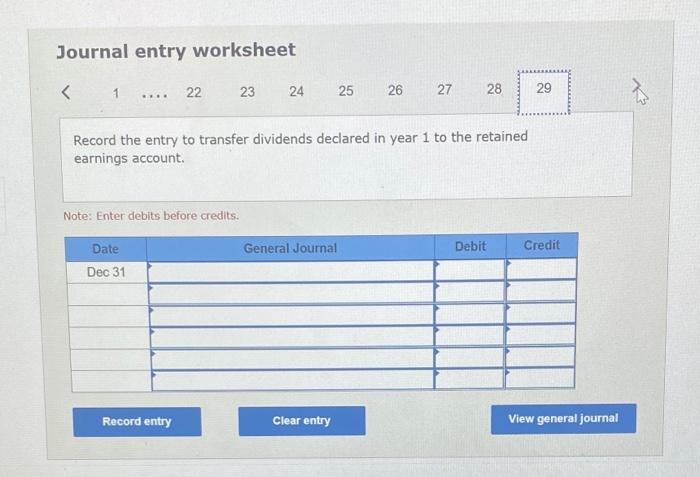

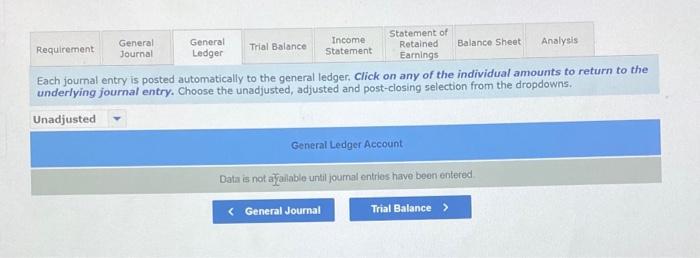

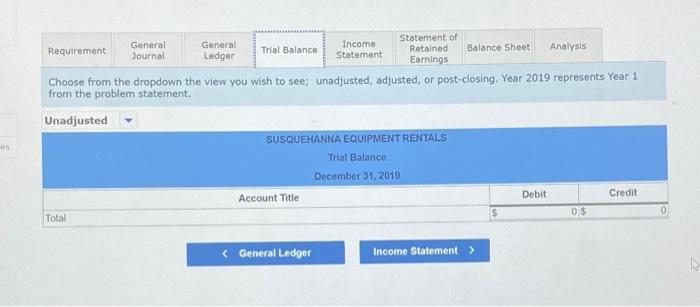

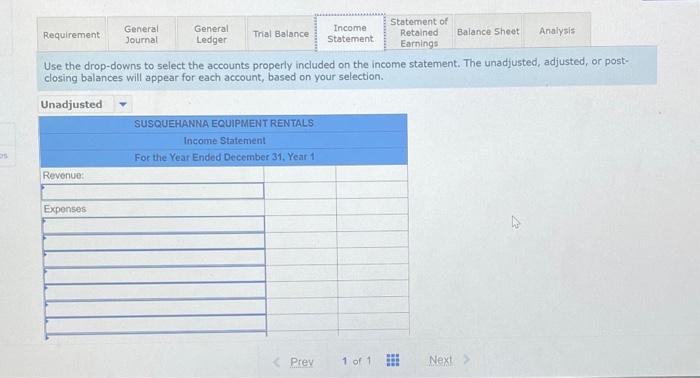

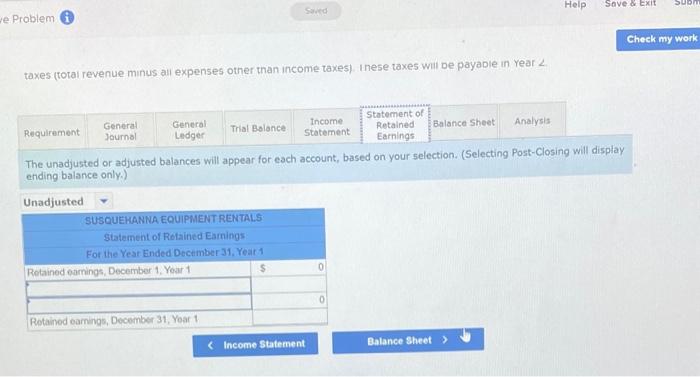

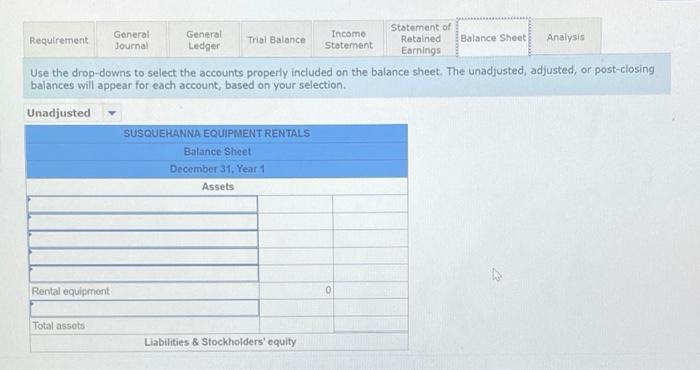

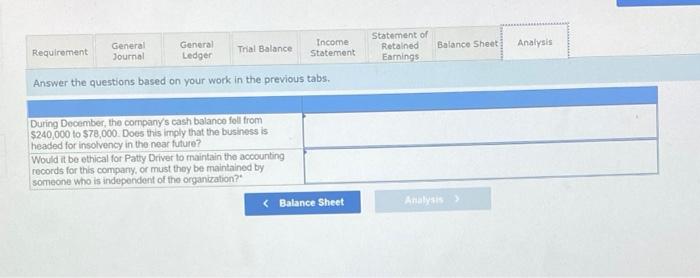

Comprehensive Problem Check my work 1 1 On December Year 1, John and Patty Driver formed a corporation called Susquehanna Equipment Rentals. The new corporation was able to begin operations immediately by purchasing the assets and taking over the location of Rent it, an equipment rental company that was going out of business. The newly formed company uses the following accounts 100 book Capital Stock Metained tamnings Dividends Incone Simary Rentales Eamed Serie Experte Accounts Receivable Prepaid fent Unexpired Insurance Office Supplies Rental Equipment Accumulated Depreciation entai Equipment Hotel Payable Accounts Payable Interest Payable Salaries Payable Dividends Payable Urned mental res Income Taxes Payable Maintenance Expense Utilities Expense Rent Expense Office Supplies Expense Depreciation Expense Interest Expense Income Tax Expense The corporation performs adjusting entries monthly Closing entries are performed annually on December 31 Duning December of its first year of operations, the corporation entered into the following transaction Check my work The corporation performs adjusting entries monthly, Closing entries are performed annually on December 31 During December of its first year of operations, the corporation entered into the following transactions Dec. 1 Issued to John and Patty Driver 20,000 shares of capital stock in exchange for a total of $240,000 cash Dec. 1 Purchased for $288,eee all of the equipment formerly owned by Rent-it. Paid $168,000 cash and issued a 1-year note payable for $120,000. The note, plus all 12 months of accrued interest, are due November 30, Year 2. Dec. 1 Paid $14,400 to Shapiro Realty as three months advance rent on the rental yard and office formerly occupied by Rent-It. Dec. 4 Purchased office supplies on account from Modern Office Co., 51,200. Payment due in 30 days. (These supplies are expected to last for several months; debit the Office Supplies asset account.) Dec. Received 59,600 cash as advance payment on equipment rental from McNaner Construction Company. (Credit Unearned Rental Fees.) Dec. 12 Paid salaries of $6,240 for the first two weeks in December Dec. 15 Excluding the McNaner advance, equipment rental fees earned during the first 15 days of December amounted to $21, 600, of which $14,400 was received in cash Dec.17 Purchased on account from Earth Movers, Inc., 5720 in parts needed to perform basic maintenance on a rental tractor. Payment is due in 10 days Dec 23 Collected $2,400 of the accounts receivable recorded on December 15. Dec,26 Rented a backhoe to Mission Landscaping at a price of $300 per day, to be paid when the backhoe is returned Mission Landscaping expects to keep the backhoe for about two or three weeks Dec 26 Paid bisekly salaries, 56,240 Dec. 27 Paid the account payable to Earth Hovers, Inc., 5720 Dec 28 Declared a dividend of 12 cents per share, payable on January 15, Year 2 Dec. 29 Susquehanna Equipment Rentals was nosed, along with ission Landscaping and collier construction, co-defendant in $30,000 lawsuit fled on behalf of Kevin Davenport, Mission Landscaping had left the rented backhoe in a fenced construction site owned by Collier Construction. After working hours on December 26, Davenport had climbed the fence to play on parked construction equipment. While playing on the backhoe, he fell and broke his arm the extent of the company legal and Financial responsibility for this accident, if any, cannot be determined at this time. (Note: This event does not requires Journal entry at this time, but may require disclosure in notes according the statements Dec. 29 Purchased a 12-month public liability insurance policy for $11,520. This policy protects the company against liability for injuries and property damage caused by its equipment. However, the policy goes into effect on January 1, Year 2, and affords no coverage for the injuries sustained by Kevin Davenport on December 26. Dec.31 Received & bill from Universal Utilities for the month of December, $840. Payment is due in 30 days. Dec 31 Equipment rental fees earned during the second half of December amounted to $24,000, of which $18,720 was received in cash. Data for Adjusting Entries in Year 1 3. The advance payment of rent on December 1 covered a period of three months b. The annual interest rate on the note payable to Rent-It is 6 percent c. The rental equipment is being depreciated by the straight-line method over a period of eight years. Any salvage value at the end of its useful life is expected to be negligible and Immaterial d. office supplies on hand at December 31 are estimated at $720 e. During December, the company eamed $4,440 of the rental fees paid in advance by McNamer Construction Company on December 8 f. As of December 31, six days' rent on the backhoe rented to Mission Landscaping on December 26 has been earned. g. Salaries earned by employees since the last payroll date (December 26) amounted to $1680 at month-end h. It is estimated that the company is subject to a combined federal and state income tax rate of 40 percent of income before income taxes (total revenue minus all expenses other than income taxes). These taxes will be payable in Year 2 1 Requirement General Journal General Ledger Total Balance Income Statement Statement of Retained Parnings Balance Sheet Analysis Every journal entry must keep the accounting equation in balance. Prepare the journal entries for each of the transactions (1-17) entering the debits before the credits. Each transaction will automatically be posted to the General Lodger as soon as you click "Record Entry". Once you have reviewed the results then record the adjusting entries (18-25), and then the closing entries as well (26 29). If no journal entry is required, select "No journal entry required in the first account field. Show less ferences View transaction list Journal entry worksheet ..... Record the issuance of cash. Note: Enter debits before credits Date General Journal Debit Credit Dec 01 Record entry Clear entry View general Journal Journal entry worksheet Record the purchase of office supplies on account. Note: Enter debits before credits. Date General Journal Debit Credit Dec 04 Record entry Clear entry View general Journal N Journal entry worksheet 5 7 4 3 5 29 7 5 4 3 5 2. 8 General Journal Requirement General Ledger Trial Balance Income Statement Statement of Retained Earnings Analysis Balance Sheet Choose from the dropdown the view you wish to see; unadjusted, adjusted, or post-closing. Year 2019 represents Year 1 from the problem statement. Unadjusted SUSQUEHANNA EQUIPMENT RENTALS es Trial Balance December 31, 2019 Debit Credit Account Title 05 0 Total Requirement General Journal General Ledger Trial Balance Income Statement Statement of Retained Earnings Balance Sheet Analysis Use the drop-downs to select the accounts properly included on the income statement. The unadjusted, adjusted, or post- closing balances will appear for each account, based on your selection. Unadjusted SUSQUEHANNA EQUIPMENT RENTALS Income Statement For the Year Ended December 31, Year 1 Revenue Expenses Prey 1 of 1 Next Help Save & Exit SUB Saved e Problem Check my work taxes (total revenue minus all expenses other than income taxes), Inese taxes will be payable in Year 2 Analysis Balance Sheet General Journal General Ledger Income Statement Trial Balance Statement of Retained Earnings Requirement The unadjusted or adjusted balances will appear for each account, based on your selection. (Selecting Post-Closing will display ending balance only) Unadjusted SUSQUEHANNA EQUIPMENT RENTALS Statement of Retained Earnings For the Year Ended December 31, Yeat 1 Retained earnings, December 1, Year 1 $ 0 0 Rotained oaming, December 31, Yoar 1 (Income Statement Balance Sheet> Requirement General Journal General Ledger Trial Balance Income Statement Statement of Retained Balance Sheet Earnings Analysis Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Unadjusted SUSQUEHANNA EQUIPMENT RENTALS Balance Sheet December 31, Year 1 Assets Rental equipment 0 Total assets Liabilities & Stockholders' equity Balance Sheet Analysis General Journal Requirement Statement of Retained Earnings General Ledger Income Statement Trial Balance Answer the questions based on your work in the previous tabs During December, the company's cash balance foll from $240,000 to $78,000. Does this imply that the business is headed for insolvency in the near futuro? Would it be ethical for Patty Driver to maintain the accounting records for this company, or must they be maintained by someone who is independent of the organization? Balance Sheet