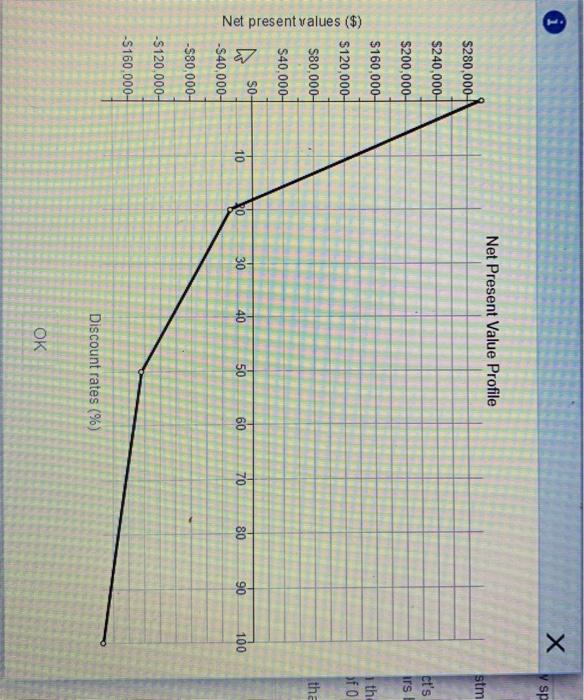

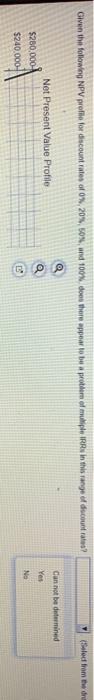

Comprehensive problem) Garmen Technologies Inc operates a small chain of specialty retail store throughout the southwestern part of the US The company markets based comumer products both in the and over het with sales spit roughly equally between the two channels of buion The company products Vange from radar detection devices and GPS mapping systems used in tomobiles to home based water monitoring Main The company recon began investigating the possible acquisition of goal warehousing faciuld be used both to stock is rutal shops and to make direct shipments to the firm's online stomers. The warehoune facility would require an expenditure of 251 000 for rented space in Oklahoma City Mahoma, and would provide a source of cash flow spanning the next 10 years. The estimated cash low areas os The negatiw.cath flow in year rellects the cost of a planned renovation and expansion of the facility Finally, in year 10 Gammenfas some recovery of investment at the case of the lease and cons igran cash flow Garmenses a discount rate of 124 percent in evaluating Is Investments As a prefinary step in analyzing the new investment Gaimer's management has decided to evaluate the projects anticipated paytac period. What is the proje's expected payback period Game CEO doned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period Specifically he ed to know what useful information the payback provides you were the analyst how would you respond to Me Gammen b. In the past, management has reled most exclusively on the IRR to make sestment choices However, in this stance the lead financial analyst on the project suggested that there may be a problem with the Emergver its Calculate the IRR for the orgie Evaluate the NPV of the role for discounts of percent 20 recent 50 percent and 100 percent. Does Game widmet schuively on the IRR es mentio However the methodnancial on the progested that the may be a problem with the because the sign on the cash flow changes three times over its Cake the IRR for the project Ev the NPV protein of the project docentes of percent, 20 percent 5 percent, and 100 percent there appear to be a problem of miles in the range of discount rates Calculate the NPV What does the NPV indicate about the potential are created by the project? Describe to Me Game what NPV means recognizing that he wasted as an engineer and has no formal hiss education Hallo, di wa customers. ine warenouse tacany would require an expenditure or >251,00U lof a rented space URM Llly, follows: The negative cash flow in year 5 reflects the cost of a planned renovation and expansion of the facility. Finally, in year 10 Garmen estimates some re higher than usual cash flow Garmen uses a discount rate of 12.4 percent in evaluating its investments a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flow wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead fin IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project fo there appear to be a problem of multiple IRRs in this range of discount rates? c. Calculate the project's NPV What does the NPV indicate about the potential value created by the project? Describe to Mr Garmen what NPV mo business education a. Given the cash flow information in the table, the payback period of the project is years. (Round to two decimal places.) The payback method tells you (Select the best choice below) O A. what the rate of return is for the investment OB. how long it takes you to recover your outflows of cash. OC. how much value you are adding or taking from the firm Click to select your answer(s) Type here to search o a sp Net Present Value Profile stm $280,000 $240,000 ct's Irs $200,000 $160,000 ith fo $120,000- $80,000 tha Net present values ($) $40.000 SO ho 10 30 40 50 60 70 80 90 100 -S40,000 -$80,000- -$120,000- -S160,000- Discount rates (%) OK Given the following NPV profile for discount rates of 0%,20% 50 und 100% does there appear to be protter of multiple IRR In this range of discount rates? Select from the one Can not be determined Net Present Value Profile doo Yes $280.000 $240.000 No c. The project's NPV is $(Round to the nearest dollar) A positive NPV implies: (Select the best choice below.) O A. nothing about the value of the company OB. value is added to the company If the project is undertaken O C. value is subtracted from the company if the project is undertaken on there is no channo in wala to the comnanu if the Comprehensive problem) Garmen Technologies Inc operates a small chain of specialty retail store throughout the southwestern part of the US The company markets based comumer products both in the and over het with sales spit roughly equally between the two channels of buion The company products Vange from radar detection devices and GPS mapping systems used in tomobiles to home based water monitoring Main The company recon began investigating the possible acquisition of goal warehousing faciuld be used both to stock is rutal shops and to make direct shipments to the firm's online stomers. The warehoune facility would require an expenditure of 251 000 for rented space in Oklahoma City Mahoma, and would provide a source of cash flow spanning the next 10 years. The estimated cash low areas os The negatiw.cath flow in year rellects the cost of a planned renovation and expansion of the facility Finally, in year 10 Gammenfas some recovery of investment at the case of the lease and cons igran cash flow Garmenses a discount rate of 124 percent in evaluating Is Investments As a prefinary step in analyzing the new investment Gaimer's management has decided to evaluate the projects anticipated paytac period. What is the proje's expected payback period Game CEO doned the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period Specifically he ed to know what useful information the payback provides you were the analyst how would you respond to Me Gammen b. In the past, management has reled most exclusively on the IRR to make sestment choices However, in this stance the lead financial analyst on the project suggested that there may be a problem with the Emergver its Calculate the IRR for the orgie Evaluate the NPV of the role for discounts of percent 20 recent 50 percent and 100 percent. Does Game widmet schuively on the IRR es mentio However the methodnancial on the progested that the may be a problem with the because the sign on the cash flow changes three times over its Cake the IRR for the project Ev the NPV protein of the project docentes of percent, 20 percent 5 percent, and 100 percent there appear to be a problem of miles in the range of discount rates Calculate the NPV What does the NPV indicate about the potential are created by the project? Describe to Me Game what NPV means recognizing that he wasted as an engineer and has no formal hiss education Hallo, di wa customers. ine warenouse tacany would require an expenditure or >251,00U lof a rented space URM Llly, follows: The negative cash flow in year 5 reflects the cost of a planned renovation and expansion of the facility. Finally, in year 10 Garmen estimates some re higher than usual cash flow Garmen uses a discount rate of 12.4 percent in evaluating its investments a. As a preliminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period. the analyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flow wanted to know what useful information the payback provides. If you were the analyst, how would you respond to Mr Garmen? b. In the past, Garmen's management has relied almost exclusively on the IRR to make its investment choices. However, in this instance the lead fin IRR because the sign on the cash flows changes three times over its life. Calculate the IRR for the project. Evaluate the NPV profile of the project fo there appear to be a problem of multiple IRRs in this range of discount rates? c. Calculate the project's NPV What does the NPV indicate about the potential value created by the project? Describe to Mr Garmen what NPV mo business education a. Given the cash flow information in the table, the payback period of the project is years. (Round to two decimal places.) The payback method tells you (Select the best choice below) O A. what the rate of return is for the investment OB. how long it takes you to recover your outflows of cash. OC. how much value you are adding or taking from the firm Click to select your answer(s) Type here to search o a sp Net Present Value Profile stm $280,000 $240,000 ct's Irs $200,000 $160,000 ith fo $120,000- $80,000 tha Net present values ($) $40.000 SO ho 10 30 40 50 60 70 80 90 100 -S40,000 -$80,000- -$120,000- -S160,000- Discount rates (%) OK Given the following NPV profile for discount rates of 0%,20% 50 und 100% does there appear to be protter of multiple IRR In this range of discount rates? Select from the one Can not be determined Net Present Value Profile doo Yes $280.000 $240.000 No c. The project's NPV is $(Round to the nearest dollar) A positive NPV implies: (Select the best choice below.) O A. nothing about the value of the company OB. value is added to the company If the project is undertaken O C. value is subtracted from the company if the project is undertaken on there is no channo in wala to the comnanu if the