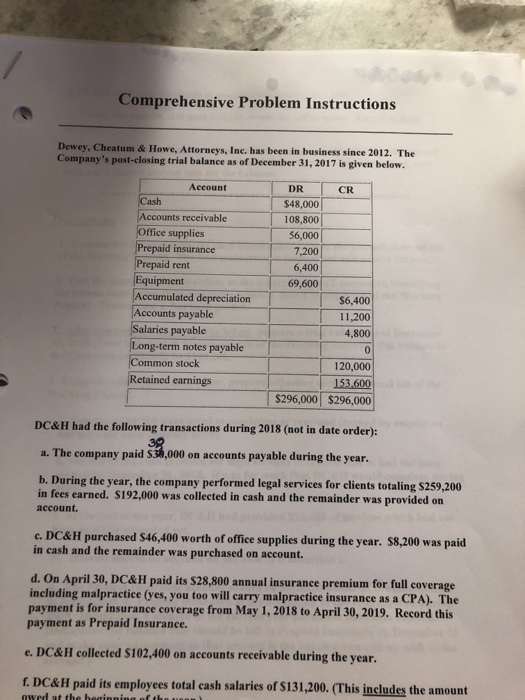

Comprehensive Problem Instructions Dewey, Cheatum & Howe, Attorneys, Inc. has been in business sinee 2012. The Company's post-closing trial balance as of December 31, 2017 is given below. Account DR CR Cash Accounts receivable 108,800 Office supplies Prepaid insurance Prepaid rent Equipment Accumulated depreciation Accounts payable Salaries payable $48,000 56,000 7.200 6,400 69,600 $6,400 11,200 4,800 Long-term notes payable Common stock Retained earnings 120,000 153.600 $296,000 $296,000 DC&H had the following transactions during 2018 (not in date order): a. The company paid S38,000 on accounts payable during the year. b. During the year, the company performed legal services for elients totaling $259,200 in fees earned. $192,000 was collected in cash and the remainder was provided on account. e. DC&H purchased $46,400 worth of office supplies during the year. S8,200 was paid in cash and the remainder was purchased on account. d. On April 30, DC&H paid its $28,800 annual insurance premium for full coverage including malpractice (yes, you too will carry malpractice insurance as a CPA). The payment is for insurance coverage from May 1, 2018 to April 30, 2019. Record this payment as Prepaid Insurance. e. DC&H collected $102,400 on accounts receivable during the year. f. DC&H paid its employees total cash salaries of S131,200. (This includes the amount Comprehensive Problem Instructions Dewey, Cheatum & Howe, Attorneys, Inc. has been in business sinee 2012. The Company's post-closing trial balance as of December 31, 2017 is given below. Account DR CR Cash Accounts receivable 108,800 Office supplies Prepaid insurance Prepaid rent Equipment Accumulated depreciation Accounts payable Salaries payable $48,000 56,000 7.200 6,400 69,600 $6,400 11,200 4,800 Long-term notes payable Common stock Retained earnings 120,000 153.600 $296,000 $296,000 DC&H had the following transactions during 2018 (not in date order): a. The company paid S38,000 on accounts payable during the year. b. During the year, the company performed legal services for elients totaling $259,200 in fees earned. $192,000 was collected in cash and the remainder was provided on account. e. DC&H purchased $46,400 worth of office supplies during the year. S8,200 was paid in cash and the remainder was purchased on account. d. On April 30, DC&H paid its $28,800 annual insurance premium for full coverage including malpractice (yes, you too will carry malpractice insurance as a CPA). The payment is for insurance coverage from May 1, 2018 to April 30, 2019. Record this payment as Prepaid Insurance. e. DC&H collected $102,400 on accounts receivable during the year. f. DC&H paid its employees total cash salaries of S131,200. (This includes the amount