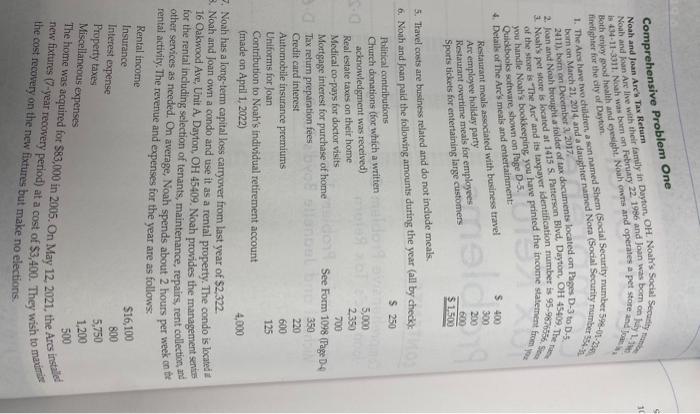

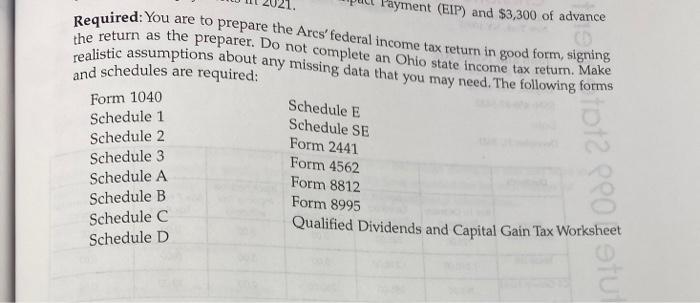

Comprehensive Problem One Both enjoy good heith and ejoigh bern on March 21, 2014, and a da a the 2. Joun and Noah brought a folder of tax documents located on Pages D-3 to D.5. 3. Noah's pet store is located at 1415S. Patterson Blva. Daytorn, OIf 4S40 D. -5. you handle Noah's bookkeeping rou have pro. 4. 5. Travel costs are business related and do not include meals 7. Noah has a long-term capital loss carryover from last year of $2,322. Noah and Joan own a condo and use it as a rental property. The condo is located at 16 Oakwood Ave, Unit A. Dayton, OH 45409. Noah provides the management senis for the rental including selection of tenants, maintenance, repairs, rent collection, and other services as needed. On average, Noah spends about 2 hours per week co th rental activity. The revenue and expenses for the vear aro ac fnllows: new fixtures (7-yearmen ior 383,000 in 2005. On May 12, 2021, the Arcs irstaled the cost recovery (7-year recovery period) at a cost of $3,400. They wish to mavifis Required: You are to prepare the Arcs' federal income tax return in good form, signing the return as the preparer. Do not complete an Ohio state income tax return. Make realistic assumptions about any missing data that you may need. The followinn forme and schedules are required: Comprehensive Problem One Both enjoy good heith and ejoigh bern on March 21, 2014, and a da a the 2. Joun and Noah brought a folder of tax documents located on Pages D-3 to D.5. 3. Noah's pet store is located at 1415S. Patterson Blva. Daytorn, OIf 4S40 D. -5. you handle Noah's bookkeeping rou have pro. 4. 5. Travel costs are business related and do not include meals 7. Noah has a long-term capital loss carryover from last year of $2,322. Noah and Joan own a condo and use it as a rental property. The condo is located at 16 Oakwood Ave, Unit A. Dayton, OH 45409. Noah provides the management senis for the rental including selection of tenants, maintenance, repairs, rent collection, and other services as needed. On average, Noah spends about 2 hours per week co th rental activity. The revenue and expenses for the vear aro ac fnllows: new fixtures (7-yearmen ior 383,000 in 2005. On May 12, 2021, the Arcs irstaled the cost recovery (7-year recovery period) at a cost of $3,400. They wish to mavifis Required: You are to prepare the Arcs' federal income tax return in good form, signing the return as the preparer. Do not complete an Ohio state income tax return. Make realistic assumptions about any missing data that you may need. The followinn forme and schedules are required