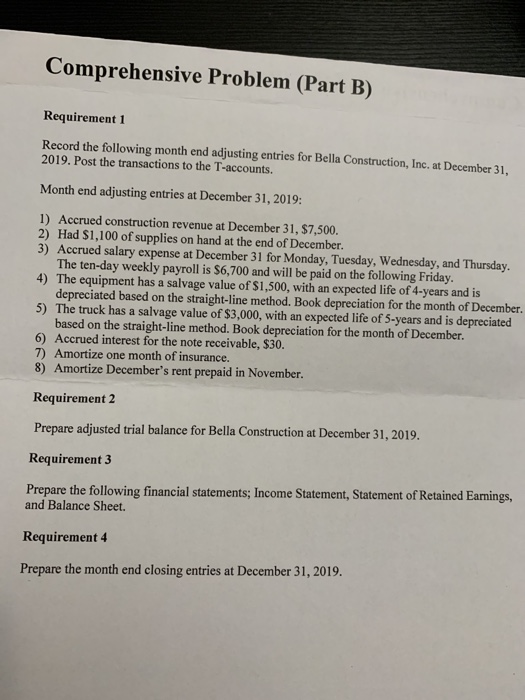

Comprehensive Problem (Part B) Requirement 1 Record the following month end adjusting entries for Bella Construction, Inc. at December 31, 2019. Post the transactions to the T-accounts Month end adjusting entries at December 31, 2019: 1) Accrued construction revenue at December 31, $7,500 2) Had $1,100 of supplies on hand at the end of December. 3) Accrued salary expense at December 31 for Monday, Tuesday, Wednesday, and Thursday. The ten-day weekly payroll is $6,700 and will be paid on the following Friday. 4) The equipment has a salvage value of $1,500, with an expected life of 4-years and is depreciated based on the straight-line method. Book depreciation for the month of December. 5) The truck has a salvage value of $3,000, with an expected life of 5-years and is depreciated based on the straight-line method. Book depreciation for the month of December. 6) Accrued interest for the note receivable, $30. 7) Amortize one month of insurance. 8) Amortize December's rent prepaid in November. Requirement 2 Prepare adjusted trial balance for Bella Construction at December 31, 2019. Requirement 3 Prepare the following financial statements; Income Statement, Statement of Retained Earnings, and Balance Sheet Requirement 4 Prepare the month end closing entries at December 31, 2019. Comprehensive Problem (Part B) Requirement 1 Record the following month end adjusting entries for Bella Construction, Inc. at December 31, 2019. Post the transactions to the T-accounts Month end adjusting entries at December 31, 2019: 1) Accrued construction revenue at December 31, $7,500 2) Had $1,100 of supplies on hand at the end of December. 3) Accrued salary expense at December 31 for Monday, Tuesday, Wednesday, and Thursday. The ten-day weekly payroll is $6,700 and will be paid on the following Friday. 4) The equipment has a salvage value of $1,500, with an expected life of 4-years and is depreciated based on the straight-line method. Book depreciation for the month of December. 5) The truck has a salvage value of $3,000, with an expected life of 5-years and is depreciated based on the straight-line method. Book depreciation for the month of December. 6) Accrued interest for the note receivable, $30. 7) Amortize one month of insurance. 8) Amortize December's rent prepaid in November. Requirement 2 Prepare adjusted trial balance for Bella Construction at December 31, 2019. Requirement 3 Prepare the following financial statements; Income Statement, Statement of Retained Earnings, and Balance Sheet Requirement 4 Prepare the month end closing entries at December 31, 2019