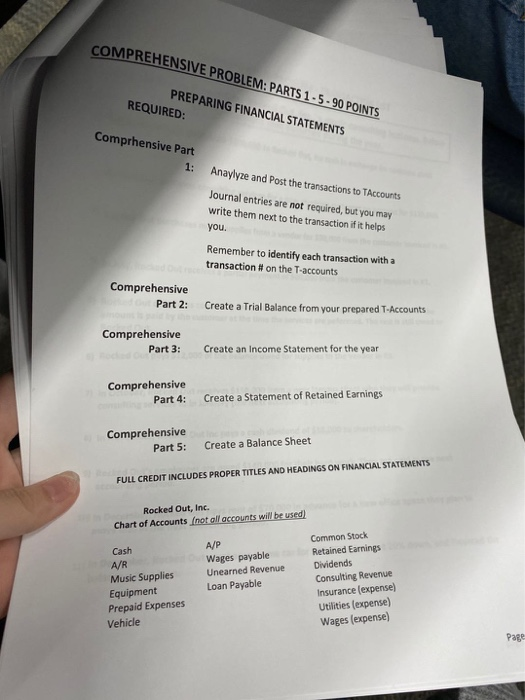

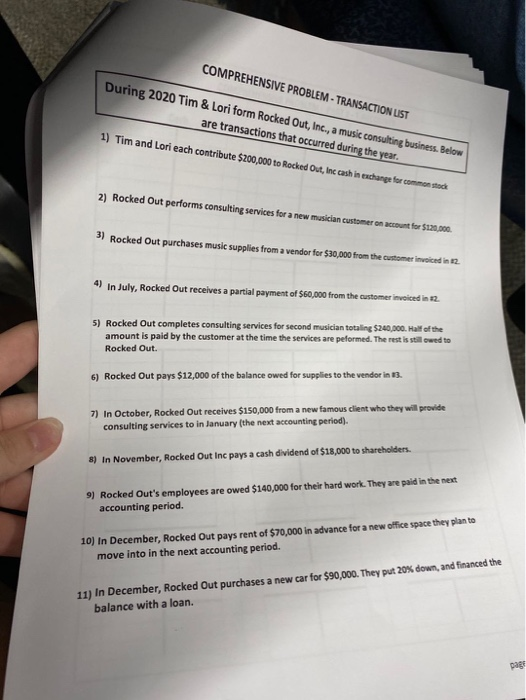

COMPREHENSIVE PROBLEM: PARTS 1 - 5 - 90 POINTS PREPARING FINANCIAL STATEMENTS REQUIRED: Comprhensive Part 1: Anaylyze and Post the transactions to Accounts Journal entries are not required, but you may write them next to the transaction if it helps you. Remember to identify each transaction with a transaction on the T-accounts Comprehensive Part 2: Create a Trial Balance from your prepared T-Accounts Comprehensive Farts: Part 3: Create an Income Statement for the year Comprehensive Part 4: Create a Statement of Retained Earnings Comprehensive Part 5: Create a Balance Sheet FULL CREDIT INCLUDES PROPER TITLES AND HEADINGS ON FINANCIAL STATEMENTS Rocked Out, Inc. Chart of Accounts (not all accounts will be used) A/P Cash A/R Wages payable Unearned Revenue Loan Payable Music Supplies Equipment Prepaid Expenses Vehicle Common Stock Retained Earnings Dividends Consulting Revenue Insurance (expense) Utilities (expense) Wages (expense) Page COMPREHENSIVE PROBLEM - TRANSACTION LIST During 2020 Tim & Lori form Rocked Out, Inc., a music consulting business. Below are transactions that occurred during the year. 1) Tim and Lori each contribute $200,000 to Rocked Out, Inc cash in exchange for common stock 2) Rocked Out performs consulting services for a new musician customer on account for $120.000 3) Rocked Out purchases music supplies from a vender for $30,000 from the customer invoiced in 12 4) In July, Rocked Out receives a partial payment of $60,000 from the customer invoiced in 12 5) Rocked Out completes consulting services for second musician totaling $240.000. Half of the amount is paid by the customer at the time the services are peformed. The rest is still owed to Rocked Out. 6) Rocked Out pays $12,000 of the balance owed for supplies to the vendor in 13. 7) in October, Rocked Out receives $150,000 from a new famous client who they will provide consulting services to in January (the next accounting period). 8) in November, Rocked Out Inc pays a cash dividend of $18,000 to shareholders 9) Rocked Out's employees are owed $140,000 for their hard work. They are paid in the next accounting period. 10) In December, Rocked Out pays rent of $70,000 in advance for a new office space they plan to move into in the next accounting period. 11) In December, Rocked Out purchases a new car for $90,000. They put 20% down, and financed the balance with a loan