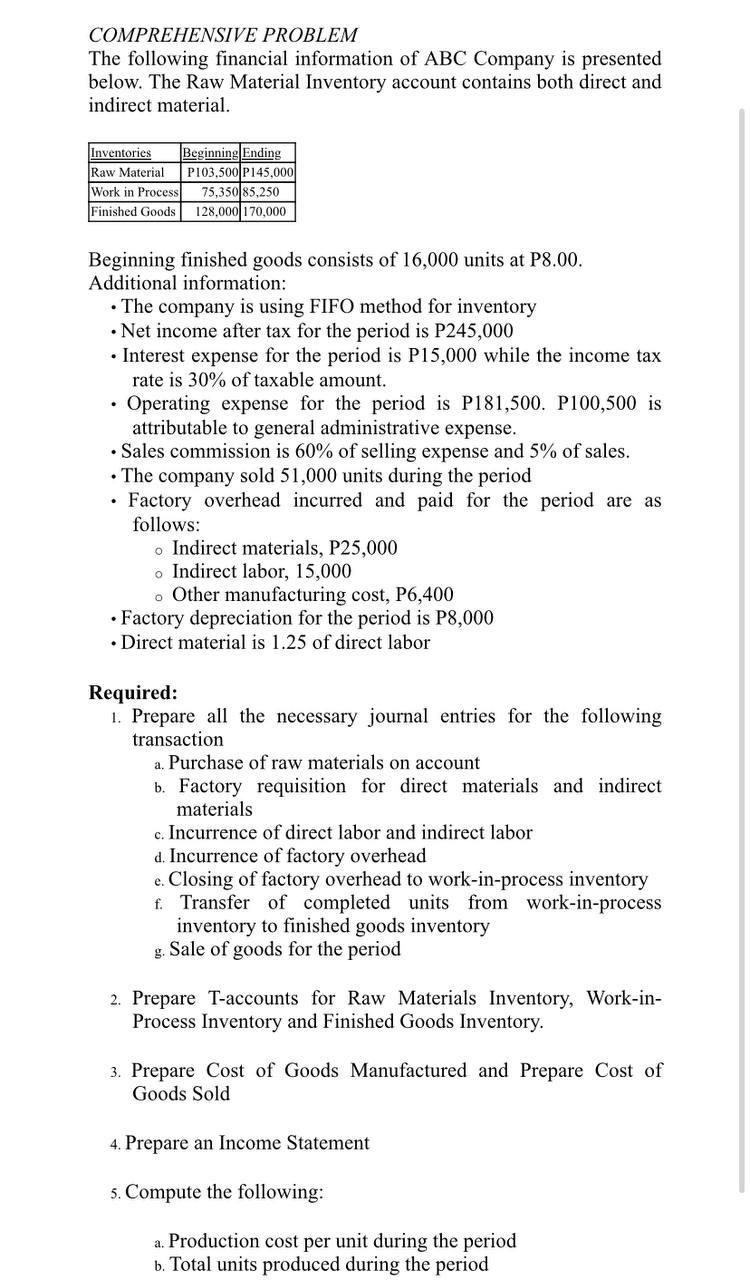

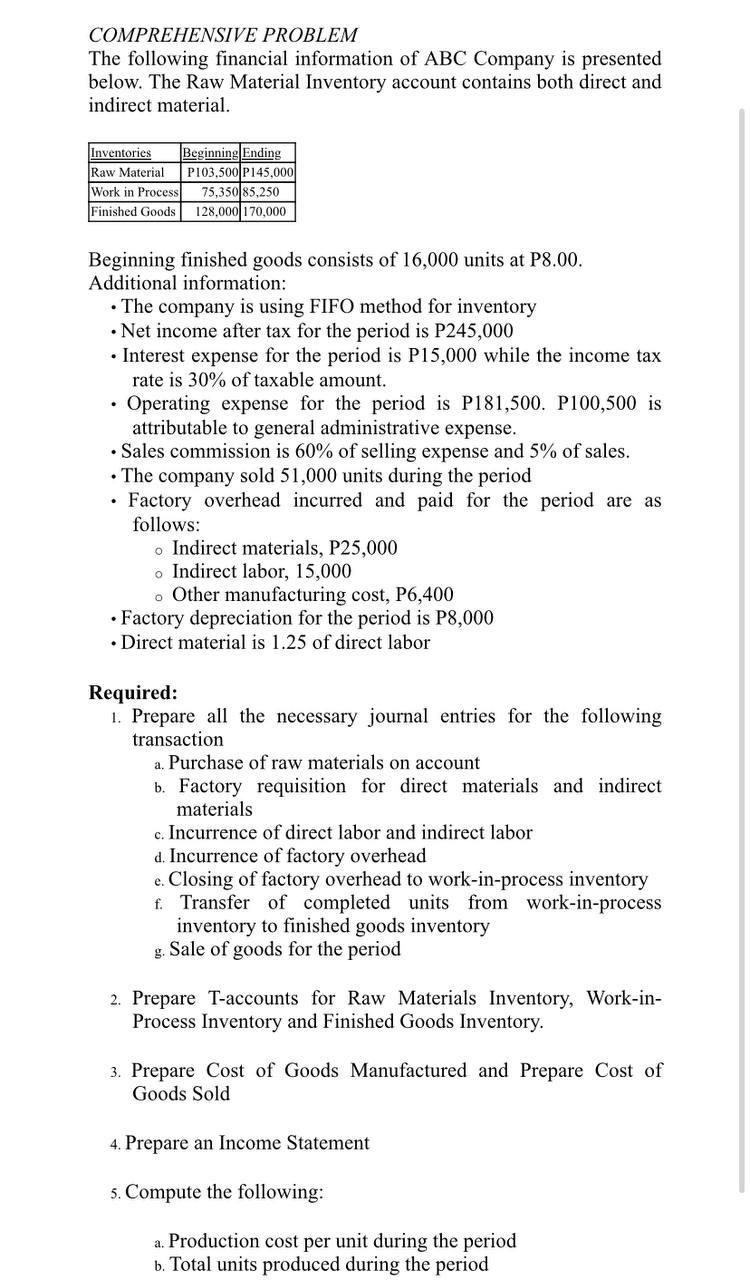

COMPREHENSIVE PROBLEM The following financial information of ABC Company is presented below. The Raw Material Inventory account contains both direct and indirect material. Beginning finished goods consists of 16,000 units at P8.00. Additional information: - The company is using FIFO method for inventory - Net income after tax for the period is P245,000 - Interest expense for the period is P15,000 while the income tax rate is 30% of taxable amount. - Operating expense for the period is P181,500. P100,500 is attributable to general administrative expense. - Sales commission is 60% of selling expense and 5% of sales. - The company sold 51,000 units during the period - Factory overhead incurred and paid for the period are as follows: - Indirect materials, P25,000 - Indirect labor, 15,000 - Other manufacturing cost, P6,400 - Factory depreciation for the period is P8,000 - Direct material is 1.25 of direct labor Required: 1. Prepare all the necessary journal entries for the following transaction a. Purchase of raw materials on account b. Factory requisition for direct materials and indirect materials c. Incurrence of direct labor and indirect labor d. Incurrence of factory overhead e. Closing of factory overhead to work-in-process inventory f. Transfer of completed units from work-in-process inventory to finished goods inventory g. Sale of goods for the period 2. Prepare T-accounts for Raw Materials Inventory, Work-inProcess Inventory and Finished Goods Inventory. 3. Prepare Cost of Goods Manufactured and Prepare Cost of Goods Sold 4. Prepare an Income Statement 5. Compute the following: a. Production cost per unit during the period b. Total units produced during the period COMPREHENSIVE PROBLEM The following financial information of ABC Company is presented below. The Raw Material Inventory account contains both direct and indirect material. Beginning finished goods consists of 16,000 units at P8.00. Additional information: - The company is using FIFO method for inventory - Net income after tax for the period is P245,000 - Interest expense for the period is P15,000 while the income tax rate is 30% of taxable amount. - Operating expense for the period is P181,500. P100,500 is attributable to general administrative expense. - Sales commission is 60% of selling expense and 5% of sales. - The company sold 51,000 units during the period - Factory overhead incurred and paid for the period are as follows: - Indirect materials, P25,000 - Indirect labor, 15,000 - Other manufacturing cost, P6,400 - Factory depreciation for the period is P8,000 - Direct material is 1.25 of direct labor Required: 1. Prepare all the necessary journal entries for the following transaction a. Purchase of raw materials on account b. Factory requisition for direct materials and indirect materials c. Incurrence of direct labor and indirect labor d. Incurrence of factory overhead e. Closing of factory overhead to work-in-process inventory f. Transfer of completed units from work-in-process inventory to finished goods inventory g. Sale of goods for the period 2. Prepare T-accounts for Raw Materials Inventory, Work-inProcess Inventory and Finished Goods Inventory. 3. Prepare Cost of Goods Manufactured and Prepare Cost of Goods Sold 4. Prepare an Income Statement 5. Compute the following: a. Production cost per unit during the period b. Total units produced during the period