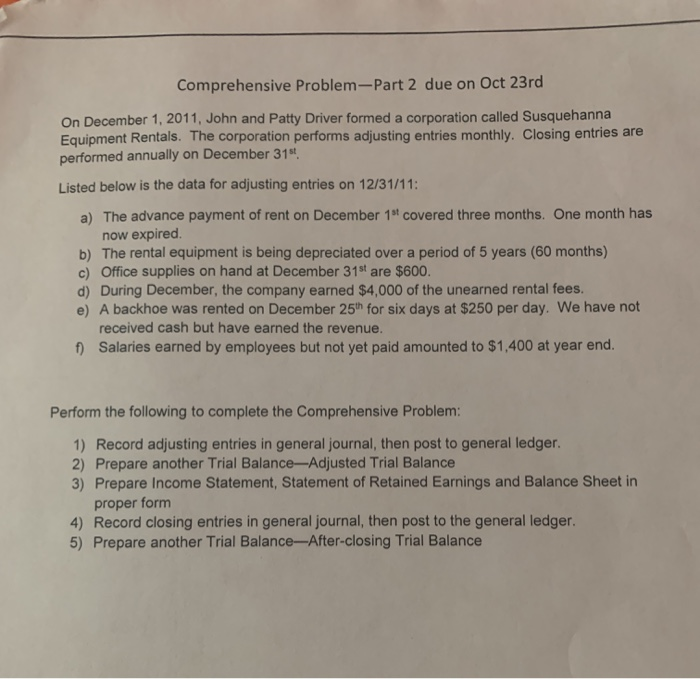

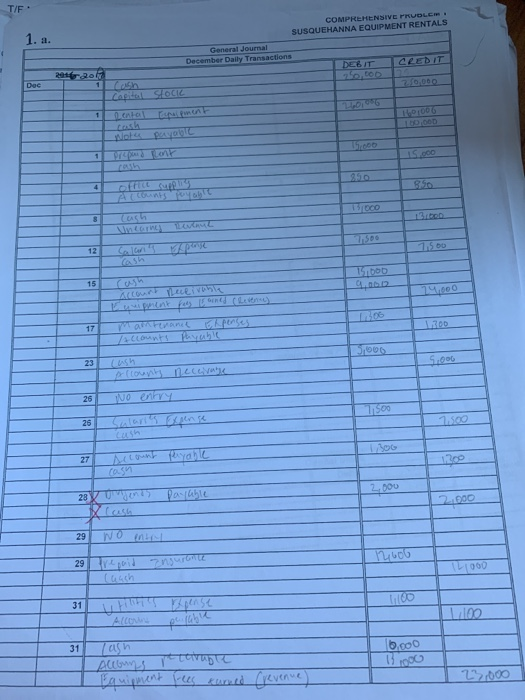

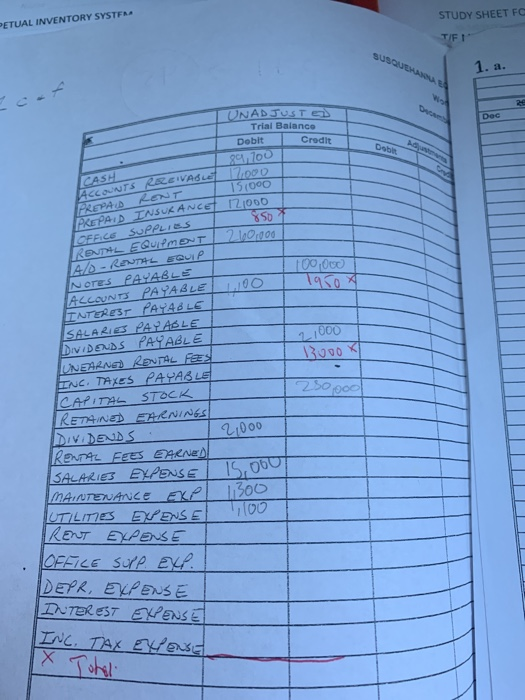

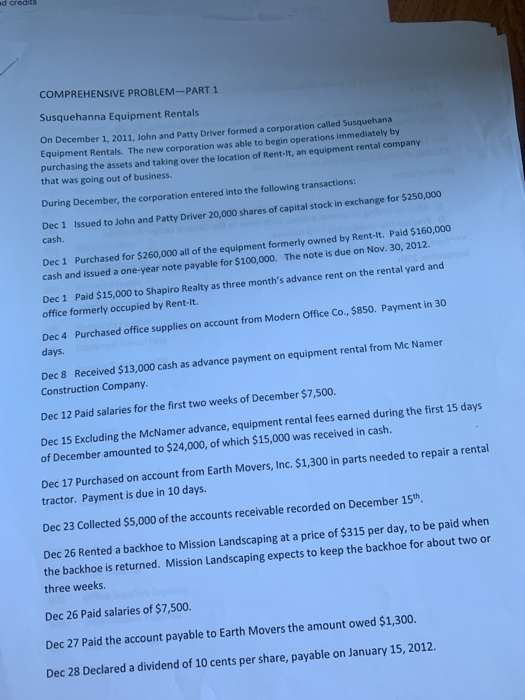

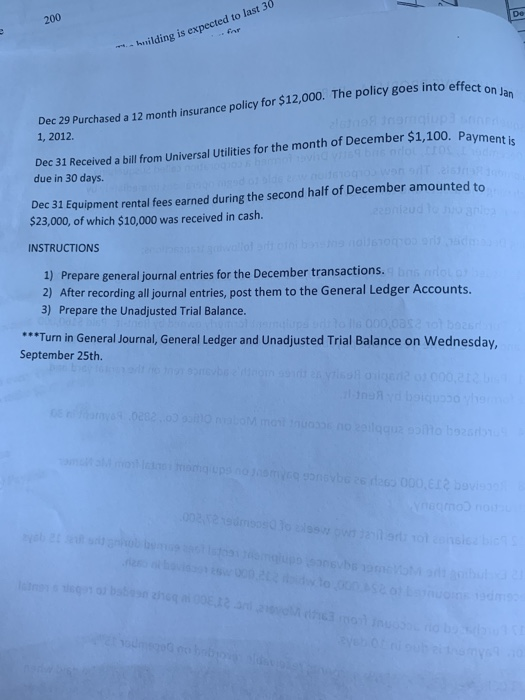

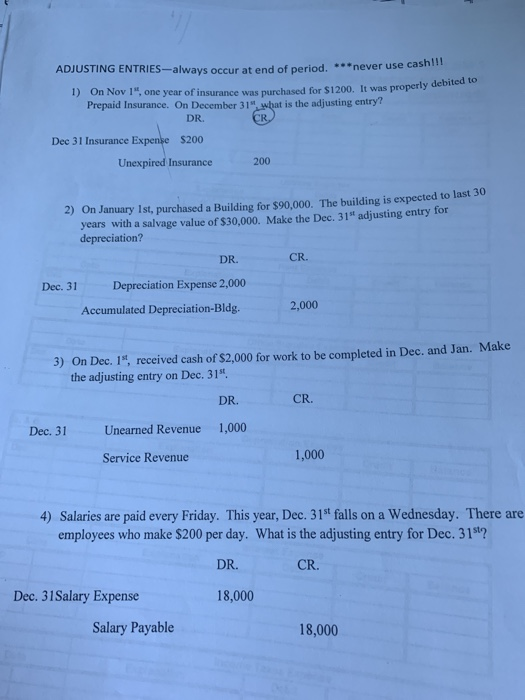

Comprehensive Problem-Part 2 due on Oct 23rd On December 1, 2011, John and Patty Driver formed a corporation called Susquehanna Equipment Rentals. The corporation performs adjusting entries monthly. Closing entries are performed annually on December 31st Listed below is the data for adjusting entries on 12/31/11: a) The advance payment of rent on December 1" covered three months. One month has now expired. b) The rental equipment is being depreciated over a period of 5 years (60 months) c) Office supplies on hand at December 31st are $600. d) During December, the company earned $4,000 of the unearned rental fees. e) A backhoe was rented on December 25th for six days at $250 per day. We have not received cash but have earned the revenue. f) Salaries earned by employees but not yet paid amounted to $1,400 at year end. Perform the following to complete the Comprehensive Problem: 1) Record adjusting entries in general journal, then post to general ledger. 2) Prepare another Trial Balance-Adjusted Trial Balance 3) Prepare Income Statement, Statement of Retained Earnings and Balance Sheet in proper form 4) Record closing entries in general journal, then post to the general ledger. 5) Prepare another Trial Balance-After-closing Trial Balance COMPREHENSIVE PRVOLE. SUSQUEHANNA EQUIPMENT RENTALS General Journal December Daily Trans 2 DEBIT CREDIT 1 _ n E SOCIE TOTO Lis000 DF Uncong Calari's at pense DO Lyuipment for oned (Revenne) mantenance Phpenses DO tous levik 25 NO entry - 25 Sularis canse Ti 500 COS 28 y u n poste 2.000 00 29 NOLI 29 repilnu 1 960 100 Tash Allbuns petarul b.000 100 2000 STUDY SHEET FC PETUAL INVENTORY SYSTEM UNADJUST Trial Balance Debit Credit 904,100 151000 S01 100,000 19 wes ReciVADL7. / 150 PREPARANT PREPAID INSURANCE 1Z1000 OFFICE SUPPLIES RED EQUIPMENT 100 4/-Rew EQUIP Neres PAUABLE ACCOUNTS PAYABLEDO INTEREST PAYABLE SALARIS PAYABLET DIVIDEUDS PAYABLE UNEARNS RENTAL Fes ENC TAXES PAYABLE CAPITAL STOCK RE74E) EXNINGS DIVADES. 2000 2,000 13000x 1 250 000 Rennel FEES EARNED SALARIES EXPENSE 15,000 IMAINTENANCE EXPL 1.300 UTILIT PENSE 100 Rent EXPENSE OFFICE SUPP. EXP. DEPR, EXPENSE DUTER EST EXPENSE INC. TAX Eyes x Johal COMPREHENSIVE PROBLEM-PART 1 Susquehanna Equipment Rentals On December 1, 2011, John and Patty Driver formed a corporation called Susquehana Equipment Rentals. The new corporation was able to begin operations immediately by purchasing the assets and taking over the location of Rent It, an equipment rental company that was going out of business. During December, the corporation entered into the following transactions: Dec 1 Issued to John and Patty Driver 20,000 shares of capital stock in exchange for $250,000 cash Dec 1 Purchased for $260,000 all of the equipment formerly owned by Rent-it. Paid $160,000 cash and issued a one-year note payable for $100,000. The note is due on Nov. 30, 2012 Dec 1 Paid $15,000 to Shapiro Realty as three month's advance rent on the rental yard and office formerly occupied by Rent-it. Dec 4 Purchased office supplies on account from Modern Office Co., $850. Payment in 30 days. Dec 8 Received $13,000 cash as advance payment on equipment rental from Mc Namer Construction Company. Dec 12 Paid salaries for the first two weeks of December $7,500. Dec 15 Excluding the McNamer advance, equipment rental fees earned during the first 15 days of December amounted to $24,000, of which $15,000 was received in cash. Dec 17 Purchased on account from Earth Movers, Inc. $1,300 in parts needed to repair a rental tractor. Payment is due in 10 days. Dec 23 Collected $5,000 of the accounts receivable recorded on December 15, Dec 26 Rented a backhoe to Mission Landscaping at a price of $315 per day, to be paid when the backhoe is returned. Mission Landscaping expects to keep the backhoe for about two or three weeks. Dec 26 Paid salaries of $7,500. Dec 27 Paid the account payable to Earth Movers the amount owed $1,300. Dec 28 Declared a dividend of 10 cents per share, payable on January 15, 2012. 200 huilding is expected to last 30 effect on Jan Dec 29 Purchased a 12 month insurance policy for $12,000. The policy goes into effect her $1,100. Payment is 1, 2012 Dec 31 Received a bill from Universal Utilities for the month of December 31.100 due in 30 days. Dec 31 Equipment rental fees earned during the second half of December amounted to $23,000, of which $10,000 was received in cash. INSTRUCTIONS 1) Prepare general journal entries for the December transactions. no 2) After recording all journal entries, post them to the General Ledger Accounts. 3) Prepare the Unadjusted Trial Balance. ***Turn in General Journal, General Ledger and Unadjusted Trial Balance on Wednesday, September 25th. botas de 000 ne bough 020 no quanto 925 og pey nov 26 25 000, bove os lo blow to the Dobsome Odwood hamon ADJUSTING ENTRIES-always occur at end of period. ***never use cash 1) On Nov 1", one year of insurance was purchased for $1200. It was properly debited Prepaid Insurance. On December 31" what is the adjusting entry? DR. CR Dec 31 Insurance Expense $200 Unexpired Insurance 200 2) On January 1st, purchased a Building for $90,000. The building is expected to last 3 years with a salvage value of $30,000. Make the Dec. 31" adjusting entry for depreciation? DR. CR. Dec. 31 Depreciation Expense 2,000 Accumulated Depreciation-Bldg. 2,000 3) On Dec. 1", received cash of $2,000 for work to be completed in Dec. and Jan. Make the adjusting entry on Dec. 31s! DR. CR. Dec. 31 Unearned Revenue 1,000 Service Revenue 1,000 4) Salaries are paid every Friday. This year, Dec. 31" falls on a Wednesday. There are employees who make $200 per day. What is the adjusting entry for Dec. 3157 DR. CR. Dec. 31Salary Expense 18,000 Salary Payable 18,000