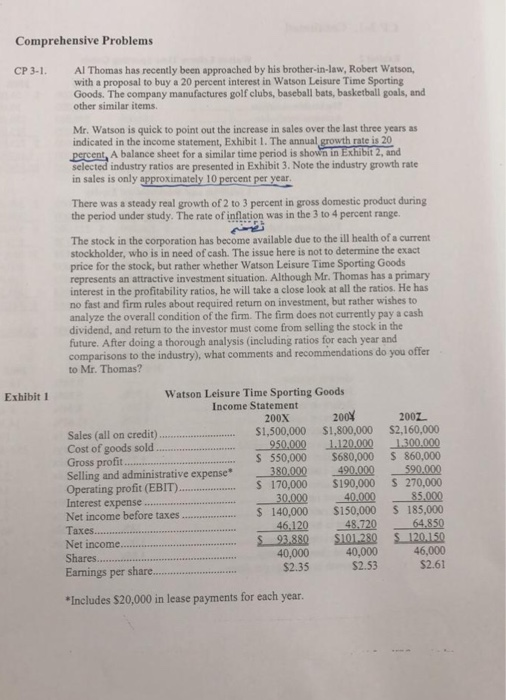

Comprehensive Problems Al Thomas has recently been approached by his brother-in-law, Robert Watson, with a proposal to buy a 20 percent interest in Watson Leisure Time Sporting Goods. The company manufactures golf clubs, baseball bats, basketball goals, and other similar items. CP3-1. Mr. Watson is quick to point out the increase in sales over the last three years as indicated in the income statement, Exhibit 1. The annual growth rate is 20 ent, A balance sheet for a similar time period is shown in selected industry ratios are presented in Exhibit 3. Note the industry growth rate in sales is only approximately 10 percent per year There was a steady real growth of 2 to 3 percent in gross domestic product during the period under study. The rate of inflation was in the 3 to 4 percent range. The stock in the corporation has become available due to the ill health of a current stockholder, who is in need of cash. The issue here is not to determine the exact price for the stock, but rather whether Watson Leisure Time Sporting Goods represents an attractive investment situation. Although Mr. Thomas has a primary interest in the profitability ratios, he will take a close look at all the ratios. He has no fast and firm rules about required return on investment, but rather wishes to analyze the overall condition of the firm. The firm does not currently pay a cash dividend, and return to the investor must come from selling the stock in the future. After doing a thorough analysis (including ratios for each year and comparisons to the industry), what comments and recommendations do you offer to Mr. Thomas? Watson Leisure Time Sporting Goods Income Statement Exhibit 1 200x 200% 2002 Sales (all on credit$1,500,000 Cost of goods sol.d. Gross profit Selling and administrative expense* $1,800,000 S2,160,000 950,000 1120.000 1300.000 S550,000 $680,000 860,000 590000 Operating profit (EBIT.S 170,000 $190,000 S 270,000 Interest expense. Net income before Taxes Net income Shares Earnings per share -380,000-490000 30.000-40.000 46,120 48.720 40,000 85.000 taxe.140,000 $150,000 S 185,000 40,000 $2.35 $2.53 46,000 $2.61 Includes $20,000 in lease payments for each year