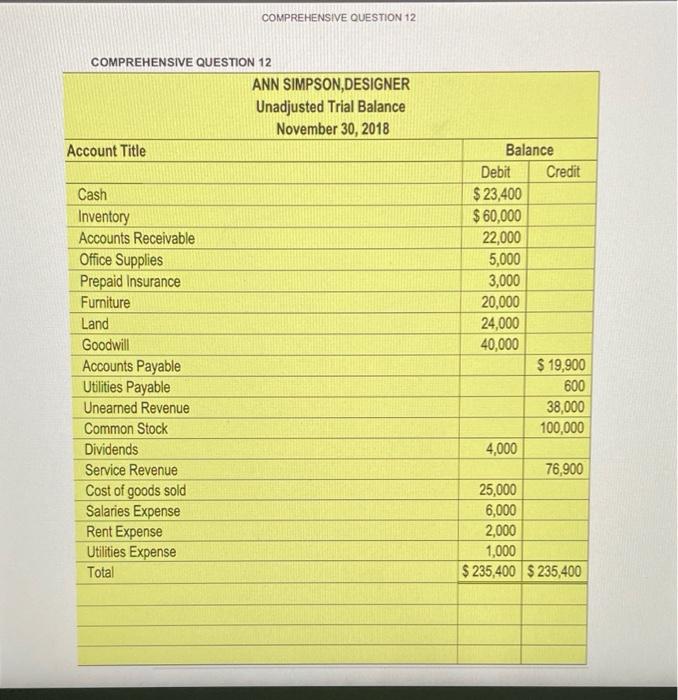

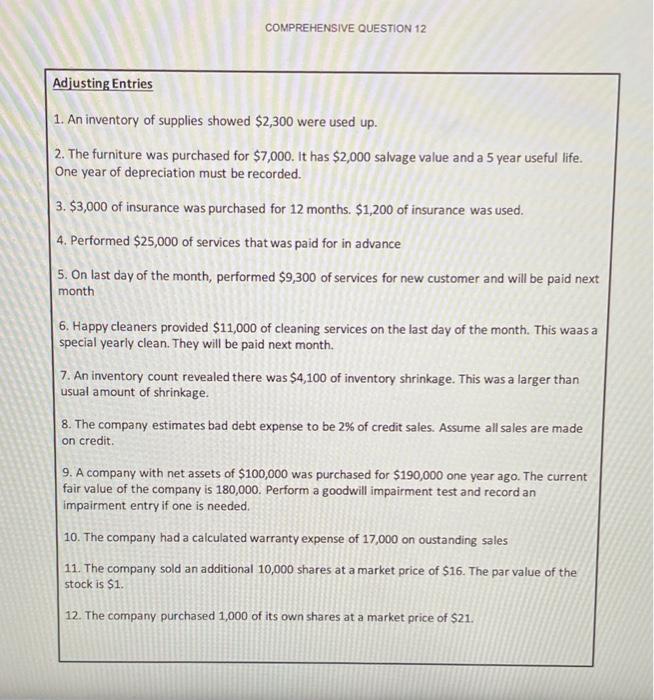

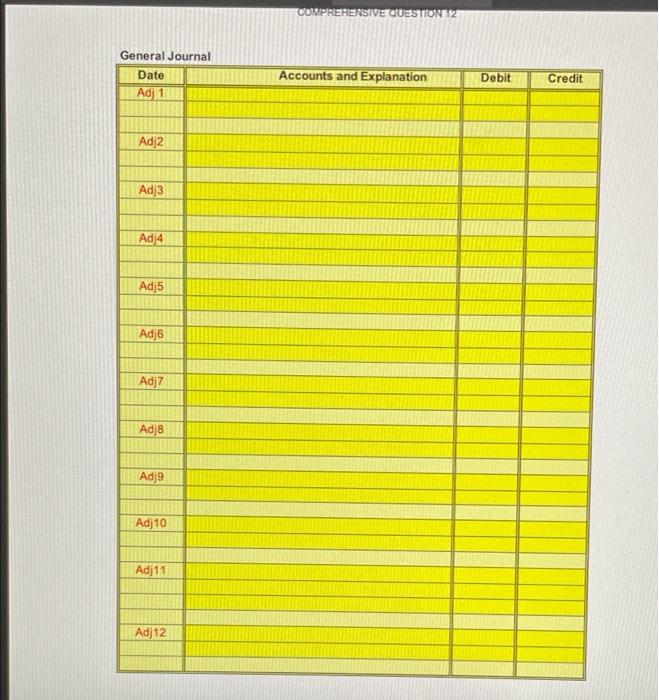

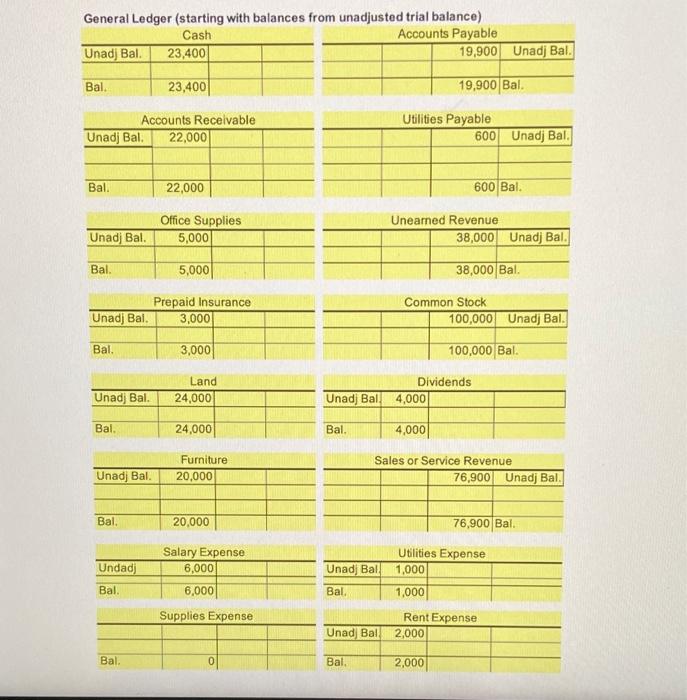

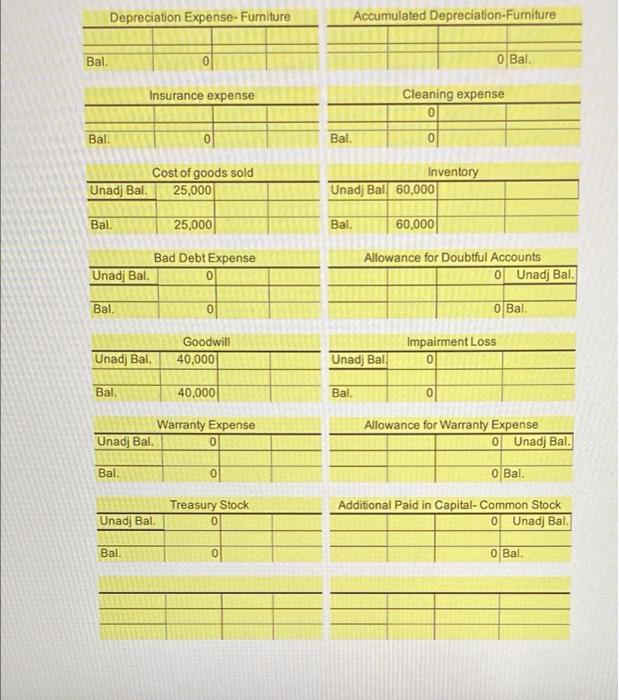

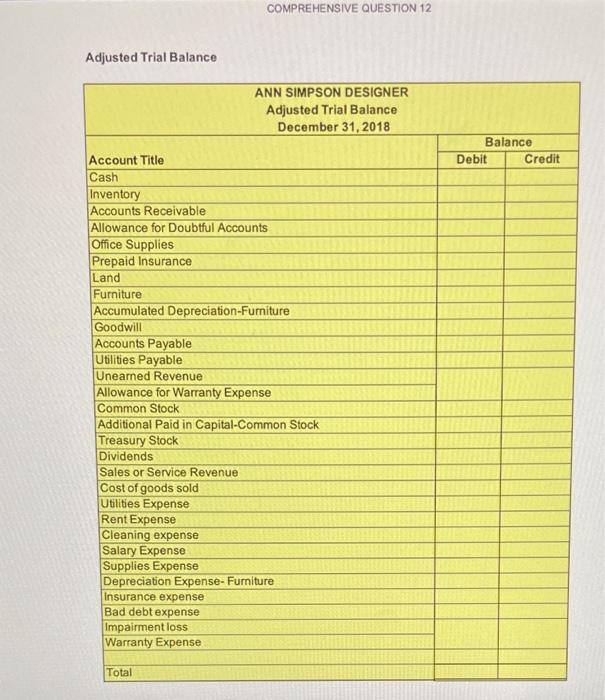

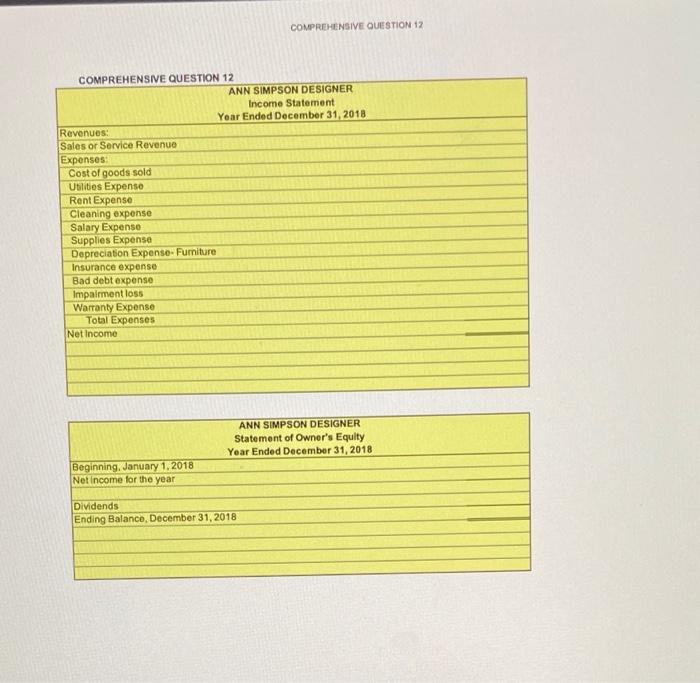

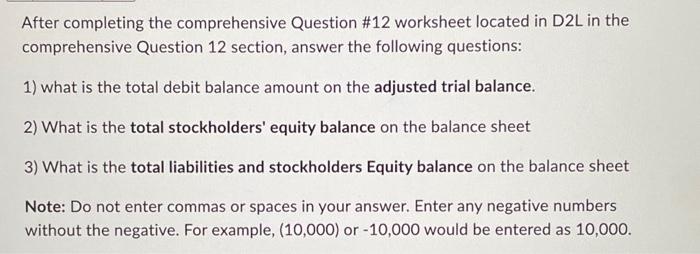

COMPREHENSIVE QUESTION 12 1. An inventory of supplies showed $2,300 were used up. 2. The furniture was purchased for $7,000. It has $2,000 salvage value and a 5 year useful life. One year of depreciation must be recorded. 3. $3,000 of insurance was purchased for 12 months. $1,200 of insurance was used. 4. Performed $25,000 of services that was paid for in advance 5. On last day of the month, performed $9,300 of services for new customer and will be paid next month 6. Happy cleaners provided $11,000 of cleaning services on the last day of the month. This waas a special yearly clean. They will be paid next month. 7. An inventory count revealed there was $4,100 of inventory shrinkage. This was a larger than usual amount of shrinkage. 8. The company estimates bad debt expense to be 2% of credit sales. Assume all sales are made on credit. 9. A company with net assets of $100,000 was purchased for $190,000 one year ago. The current fair value of the company is 180,000. Perform a goodwill impairment test and record an impairment entry if one is needed. 10. The company had a calculated warranty expense of 17,000 on oustanding sales 11. The company sold an additional 10,000 shares at a market price of $16. The par value of the stock is $1. 12. The company purchased 1,000 of its own shares at a market price of $21. General Journal General Ledger (starting with balances from unadjusted trial balance) \begin{tabular}{l|c|lll|l|r|r|} \multicolumn{3}{c|}{ Cash } & \multicolumn{3}{c|}{ Accounts Payable } \\ \cline { 1 - 7 } Unadj Bal. & 23,400 & & & & 19,900 & Unadj Bal. \\ \hline & & & & & & \\ \hline & 23,400 & & & & & 19,900 Bal. \end{tabular} \begin{tabular}{l|c|l|ll|c|c|c} \multicolumn{3}{c}{ Office Supplies } & & \multicolumn{3}{c}{ Uneamed Revenue } \\ \cline { 1 - 7 } Unadj Bal. & 5,000 & & & & 38,000 & Unadj Bal. \\ \hline & & & & & & & \\ \hline & 5,000 & & & & & 38,000 & Bal. \end{tabular} \begin{tabular}{l|r|lll|l|l|l} \multicolumn{3}{c}{ Prepaid Insurance } & & \multicolumn{3}{c}{ Common Stock } \\ \cline { 1 - 7 } Unadj Bal. & 3,000 & & & & & 100,000 & Unadj Bal. \\ \cline { 1 - 7 } & & & & & & & \\ \hline Bal. & 3,000 & & & & 100,000 Bal. \end{tabular} \begin{tabular}{l|r|r|r} \multicolumn{4}{c|}{ Depreciation Expense-Fumiture } \\ \hline & & & \\ \hline & 0 & \\ \hline Bal. & 0 & \end{tabular} 11 COMPREHENSIVE OUESTION 17 After completing the comprehensive Question #12 worksheet located in D2L in the comprehensive Question 12 section, answer the following questions: 1) what is the total debit balance amount on the adjusted trial balance. 2) What is the total stockholders' equity balance on the balance sheet 3) What is the total liabilities and stockholders Equity balance on the balance sheet Note: Do not enter commas or spaces in your answer. Enter any negative numbers without the negative. For example, (10,000) or 10,000 would be entered as 10,000