Answered step by step

Verified Expert Solution

Question

1 Approved Answer

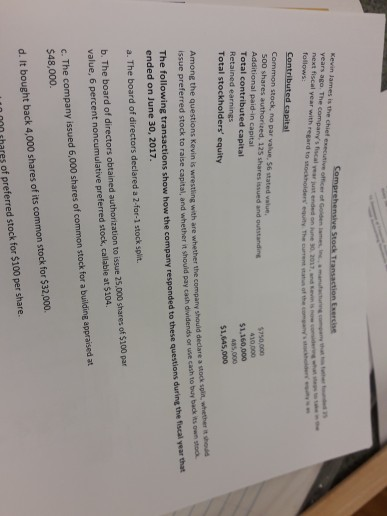

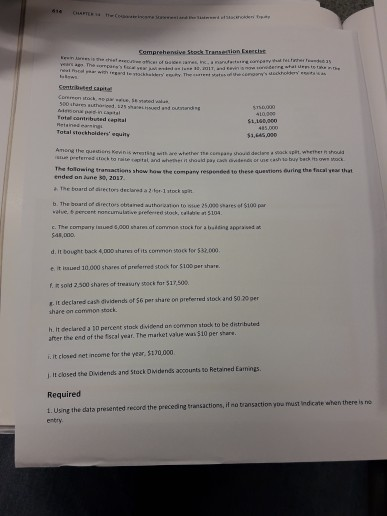

Comprehensive Stock Transaction Exercise years ago the company's 2017 next fiscal year with regar follows: Contributed capital Common stock, no par value, 56 stated 500

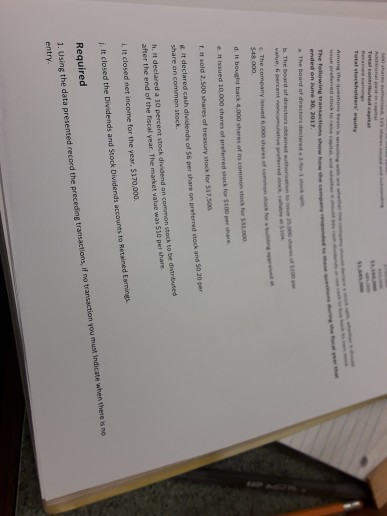

Comprehensive Stock Transaction Exercise years ago the company's 2017 next fiscal year with regar follows: Contributed capital Common stock, no par value, 56 stated 500 shares authorized, 125 shares issued and outstanding Additional paid in capital Total contributed capital Retained earnings Total stockholders' equity $750,000 410,000 $1,100,000 485,000 $1,645,000 one che questions Kevin is wrestling with are whether the company should declare a stackson issue preferred stock to raise capital and whether it should pay cash dividends or use cash to buy back is own The following transactions show how the company responded to these questions during the face ended on June 30, 2017. a. The board of directors declared a 2-for-1 stock split. b. The board of directors obtained authorization to issue 25,000 shares of $100 par value, 6 percent noncumulative preferred stock, callable at $104. c. The company issued 6,000 shares of common stock for a building appraised at $48,000 d. It bought back 4,000 shares of its common stock for $32,000 m shares of preferred stock for $100 per share. b. The board of directors obtained company red 6,000 shares of commentform d. It bought back 4,000 shares of its common to for $1.000 e. It issued 10.000 shares of preferred stock for $100 per har sold 2,500 shares of treasury stock for $17.500 it declared cash dividends of $6 per share on preferred stock and share an common stock true I declared a 10 percent stock dividend on common stock to be after the end of the fiscal year. The market value was Sie per 1. It closed net income for the year, $170,000 It closed the Dividends and Stock Dividends accounts to Retained Estes Required 1. Using the data presented record the preceding transactions, if no transaction you must indicate when there is no entry Comprehensive Stock Transextion Exch $1,445,000 que ens wat w e were con i decisockpit.wherethodla to tal and w i ld pay to reach a buy back to Hollowing transactions show how the company responded to these questions curing the finale that ended on ne 2 2017 The board of recordeclareda t ok a b. The board of directors and wh o wice 25.000 shares of $100 par c. The compartyid 6,000 shares of common stock for a bating apparaat d. I bought back 4,000 shares of its common for $32.000 tid 10.000 shares o prerred stock for $10 per share 1. od 2500 shares of treasury stock for $17.500 20 per It declared cash dividends of 56 per share on preferred stock and share on common stock h. It declared a 10 percent stock died on common stock to be distributed after the end of the scal year. The market value was $10 per share. i.it closed reincome for the year $110.000 It closed the Dividends and Stock O dends accounts to Retained Earnings. Required 1. Using the data presented record the preceding transactions, if no transaction you must indicate when there is no

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started