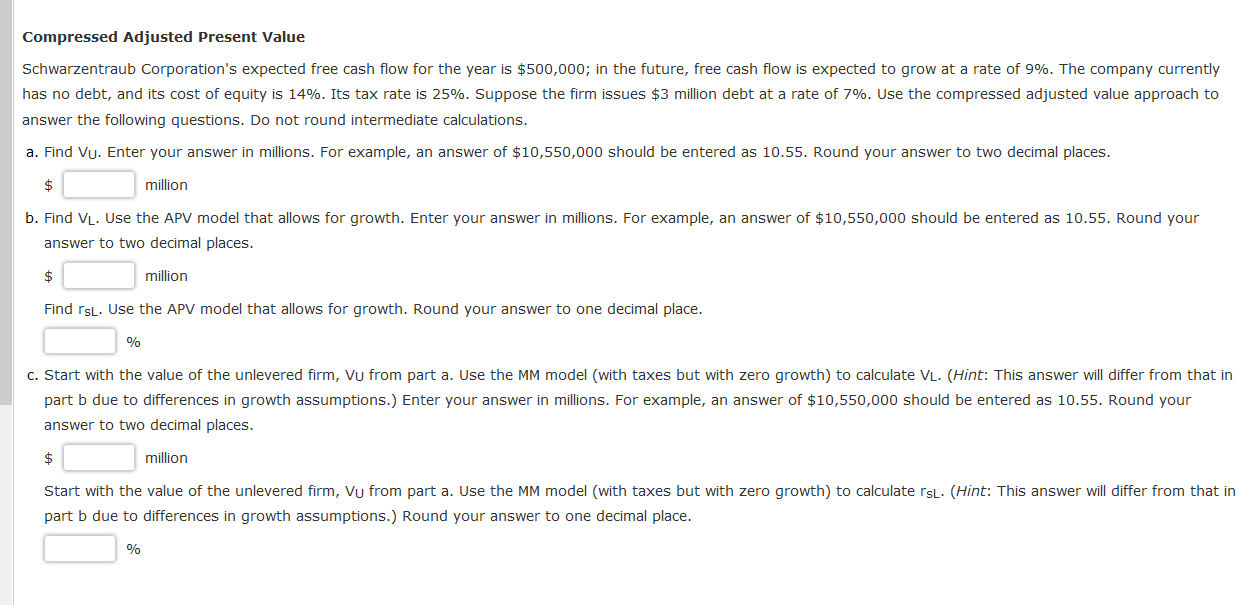

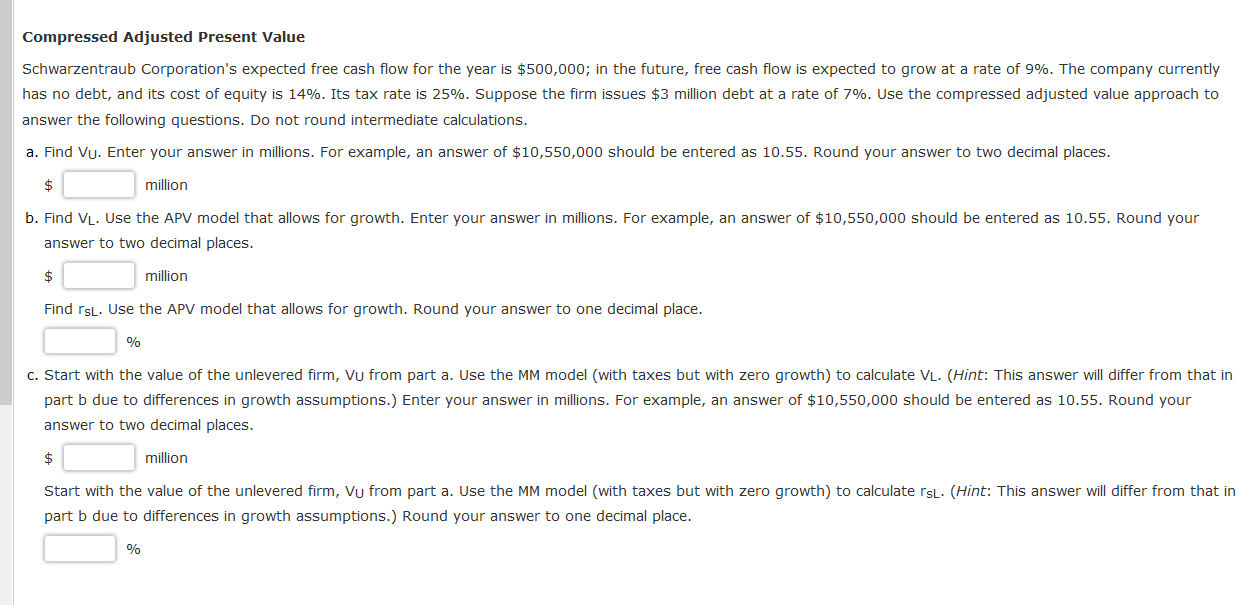

Compressed Adjusted Present Value answer the following questions. Do not round intermediate calculations. a. Find Vu. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. $ million b. Find VL. Use the APV model that allows for growth. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. \$ million Find rsL. Use the APV model that allows for growth. Round your answer to one decimal place. % c. Start with the value of the unlevered firm, VU from part a. Use the MM model (with taxes but with zero growth) to calculate VL. (Hint: This answer will differ from that in part b due to differences in growth assumptions.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. \$ million Start with the value of the unlevered firm, VU from part a. Use the MM model (with taxes but with zero growth) to calculate rsL. (Hint: This answer will differ from that in part b due to differences in growth assumptions.) Round your answer to one decimal place. % Compressed Adjusted Present Value answer the following questions. Do not round intermediate calculations. a. Find Vu. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. $ million b. Find VL. Use the APV model that allows for growth. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. \$ million Find rsL. Use the APV model that allows for growth. Round your answer to one decimal place. % c. Start with the value of the unlevered firm, VU from part a. Use the MM model (with taxes but with zero growth) to calculate VL. (Hint: This answer will differ from that in part b due to differences in growth assumptions.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. \$ million Start with the value of the unlevered firm, VU from part a. Use the MM model (with taxes but with zero growth) to calculate rsL. (Hint: This answer will differ from that in part b due to differences in growth assumptions.) Round your answer to one decimal place. %