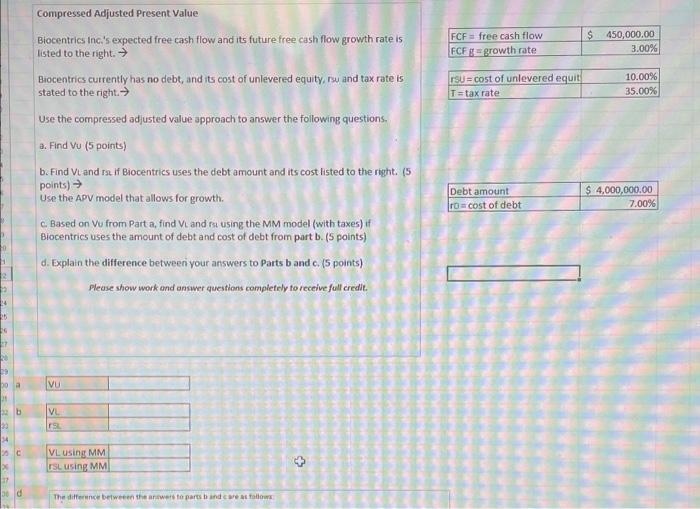

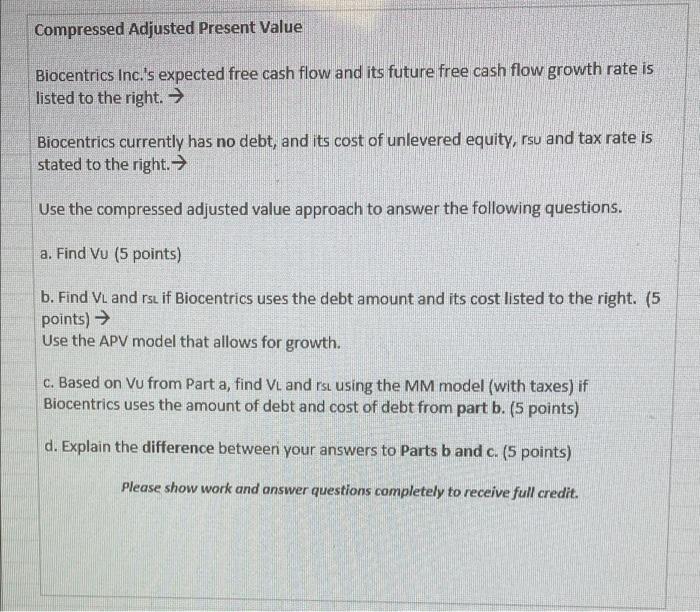

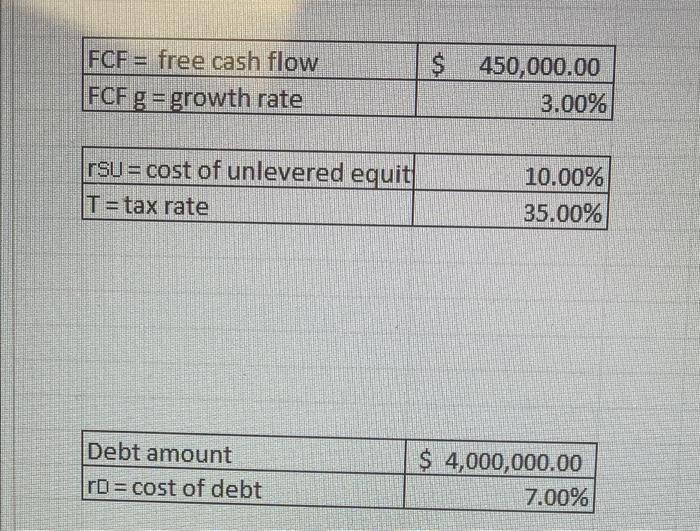

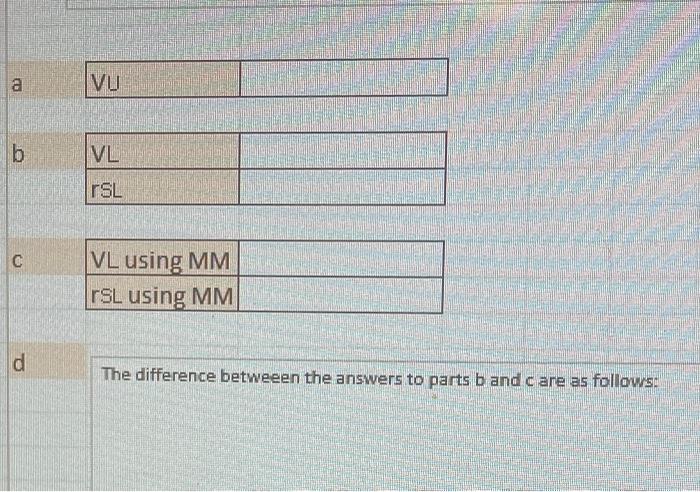

Compressed Adjusted Present Value $ FCF free cash flow FCF B growth rate 450,000.00 3.00% TSU = cost of unlevered equit T=tax rate 10.00% 35.00% Biocentrics Inc.'s expected free cash flow and its future free cash flow growth rate is listed to the right. Biocentrics currently has no debt, and its cost of unlevered equity, rw and tax rate is stated to the right.- Use the compressed adjusted value approach to answer the following questions a. Find Vu (5 points) b. Find VL and ta if Biocentrics uses the debt amount and its cost listed to the right. (5 points) Use the APV model that allows for growth. C. Based on Vu from Part a, find V and rau using the MM model (with taxes) f Biocentrics uses the amount of debt and cost of debt from part b. (5 points) d. Explain the difference between your answers to Parts band e. (5 points) Please show work and answer questions completely to receive full credit. Debt amount ro e cost of debt $ 4,000,000.00 7.00% 2 19 o a VU b VL 14 SC VL using MM ISL using MM + 17 bed The difference between theaters to parts and crew Compressed Adjusted Present Value Biocentrics Inc.'s expected free cash flow and its future free cash flow growth rate is listed to the right. Biocentrics currently has no debt, and its cost of unlevered equity, rsu and tax rate is stated to the right. Use the compressed adjusted value approach to answer the following questions. a. Find Vu (5 points) b. Find VL and rs if Biocentrics uses the debt amount and its cost listed to the right. (5 points) Use the APV model that allows for growth. C. Based on Vu from Part a, find V and rs using the MM model (with taxes) if Biocentrics uses the amount of debt and cost of debt from part b. (5 points) d. Explain the difference between your answers to Parts b and c. (5 points) Please show work and answer questions completely to receive full credit. FCF = free cash flow FCF g = growth rate $ $ 450,000.00 3.00% rsu = cost of unlevered equit| T=tax rate 10.00% 35.00% Debt amount ID = cost of debt $ 4,000,000.00 7.00% a CO IVU b VL FSL C VL using MM rSL using MM d The difference betweeen the answers to parts b and care as follows: Compressed Adjusted Present Value $ FCF free cash flow FCF B growth rate 450,000.00 3.00% TSU = cost of unlevered equit T=tax rate 10.00% 35.00% Biocentrics Inc.'s expected free cash flow and its future free cash flow growth rate is listed to the right. Biocentrics currently has no debt, and its cost of unlevered equity, rw and tax rate is stated to the right.- Use the compressed adjusted value approach to answer the following questions a. Find Vu (5 points) b. Find VL and ta if Biocentrics uses the debt amount and its cost listed to the right. (5 points) Use the APV model that allows for growth. C. Based on Vu from Part a, find V and rau using the MM model (with taxes) f Biocentrics uses the amount of debt and cost of debt from part b. (5 points) d. Explain the difference between your answers to Parts band e. (5 points) Please show work and answer questions completely to receive full credit. Debt amount ro e cost of debt $ 4,000,000.00 7.00% 2 19 o a VU b VL 14 SC VL using MM ISL using MM + 17 bed The difference between theaters to parts and crew Compressed Adjusted Present Value Biocentrics Inc.'s expected free cash flow and its future free cash flow growth rate is listed to the right. Biocentrics currently has no debt, and its cost of unlevered equity, rsu and tax rate is stated to the right. Use the compressed adjusted value approach to answer the following questions. a. Find Vu (5 points) b. Find VL and rs if Biocentrics uses the debt amount and its cost listed to the right. (5 points) Use the APV model that allows for growth. C. Based on Vu from Part a, find V and rs using the MM model (with taxes) if Biocentrics uses the amount of debt and cost of debt from part b. (5 points) d. Explain the difference between your answers to Parts b and c. (5 points) Please show work and answer questions completely to receive full credit. FCF = free cash flow FCF g = growth rate $ $ 450,000.00 3.00% rsu = cost of unlevered equit| T=tax rate 10.00% 35.00% Debt amount ID = cost of debt $ 4,000,000.00 7.00% a CO IVU b VL FSL C VL using MM rSL using MM d The difference betweeen the answers to parts b and care as follows