Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Computation (write out the Excel function used with right parameters) 1. If you inherited $50,000 today and invested all of in mutual fund earning an

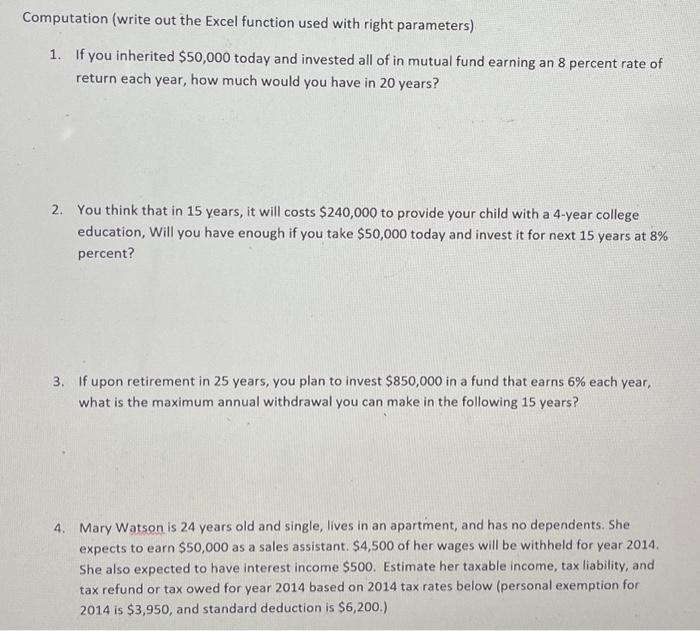

Computation (write out the Excel function used with right parameters) 1. If you inherited $50,000 today and invested all of in mutual fund earning an 8 percent rate of return each year, how much would you have in 20 years? 2. You think that in 15 years, it will costs $240,000 to provide your child with a 4-year college education, Will you have enough if you take $50,000 today and invest it for next 15 years at 8% percent? 3. If upon retirement in 25 years, you plan to invest $850,000 in a fund that earns 6% each year, what is the maximum annual withdrawal you can make in the following 15 years? 4. Mary Watson is 24 years old and single, lives in an apartment, and has no dependents. She expects to earn $50,000 as a sales assistant. $4,500 of her wages will be withheld for year 2014. She also expected to have interest income $500. Estimate her taxable income, tax liability, and tax refund or tax owed for year 2014 based on 2014 tax rates below (personal exemption for 2014 is $3,950, and standard deduction is $6,200.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started