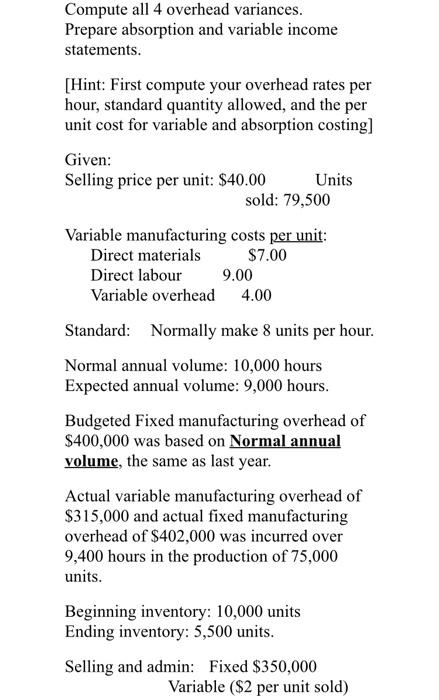

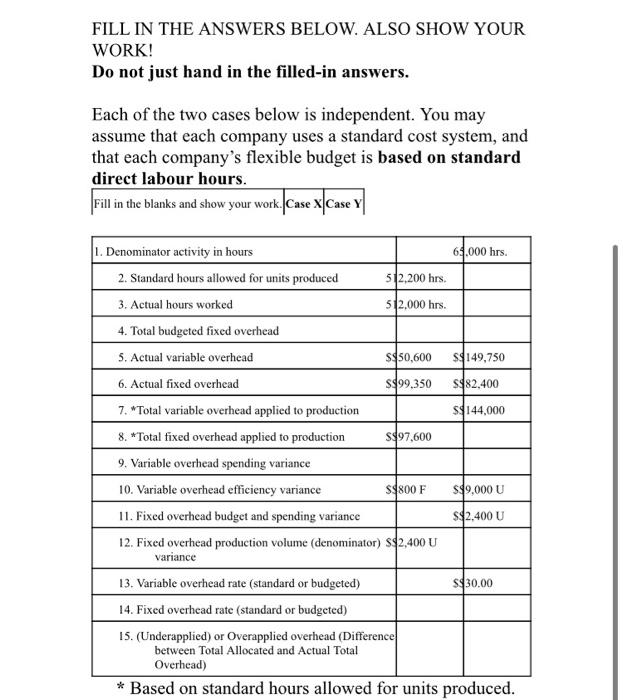

Compute all 4 overhead variances. Prepare absorption and variable income statements. [Hint: First compute your overhead rates per hour, standard quantity allowed, and the per unit cost for variable and absorption costing] Given: Selling price per unit: $40.00 Units sold: 79,500 Variable manufacturing costs per unit: Direct materials $7.00 Direct labour 9.00 Variable overhead 4.00 Standard: Normally make 8 units per hour. Normal annual volume: 10,000 hours Expected annual volume: 9,000 hours. Budgeted Fixed manufacturing overhead of $400,000 was based on Normal annual volume, the same as last year. Actual variable manufacturing overhead of $315,000 and actual fixed manufacturing overhead of $402,000 was incurred over 9,400 hours in the production of 75,000 units. Beginning inventory: 10,000 units Ending inventory: 5,500 units. Selling and admin: Fixed $350,000 Variable ($2 per unit sold) FILL IN THE ANSWERS BELOW. ALSO SHOW YOUR WORK! Do not just hand in the filled-in answers. Each of the two cases below is independent. You may assume that each company uses a standard cost system, and that each company's flexible budget is based on standard direct labour hours. Fill in the blanks and show your work. Case Case X 64.000 hrs. 1. Denominator activity in hours 2. Standard hours allowed for units produced 512.200 hrs. 3. Actual hours worked 512.000 hrs. 4. Total budgeted fixed overhead 5. Actual variable overhead $50,600 $$149,750 6. Actual fixed overhead $$99.350 S$82,400 7. Total variable overhead applied to production S$144,000 8. *Total fixed overhead applied to production $$97,600 9. Variable overhead spending variance 10. Variable overhead efficiency variance $$800 F $$9,000 U 11. Fixed overhead budget and spending variance $$2.400 U 12. Fixed overhead production volume denominator) S$2,400 U variance 13. Variable overhead rate (standard or budgeted) $$30.00 14. Fixed overhead rate (standard or budgeted) 15. (Underapplied) or Overapplied overhead (Difference between Total Allocated and Actual Total Overhead) * Based on standard hours allowed for units produced. Compute all 4 overhead variances. Prepare absorption and variable income statements. [Hint: First compute your overhead rates per hour, standard quantity allowed, and the per unit cost for variable and absorption costing] Given: Selling price per unit: $40.00 Units sold: 79,500 Variable manufacturing costs per unit: Direct materials $7.00 Direct labour 9.00 Variable overhead 4.00 Standard: Normally make 8 units per hour. Normal annual volume: 10,000 hours Expected annual volume: 9,000 hours. Budgeted Fixed manufacturing overhead of $400,000 was based on Normal annual volume, the same as last year. Actual variable manufacturing overhead of $315,000 and actual fixed manufacturing overhead of $402,000 was incurred over 9,400 hours in the production of 75,000 units. Beginning inventory: 10,000 units Ending inventory: 5,500 units. Selling and admin: Fixed $350,000 Variable ($2 per unit sold) FILL IN THE ANSWERS BELOW. ALSO SHOW YOUR WORK! Do not just hand in the filled-in answers. Each of the two cases below is independent. You may assume that each company uses a standard cost system, and that each company's flexible budget is based on standard direct labour hours. Fill in the blanks and show your work. Case Case X 64.000 hrs. 1. Denominator activity in hours 2. Standard hours allowed for units produced 512.200 hrs. 3. Actual hours worked 512.000 hrs. 4. Total budgeted fixed overhead 5. Actual variable overhead $50,600 $$149,750 6. Actual fixed overhead $$99.350 S$82,400 7. Total variable overhead applied to production S$144,000 8. *Total fixed overhead applied to production $$97,600 9. Variable overhead spending variance 10. Variable overhead efficiency variance $$800 F $$9,000 U 11. Fixed overhead budget and spending variance $$2.400 U 12. Fixed overhead production volume denominator) S$2,400 U variance 13. Variable overhead rate (standard or budgeted) $$30.00 14. Fixed overhead rate (standard or budgeted) 15. (Underapplied) or Overapplied overhead (Difference between Total Allocated and Actual Total Overhead) * Based on standard hours allowed for units produced