4) As the beneficiary of a life insurance policy, Hanisah have two options for receiving the insurance proceeds. She can receive a lump sum

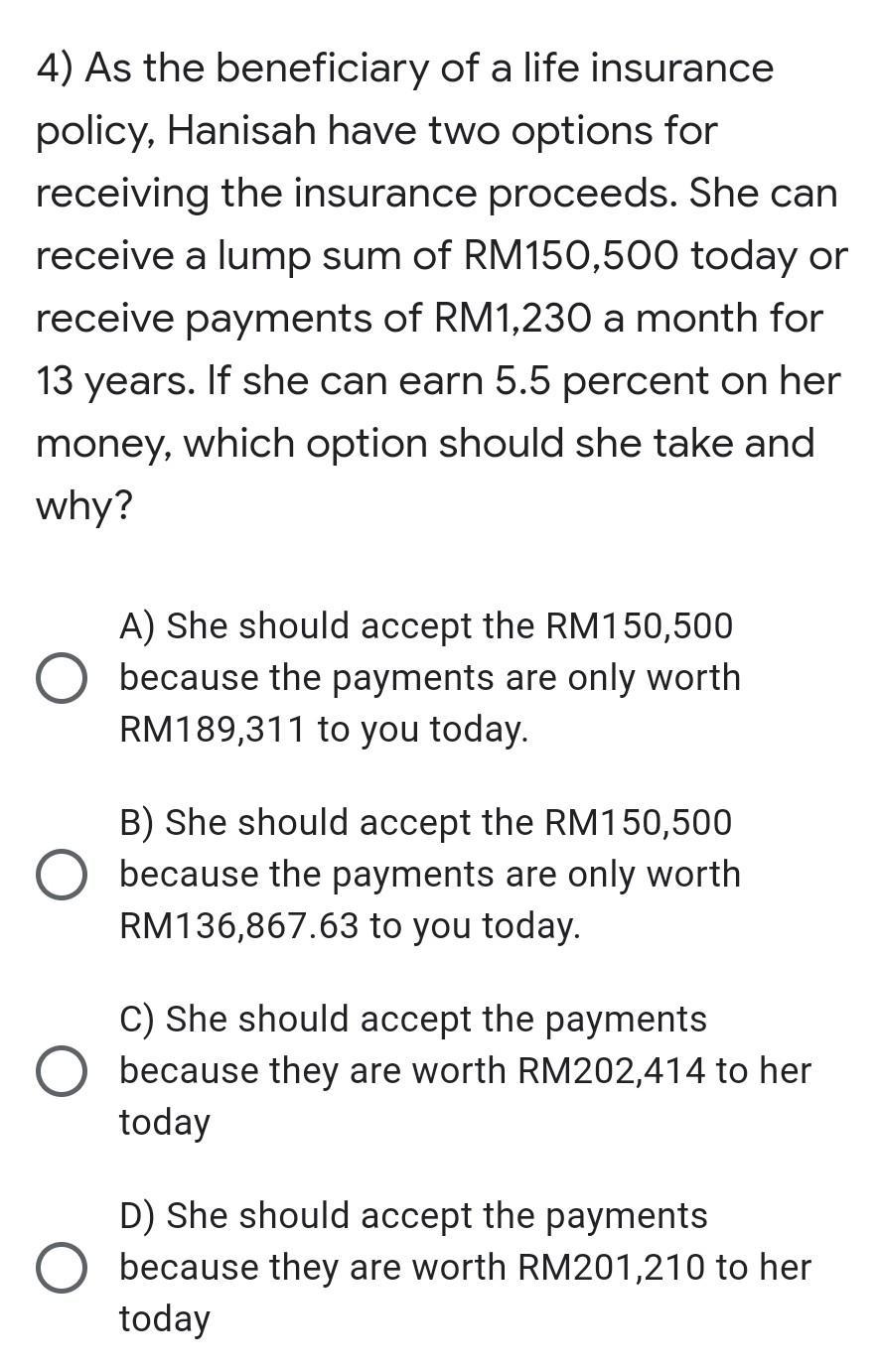

4) As the beneficiary of a life insurance policy, Hanisah have two options for receiving the insurance proceeds. She can receive a lump sum of RM150,500 today or receive payments of RM1,230 a month for 13 years. If she can earn 5.5 percent on her money, which option should she take and why? A) She should accept the RM150,500 because the payments are only worth RM189,311 to you today. B) She should accept the RM150,500 because the payments are only worth RM136,867.63 to you today. C) She should accept the payments because they are worth RM202,414 to her today D) She should accept the payments because they are worth RM201,210 to her today

Step by Step Solution

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

C She should accept the payments because they are worth RM202414 to ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started