Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute and present a Sales Budget 2.Determine production volume 3.Compute the estimate manufacturing costs and operating expenses a.Purchases (material) budget b.Personnel budget c.Overhead budget d.

Compute and present a Sales Budget

2.Determine production volume

3.Compute the estimate manufacturing costs and operating expenses

a.Purchases (material) budget

b.Personnel budget

c.Overhead budget

d. Selling and administrative budget

Informations needed are provided below (pictures serve as given):

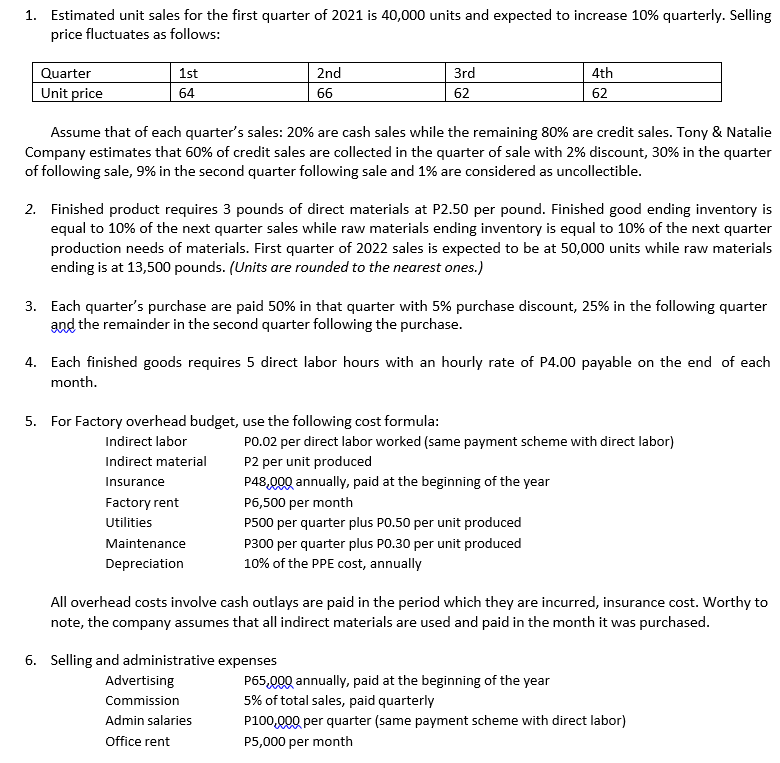

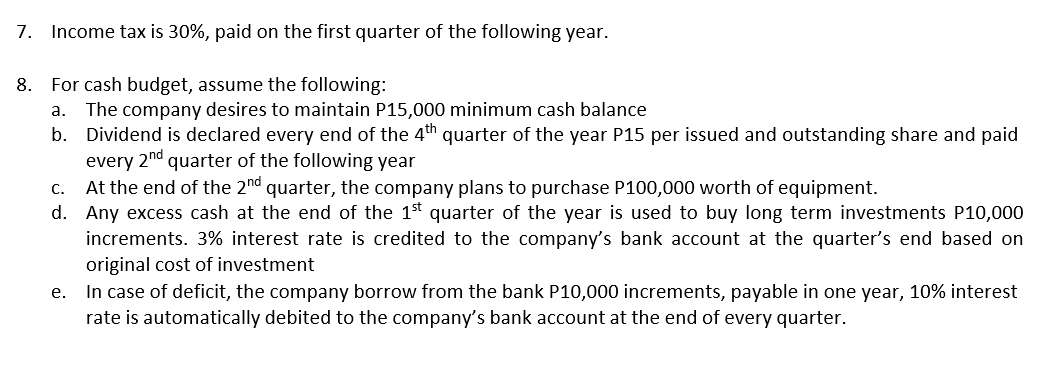

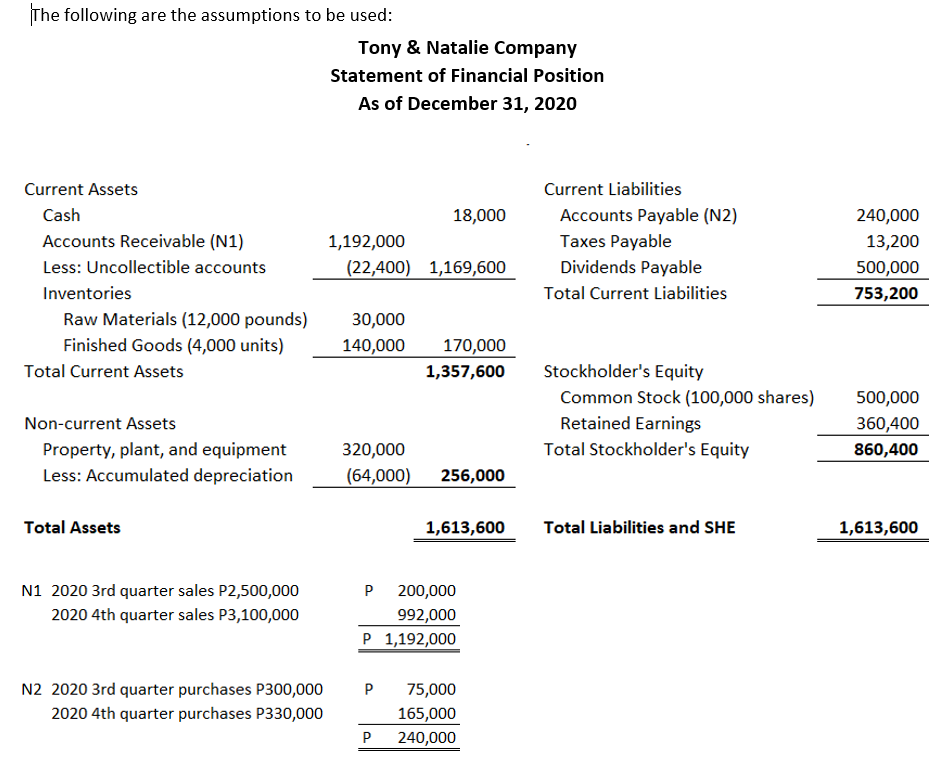

1. Estimated unit sales for the first quarter of 2021 is 40,000 units and expected to increase 10% quarterly. Selling price fluctuates as follows: Quarter Unit price 1st 64 2nd 66 3rd 62 4th 62 Assume that of each quarter's sales: 20% are cash sales while the remaining 80% are credit sales. Tony & Natalie Company estimates that 60% of credit sales are collected in the quarter of sale with 2% discount, 30% in the quarter of following sale, 9% in the second quarter following sale and 1% are considered as uncollectible. 2. Finished product requires 3 pounds of direct materials at P2.50 per pound. Finished good ending inventory is equal to 10% of the next quarter sales while raw materials ending inventory is equal to 10% of the next quarter production needs of materials. First quarter of 2022 sales is expected to be at 50,000 units while raw materials ending is at 13,500 pounds. (Units are rounded to the nearest ones.) 3. Each quarter's purchase are paid 50% in that quarter with 5% purchase discount, 25% in the following quarter and the remainder in the second quarter following the purchase. 4. Each finished goods requires 5 direct labor hours with an hourly rate of P4.00 payable on the end of each month. 5. For Factory overhead budget, use the following cost formula: Indirect labor Indirect material Insurance P48,000 annually, paid at the beginning of the year PO.02 per direct labor worked (same payment scheme with direct labor) P2 per unit produced Factory rent P6,500 per month P500 per quarter plus P0.50 per unit produced P300 per quarter plus P0.30 per unit produced 10% of the PPE cost, annually Utilities Maintenance Depreciation All overhead costs involve cash outlays are paid in the period which they are incurred, insurance cost. Worthy to note, the company assumes that all indirect materials are used and paid in the month it was purchased. 6. Selling and administrative expenses Advertising Commission Admin salaries Office rent P65,000 annually, paid at the beginning of the year 5% of total sales, paid quarterly P100,000 per quarter (same payment scheme with direct labor) P5,000 per month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Sales Budget Quarter 1 Sales Units 40000 Unit Price P64 Sales Units x Unit Price 40000 x P64 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started