Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute Bond Proceeds, Amortizing Discount by Interest Method, and Interest Expense Lewis Co. produces and sells aviation equipment. On the first day of its

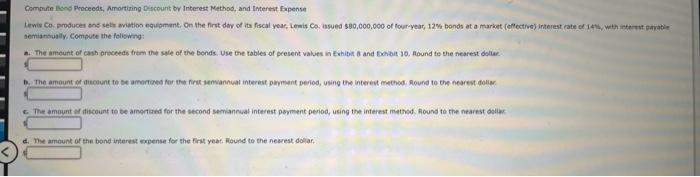

Compute Bond Proceeds, Amortizing Discount by Interest Method, and Interest Expense Lewis Co. produces and sells aviation equipment. On the first day of its fiscal year, Lewis Co. issued $80,000,000 of four-year, 12% bonds at a market (effective) interest rate of 14%, with interest payable semiannually. Compute the following: a. The amount of cash proceeds from the sale of the bonds. Use the tables of present values in Exhibit 8 and Exhibit 10. Round to the nearest dollar The amount of discount to be amortized for the first semiannual interest payment period, using the interest method. Round to the nearest dollar The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar d. The amount of the bond interest expense for the first year. Round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started