Answered step by step

Verified Expert Solution

Question

1 Approved Answer

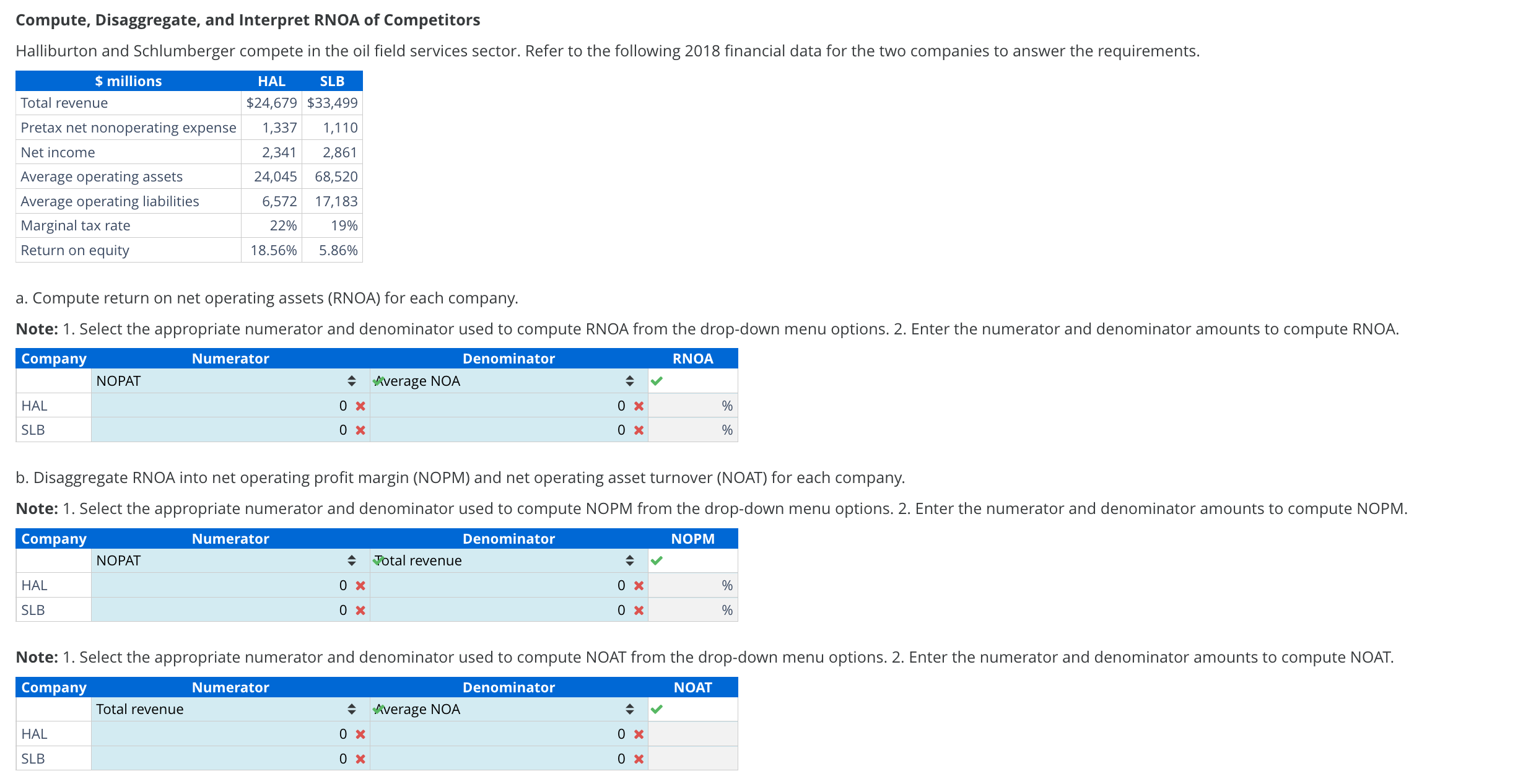

Compute, Disaggregate, and Interpret RNOA of Competitors Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data

Compute, Disaggregate, and Interpret RNOA of Competitors Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data for the two companies to answer the requirements. $ millions Total revenue Pretax net nonoperating expense Net income Average operating assets HAL SLB $24,679 $33,499 1,337 1,110 2,341 2,861 24,045 68,520 Average operating liabilities 6,572 17,183 22% 19% 18.56% 5.86% Marginal tax rate Return on equity a. Compute return on net operating assets (RNOA) for each company. Note: 1. Select the appropriate numerator and denominator used to compute RNOA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute RNOA. Company Denominator Numerator RNOA HAL SLB NOPAT Average NOA 0 0 0 % 0 % b. Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for each company. Note: 1. Select the appropriate numerator and denominator used to compute NOPM from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute NOPM. Company Denominator Numerator NOPM HAL NOPAT Total revenue 0 0 0 0 % % SLB Note: 1. Select the appropriate numerator and denominator used to compute NOAT from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute NOAT. Company Denominator HAL SLB Numerator Total revenue Average NOA 0 0 0 0 NOAT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started