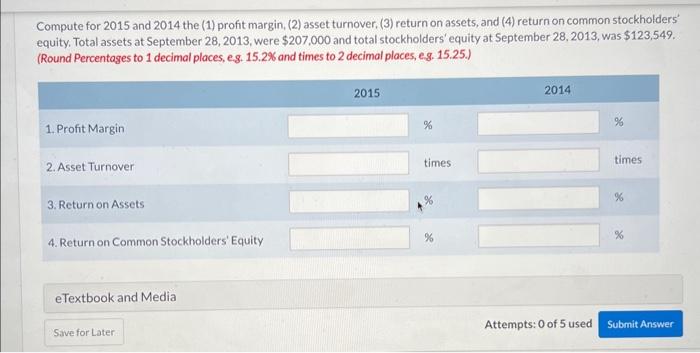

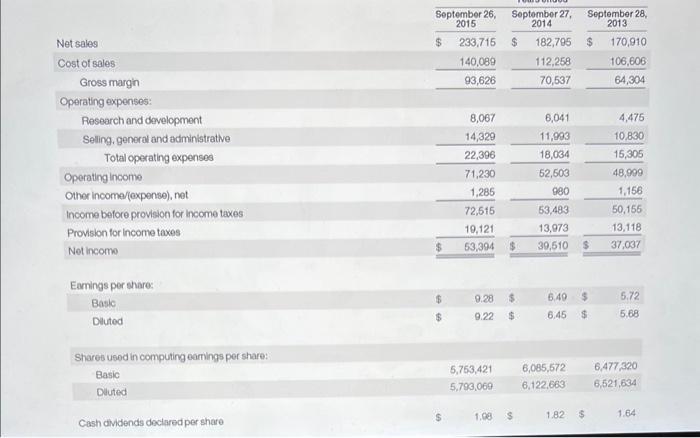

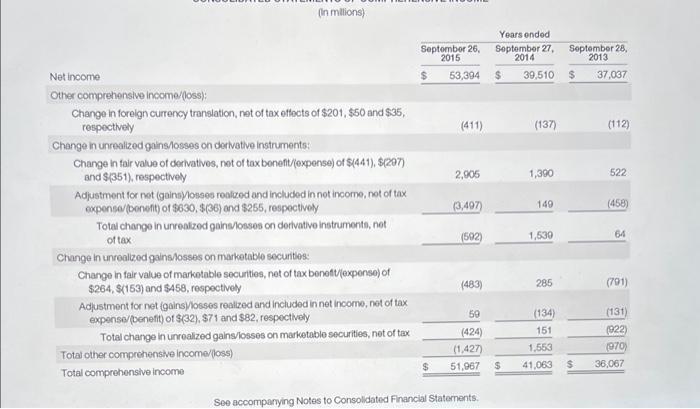

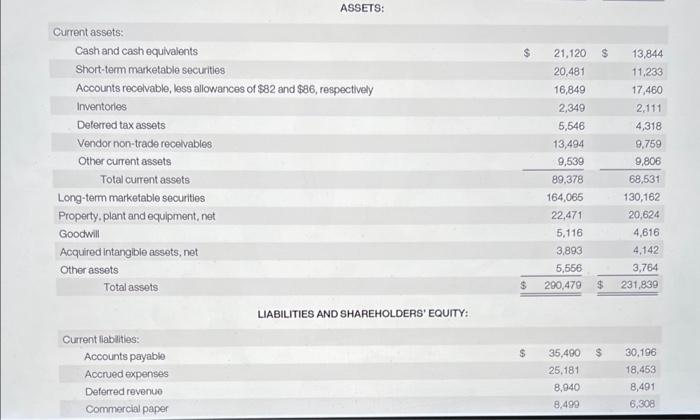

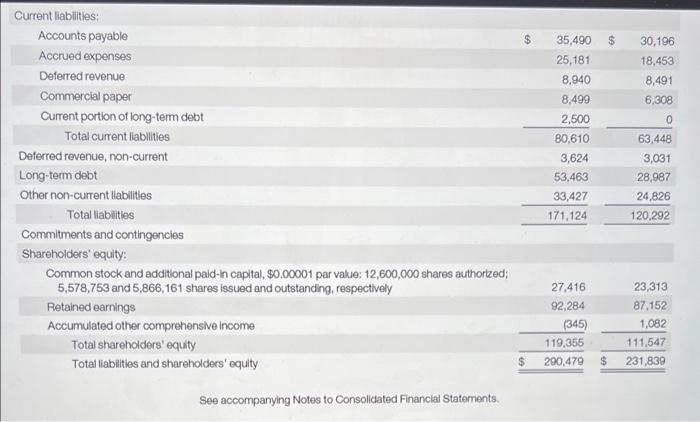

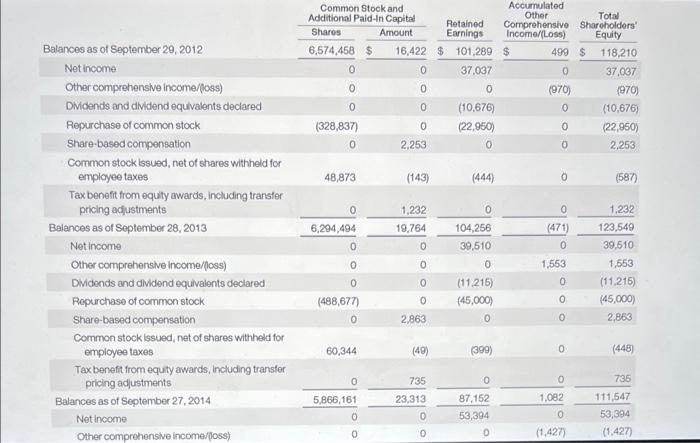

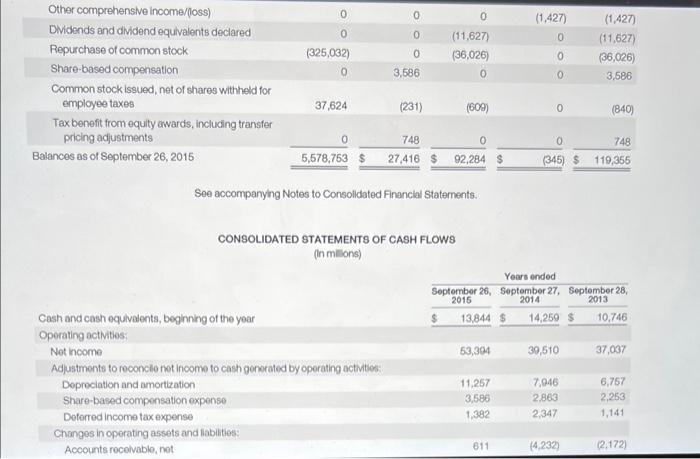

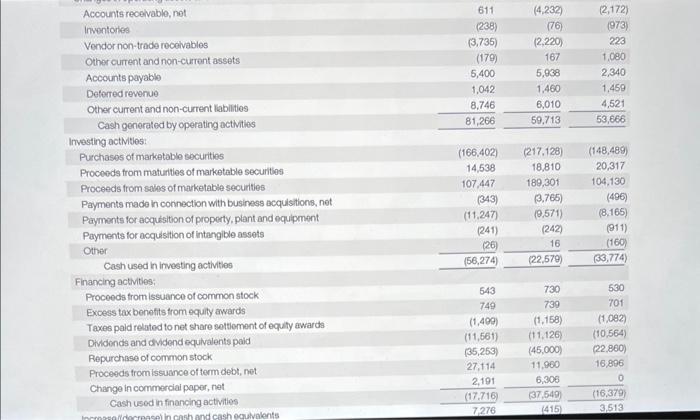

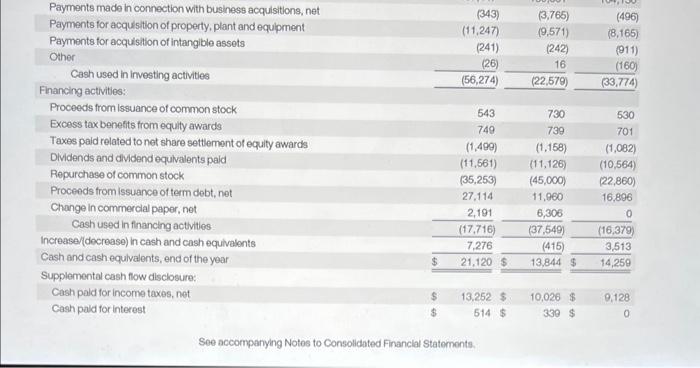

Compute for 2015 and 2014 the (1) profit margin, (2) asset turnover, (3) return on assets, and (4) return on common stockholders" equity. Total assets at September 28, 2013, were \$207,000 and total stockholders' equity at September 28, 2013, was $123,549. (Round Percentages to 1 decimal places, e.g. 15.2\% and times to 2 decimal places, eg. 15.25.) Net sales Operating expenses: Earmings per share: Basic Diuted $$9.289.22$$6.496.45$$5.725.68 Shares usod in computing earrings per share: Net income Other comprehensive income/loss): Years ended Change in foreign currency translation, net of tax oftects of $201,$50 and $35, respectively (411) (137) (112) Change in unrealzed gains/asses on derivative instruments: Change in fair value of dorivatives, not of tax bonefit/(expense) of $(441), \$(297) and $(351), respectively 2,9051,390522 Adjustment for not (gainsy/losses realzed and included in not income, not of tax capense/(bonefit) of \$630, \$(36) and \$255, respectively (3,497)149 (458) Total chango in unrealzed gainslosses on derivative instruments, not ot tax (592) 1,53064 Change in unrealzed gains/osses on marketable securibes: Change in fair value of markotable securties, net of tax beneft//expense) of $264,$(153) and $458, respectively (483) 285 Adfustment for net (gains)hosses realized and included in net income, not of tax expense/(benefit) of $(32),$71 and $82, respectively Total change in unrealized gainsilosses on marketable securities, net of tax Total other comprchensive income/loss) Total comprehensive income See accomparying Notes to Consolidated Financial Staternents. ASSETS: Current assets: Cash and cash equivalents Short-term marketable securities Accounts recelvable, less allowances of $82 and $86, respectively Inventories Delerred tax assets Vendor non-trade recelvables Other current assets Total current assets Long-term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assots, net Other assets Total assets LIABILITIES AND SHAREHOLDERS' EQUITY: Current liablities: Accounts payabis Accrued expenses Deferred revenue Commercial paper Current liabilites: Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorked; 5,578,753 and 5,866,161 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income Total shareholders' equity Total liabilities and shareholders' equity See accompanying Notes to Consolidated Financial Statements. See accompanying Notes to Consolidated Financial Staternents. CONSOLIDATED STATEMENTS OF CASH FLOWS (in milions) Accounts recelvable, not Inventories Vendor non-trade recolvables Other current and non-current assets Accounts payabla Defered reverue Other current and non-current labilities Cash generated by operating activitios Investing octhitles: Finarcing activities: Proceeds from issuance of common stock Excess tax benefits from equily awards Taxes paid related to net share sottiement of equaty awards Dhidends and dividend equivalents paid Repurchase of common stock Proceeds fromissuance of tem debt, net Change in commerciai poper, net Cash used in financing activities See accompanying Notos to Consolidated Financlal Staternents