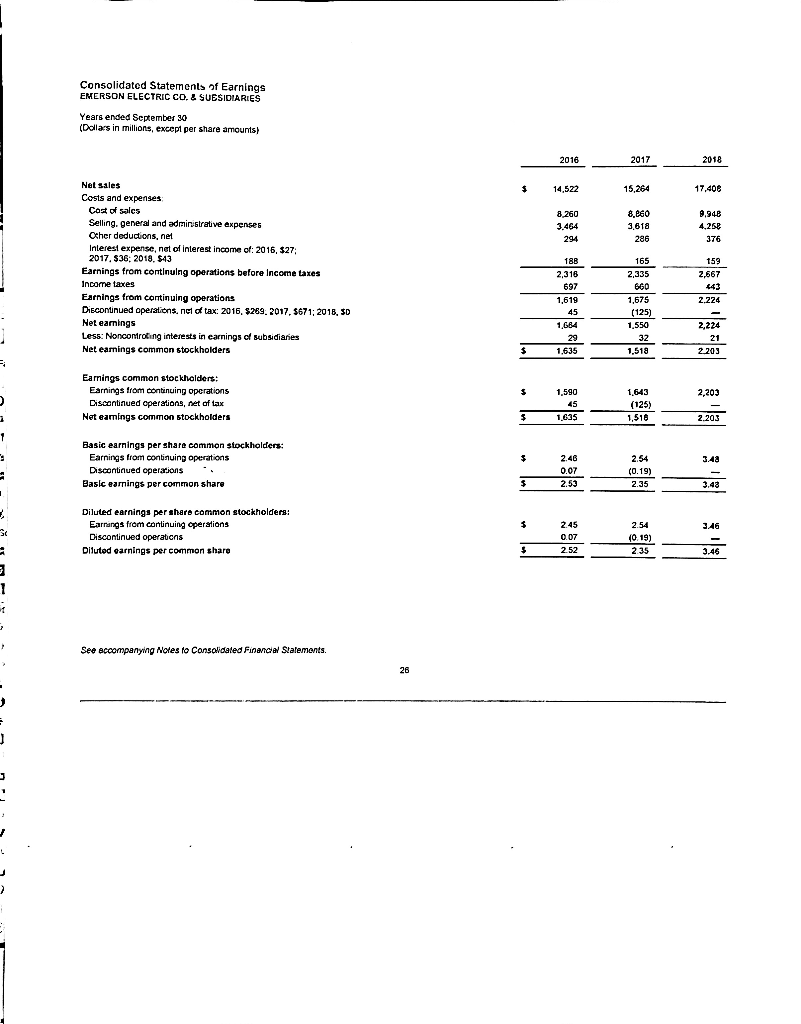

Compute for 2018 and 2017 the (1) profit margin, (2) asset turnover, (3) return on assets and (4) return on common stockholders equity. How would you evaluate the companies probability?

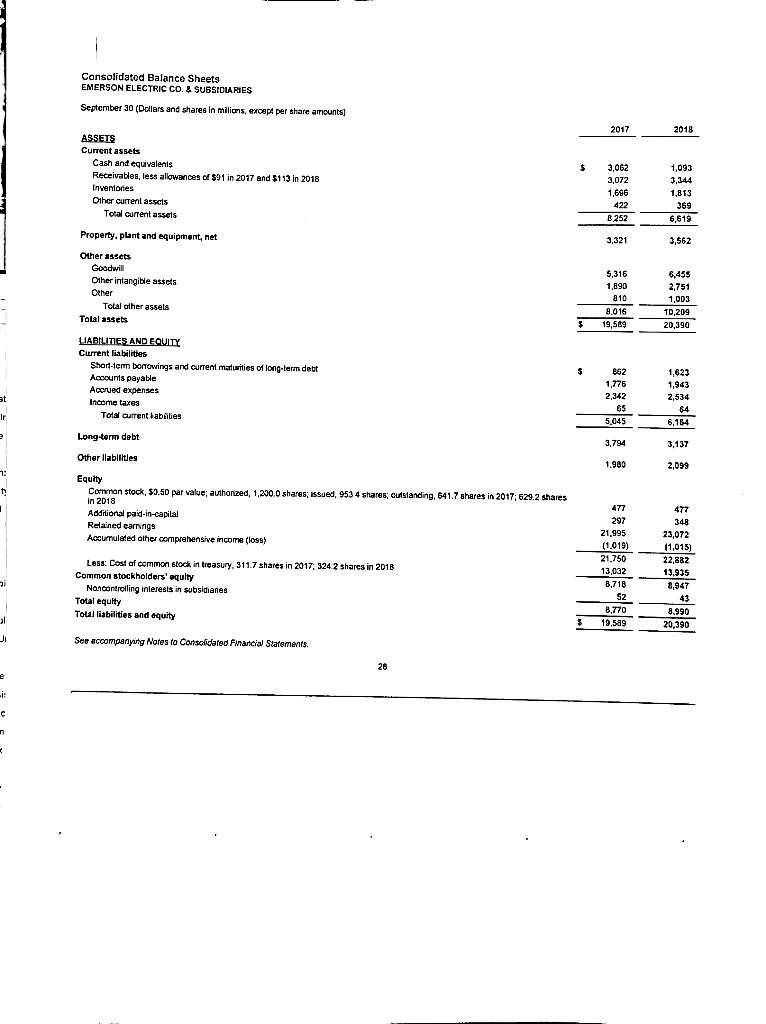

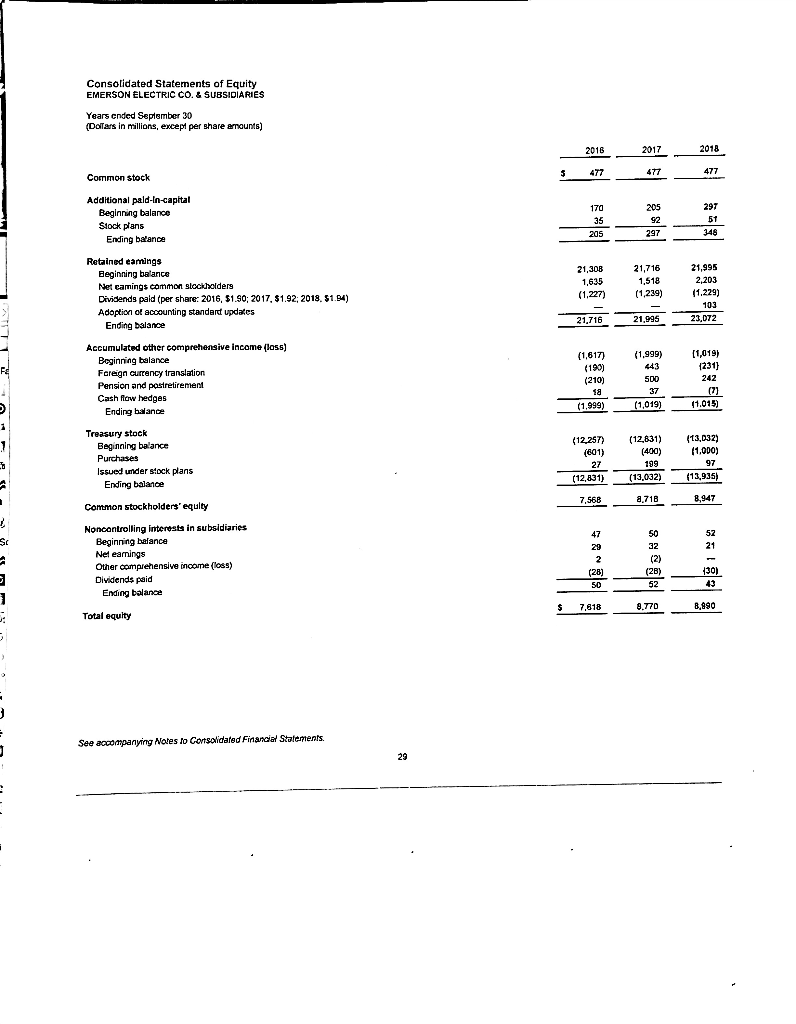

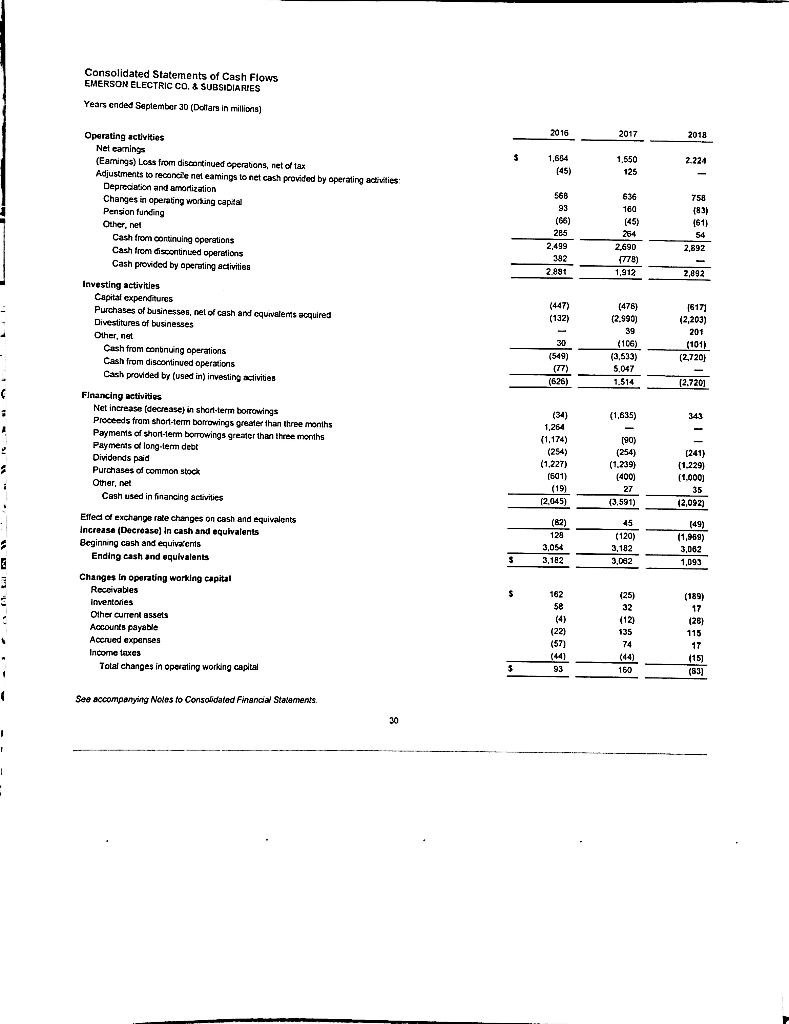

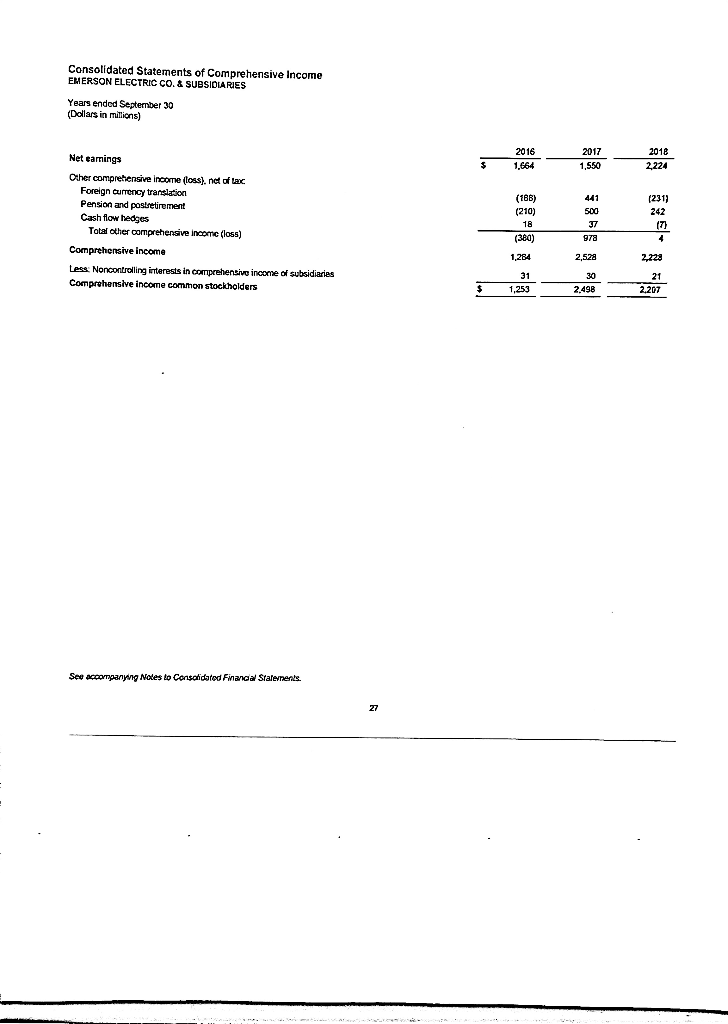

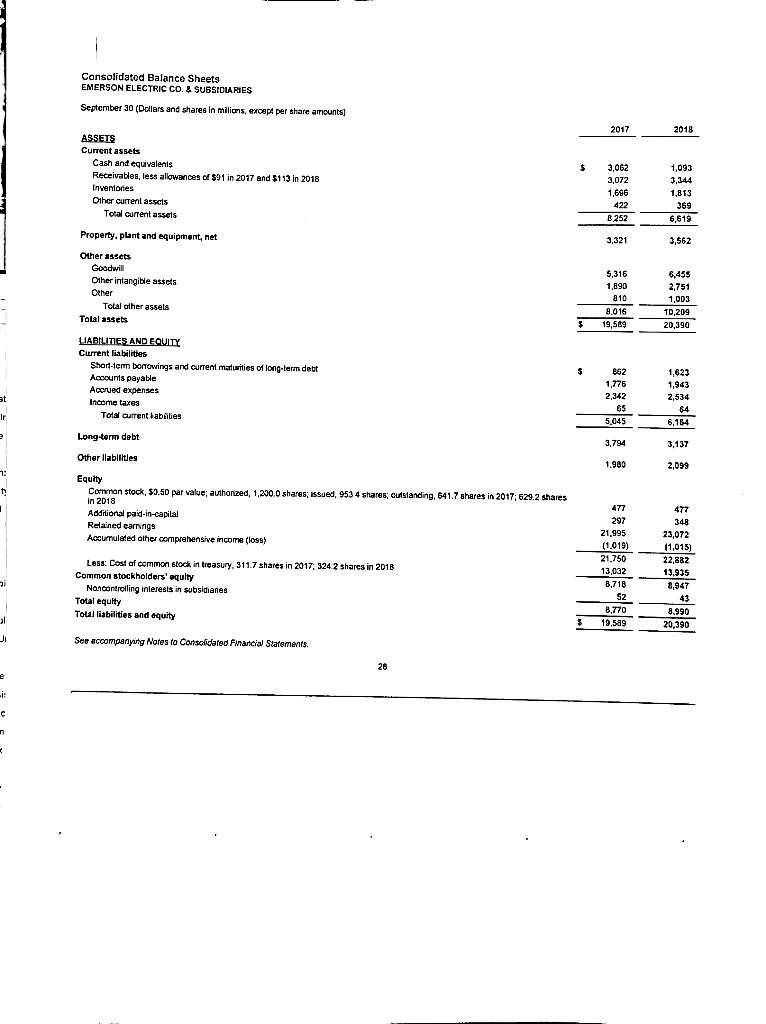

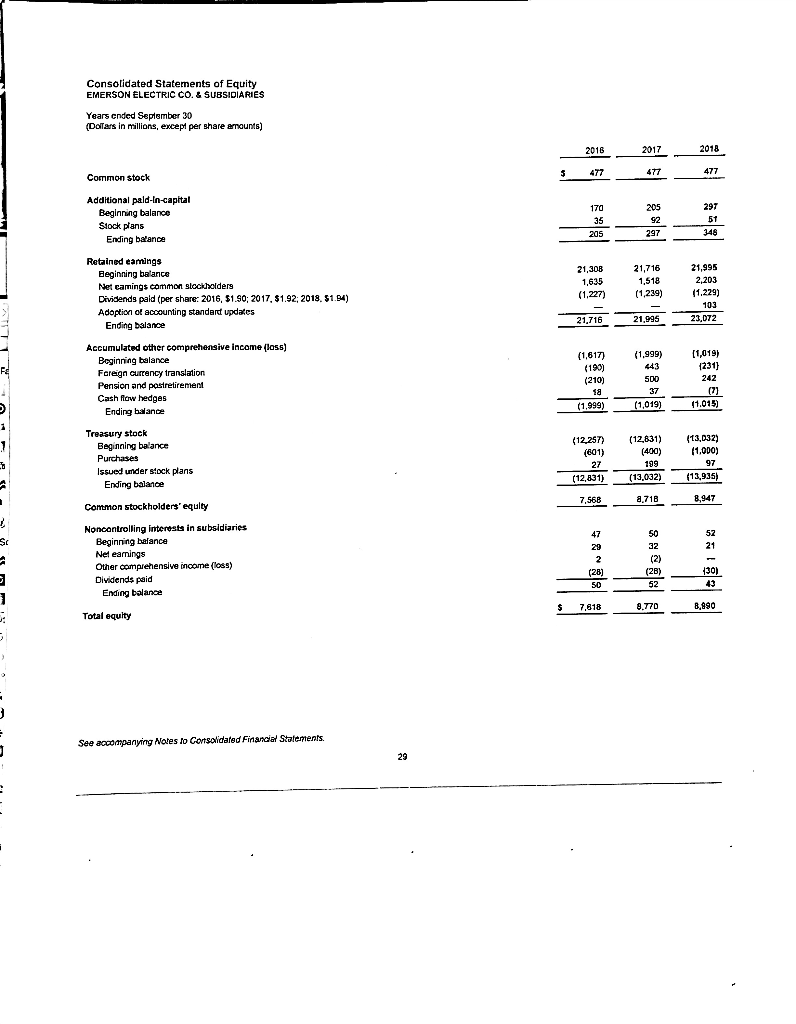

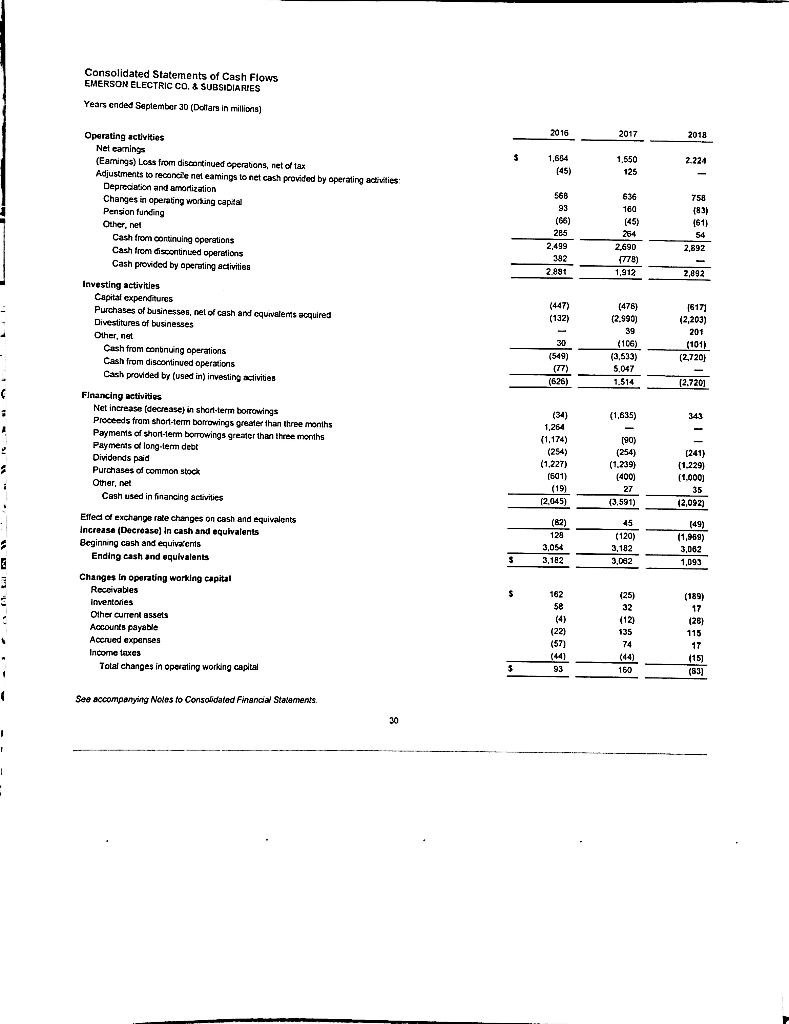

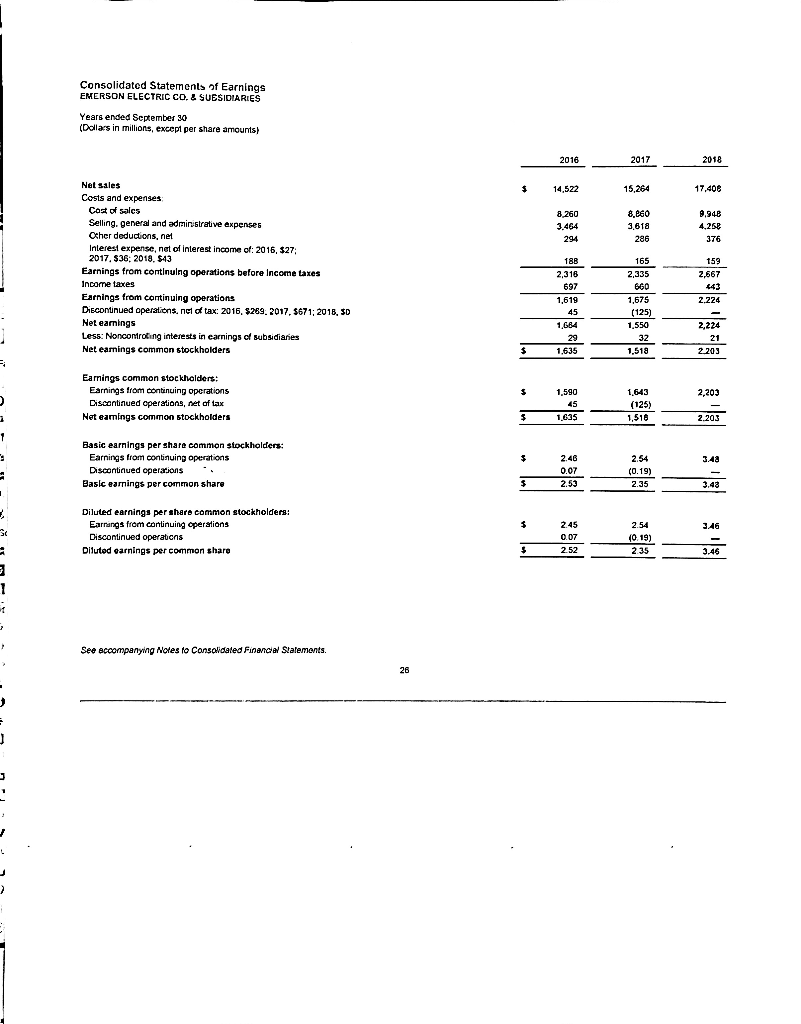

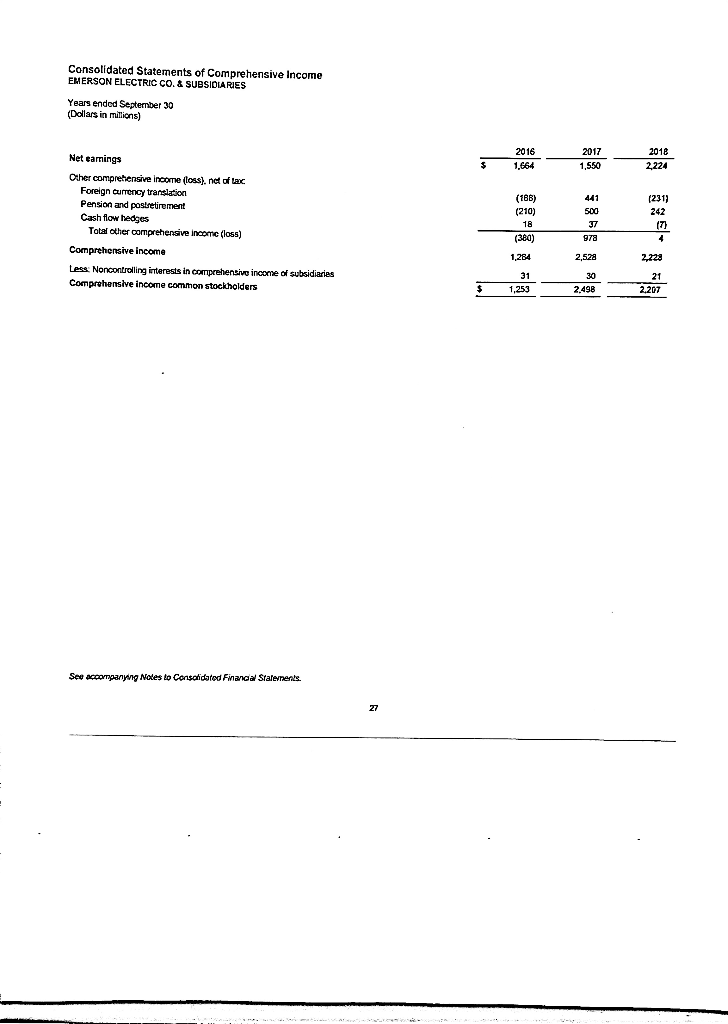

Consolidated Balance Sheets EMERSON ELECTRIC CO. & SUBSIDIARIES September 30 (Dollars and shares in milions, excap per share amounts] 2017 2018 1,093 ASSETS Current assets Cash and equivalents Receivables, less allowances of $91 in 2017 and 5113 In 2018 Inventories Other current assets Total current assets 3,062 3,072 1,666 422 B 252 1.813 369 6,619 Property, plant and equipment, net 3,321 3,562 Other assets Goodwill Other intangible assets Other 5,316 1.890 310 8.016 19,569 6,455 2,751 1.003 10,209 20,390 Total other assets Total assets LIABILITIES AND EQUITY Current liabilities Short-tem bontowings and current maturities of long-term dett Accounts payable Apprued expenses Income taxes Total current abflies B62 1,775 2,342 1,623 1,943 2,534 in f 5,045 6,184 Long-term debt Other liabilities 3,137 2,099 1.980 Equity Corrinon stock, 50.50 par value; authorized, 1,200.0 shares, issued, 953 4shares; outstanding, 641.7 shares in 2017, 629.2 shares in 2018 Additional pald-in-capilal Relained earnings Accumulated other comprehensive income (loss) 21,995 (10191 477 348 23,072 11.0151 22.882 13.935 8,947 Less: Cost of common stock in treasury, 311.7 shares in 2017, 324 2 shares in 2018 Common stockholders' equity Noncontrolling interests in subsidianes Total equity Toul liabilities and equity 21.750 13.032 8,718 52 8.770 19,599 8.990 20,390 Ser accompanying Notes to Consolidated Financial Statements Consolidated Statements of Equity EMERSON ELECTRIC CO. & SUBSIDIARIES Years ended September 30 (Dolars in millions, except per share arounts) Common stock Additional pald-In-capital Beginning balance Stock plans Ending balance 11 Retained eamings Beginning balance Net camings common stockholders Dividends paid (per share: 2016, $1.50; 2017. $1.92, 2018. $1.94) Adoption of accounting standard updates Ending balance 21,308 1,635 (1,227) 21,716 1.518 (1,239) 21.995 2,203 (1.229) 103 A 21.716 21.995 21.072 (1.999) Accumulated other comprehensive income foss) Beginning balance Foreign currency translation Pension and postretirement Cash flow hedges Ending balance (1,617) (190) (210) 443 [1,019) (231) 242 . (1.999)(1.01971.01 (13.0.323 (1.000) Treasury stock Beginning balance Purchases Issued under stock plans Ending balance (12,257) (601) 27 (12,831) (12,831) (400) 199 (13,032) 97 (13,935) 7,568 a.718 8,947 Common stockholders' equity 15 I Noncontrolling interests in subsidiaries Beginning balance Nel earnings Other comprehensive income (loss) Dividends paid Ending balance (28) 50 130) 7,618 8.770 8,990 Total equity n- See accompanying Notes to Cortsolidated Financial Statements. Consolidated Statements of Cash Flows EMERSON ELECTRIC CO. & SUBSIDIARIES Years ended September 30 (Datars in millions) 2016 2017 2018 2.224 1,654 (45) 1.550 125 Operating activities Nel camnings (Earnings) Loss from discontinued operations, net of tax Adjustments to reconcile net eamings to net cash provided by operating activities Depreciation and amortization Changes in operating working capital Pension funding Other, net Cash from continuing operations Cash from discontinued operations Cash provided by operating activities 566 636 160 758 183) (61) 225 2.499 264 2.690 778) 2987 1,912 2,892 (447) (132) (476) (2.990) 15171 12,203) Investing activities Capital expenditures Purchases of businesses, nel of cash and equivalents acquired Divestitures of businesses Other, net Cash from contnuing operations Cash from discontinued operations Cash provided by (used in) investing activities 39 30 (549) (77) (626) (106) (3,533) 5.047 (101) (2720) 1,514 [2.720) (34) (1,635) 1,264 (1,174) Financing activities Net increase (decrease in short-term borrowings Proceeds from short-term borrowings greater than three months Payments of short-term borrowings greater than three months Payments of long-term debt Dividonds paid Purchases of common stock Othernet Cash used in financing activities (254) (1,227) (501) 190) (254) (1.239) (400) (241) (1.229) (1.000) (19) 35 12.045) 13,591) 12,092) Elled of exchange rate changes on cash and equivalents Increase (Decrease) In cash and equivalents Beginning cash and equivalents Ending cash and equivalents (62) 129 3,054 3,182 (49) (1,969) 3,082 1,093 162 (25) (189) Changes in operating working capital Receivables Inventories Other current assets Accounts payable Accrued expenses Income taxes Total changes in operating working capital (12) 135 (26) 115 74 (44) (44) (15) See accompartying Noles to Consolidated Financial Statements. Consolidated Statements of Earnings EMERSON ELECTRIC CO. & SUESIDIARIES Years ended September 30 (Dollars in millions, except per share amounts) 2016 2017 2018 14.522 15,264 17,40 8.260 3.464 8.250 3,618 286 9.948 4.262 376 294 165 Nel sales Costs and expenses Cost of sales Selling general and administrative expenses Osher deductions, net Interest expense, net of interest income of: 2016, $27 2017. $36: 2018. $43 Earnings from continuing operations before Income taxes Income taxes Earnings from continuing operations Discontinued operations. nel of tax: 2016, $269, 2017, 5671; 2016,30 Net earnings Less: Noncontroting interests in earnings of subsidiaries Net eamings common stockholders 18B 2.316 697 2.335 660 1,684 1 .! 2,203 Earnings common stockholders: Earnings from continuing operations Discontinued operations, net of tax Net eamings common stockholders - 1 45 1.643 (125) 1,516 2.203 - Basic earnings per share common stockholders: Earnings from continuing operations Discontinued operations Basic earnings per common share 2.46 0.07 2.53 v M 2.54 (0.19) 2.35 13 . Diluted earnings per share common stockholders: Earnings from continuing operations Discontinued operations Diluted earnings per common share 0.07 252 2.54 (0.19) 235 15 II - P L See accompanying Notes to consolidated Financial Statements. U S 1. VL4 Consolidated Statements of Comprehensive Income EMERSON ELECTRIC CO. & SUBSIDIARIES Years ended September 30 (Dollars in millions) 2016 1,664 2017 1,550 (188) (210) Net eamings Other comprehensive income foss), net of taxe Foreign currency translation Pension and postretirement Cash flow hedges Total other comprehensive income (loss) Comprehensive income Less: Noncontrolling interests in comprehensive income of subsidiaries Comprehensive income common stockholders (380) 1,284 2,528 See accompanyi Notes to Consolidated Finanaw Stalevents