Answered step by step

Verified Expert Solution

Question

1 Approved Answer

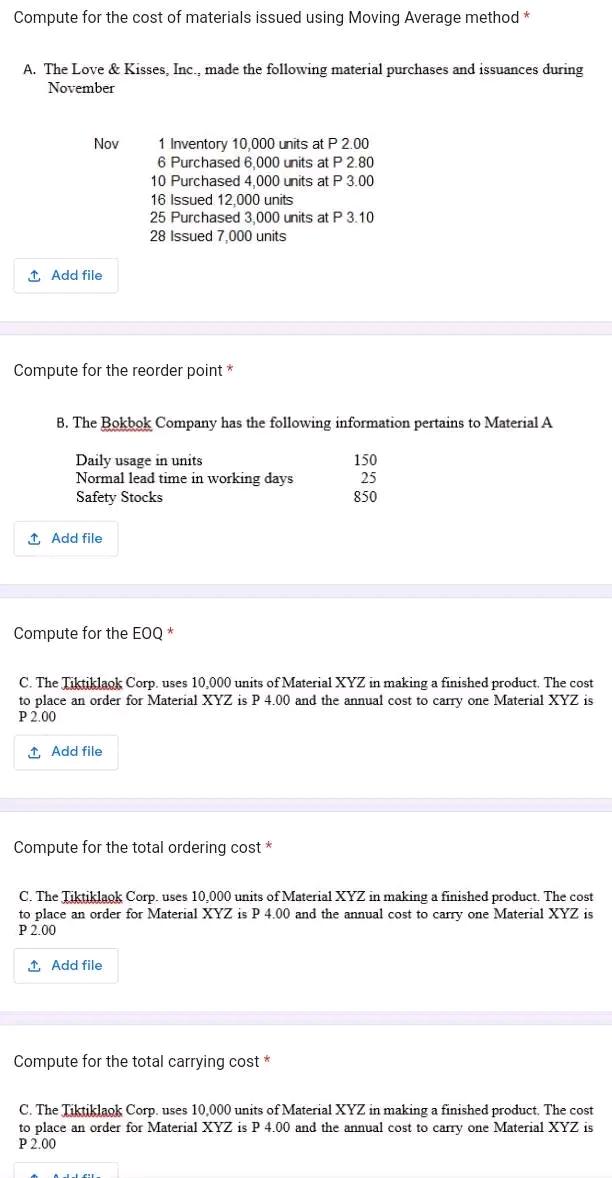

Compute for the cost of materials issued using Moving Average method * A. The Love & Kisses, Inc., made the following material purchases and

Compute for the cost of materials issued using Moving Average method * A. The Love & Kisses, Inc., made the following material purchases and issuances during November Nov 1 Add file: 1 Inventory 10,000 units at P 2.00 6 Purchased 6,000 units at P 2.80 10 Purchased 4,000 units at P 3.00 16 Issued 12,000 units 25 Purchased 3,000 units at P 3.10 28 Issued 7,000 units Compute for the reorder point * B. The Bokbok Company has the following information pertains to Material A Daily usage in units Normal lead time in working days Safety Stocks 1 Add file Compute for the EOQ * C. The Tiktiklaok Corp. uses 10,000 units of Material XYZ in making a finished product. The cost to place an order for Material XYZ is P 4.00 and the annual cost to carry one Material XYZ is P 2.00 1 Add file Compute for the total ordering cost * 150 25 850 C. The Tiktiklaok Corp. uses 10,000 units of Material XYZ in making a finished product. The cost to place an order for Material XYZ is P 4.00 and the annual cost to carry one Material XYZ is P 2.00 1 Add file Compute for the total carrying cost * C. The Tiktiklaok Corp. uses 10,000 units of Material XYZ in making a finished product. The cost to place an order for Material XYZ is P 4.00 and the annual cost to carry one Material XYZ is P 2.00

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A Cost of Materials Issued using Moving Average Method Lets calculate the moving average cost per un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started