Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute for the following the total allowable deductions if Ethyl Corp. is a/an: a. Individual taxpayer b. Corporate taxpayer 1. Ethyl Corporation, a financial

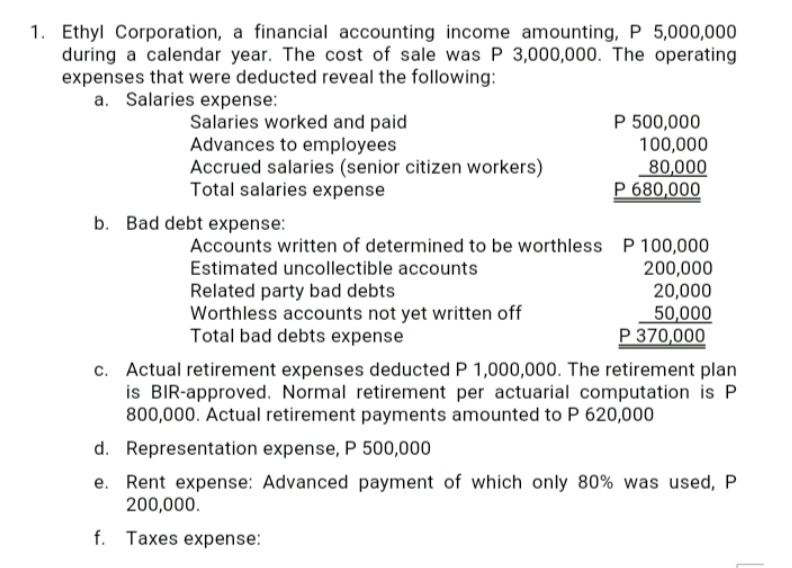

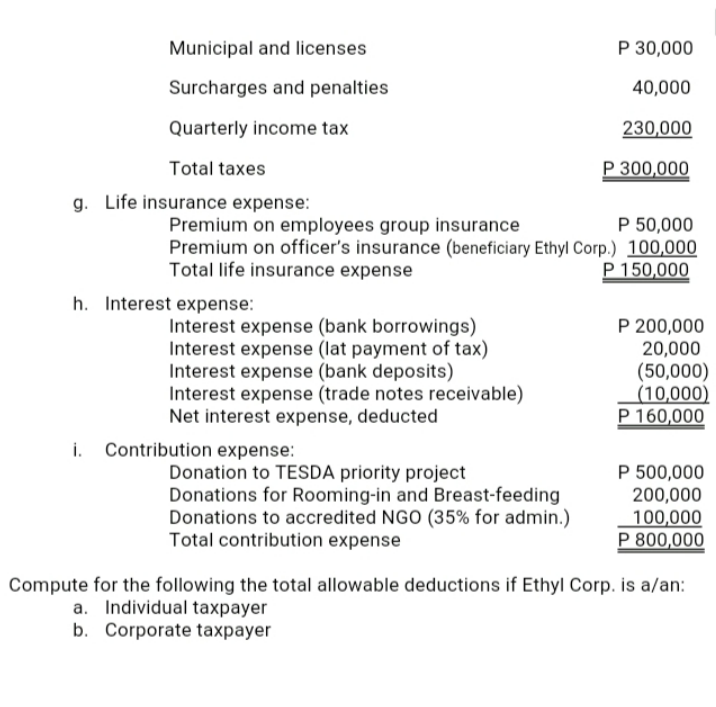

Compute for the following the total allowable deductions if Ethyl Corp. is a/an: a. Individual taxpayer b. Corporate taxpayer 1. Ethyl Corporation, a financial accounting income amounting, P 5,000,000 during a calendar year. The cost of sale was P 3,000,000. The operating expenses that were deducted reveal the following: a. Salaries expense: Salaries worked and paid Advances to employees Accrued salaries (senior citizen workers) Total salaries expense b. Bad debt expense: P 500,000 100,000 80,000 P 680,000 Accounts written of determined to be worthless P 100,000 Estimated uncollectible accounts 200,000 Related party bad debts 20,000 50,000 Worthless accounts not yet written off Total bad debts expense P 370,000 c. Actual retirement expenses deducted P 1,000,000. The retirement plan is BIR-approved. Normal retirement per actuarial computation is P 800,000. Actual retirement payments amounted to P 620,000 d. Representation expense, P 500,000 e. Rent expense: Advanced payment of which only 80% was used, P 200,000. f. Taxes expense: Municipal and licenses. Surcharges and penalties Quarterly income tax Total taxes g. Life insurance expense: P 50,000 Premium on employees group insurance Premium on officer's insurance (beneficiary Ethyl Corp.) 100,000 Total life insurance expense P 150,000 h. Interest expense: Interest expense (bank borrowings) Interest expense (lat payment of tax) Interest expense (bank deposits) Interest expense (trade notes receivable) Net interest expense, deducted i. Contribution expense: Donation to TESDA priority project P 30,000 40,000 230,000 P 300,000 Donations for Rooming-in and Breast-feeding Donations to accredited NGO (35% for admin.) Total contribution expense P 200,000 20,000 (50,000) (10,000) P 160,000 P 500,000 200,000 100,000 P 800,000 Compute for the following the total allowable deductions if Ethyl Corp. is a/an: a. Individual taxpayer b. Corporate taxpayer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the total allowable deductions for Ethyl Corp as both an individual taxpayer and a corporate taxpayer well analyze the expenses provided an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started