Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute for the total allowed deduction? 2. Compute for the vanishing deduction? 3. Compute for the net taxable estate? 4. Compute for the allowed judicial

Compute for the total allowed deduction?

2. Compute for the vanishing deduction?

3. Compute for the net taxable estate?

4. Compute for the allowed judicial expense?

5. Compute for the gross estate of Absolute community?

6. Compute for the estate tax?

7. Compute for the allowed funeral expense?

8.Compute for the total gross estate?

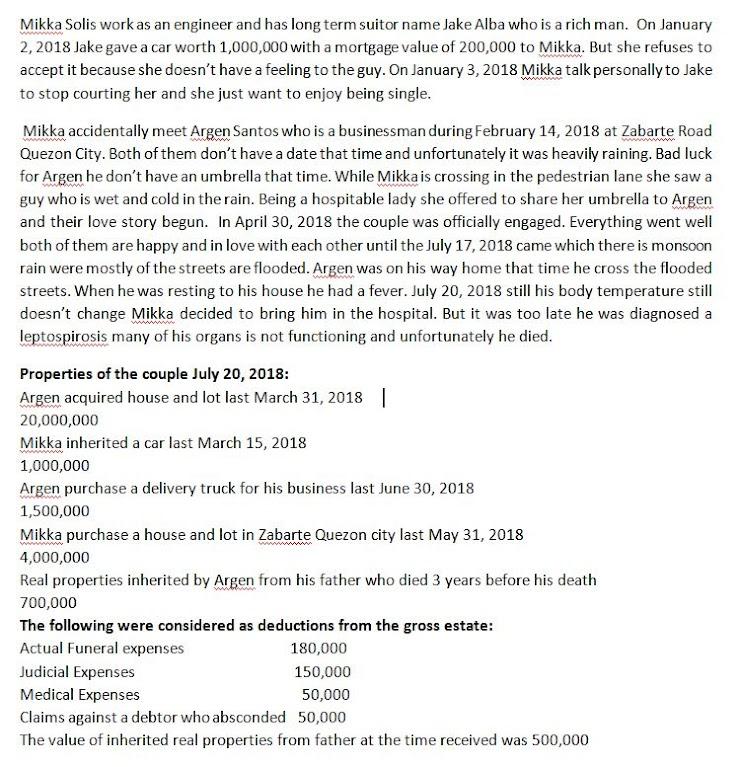

Mikka Solis work as an engineer and has long term suitor name Jake Alba who is a rich man. On January 2, 2018 Jake gave a car worth 1,000,000 with a mortgage value of 200,000 to Mikka. But she refuses to accept it because she doesn't have a feeling to the guy. On January 3, 2018 Mikka talk personally to Jake to stop courting her and she just want to enjoy being single. Mikka accidentally meet Argen Santos who is a businessman during February 14, 2018 at Zabarte Road Quezon City. Both of them don't have a date that time and unfortunately it was heavily raining. Bad luck for Argen he don't have an umbrella that time. While Mikka is crossing in the pedestrian lane she saw a guy who is wet and cold in the rain. Being a hospitable lady she offered to share her umbrella to Argen and their love story begun. In April 30, 2018 the couple was officially engaged. Everything went well both of them are happy and in love with each other until the July 17, 2018 came which there is monsoon rain were mostly of the streets are flooded. Argen was on his way home that time he cross the flooded streets. When he was resting to his house he had a fever. July 20, 2018 still his body temperature still doesn't change Mikka decided to bring him in the hospital. But it was too late he was diagnosed a leptospirosis many of his organs is not functioning and unfortunately he died. Properties of the couple July 20, 2018: Argen acquired house and lot last March 31, 2018 | 20,000,000 Mikka inherited a car last March 15, 2018 1,000,000 Argen purchase a delivery truck for his business last June 30, 2018 1,500,000 Mikka purchase a house and lot in Zabarte Quezon city last May 31, 2018 4,000,000 Real properties inherited by Argen from his father who died 3 years before his death 700,000 The following were considered as deductions from the gross estate: Actual Funeral expenses 180,000 Judicial Expenses 150,000 Medical Expenses 50,000 Claims against a debtor who absconded 50,000 The value of inherited real properties from father at the time received was 500,000

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To compute the various values and deductions related to the estate we need to gather the relevant information and perform the necessary calculations Here are the answers to each of your questions 1 Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started