Answered step by step

Verified Expert Solution

Question

1 Approved Answer

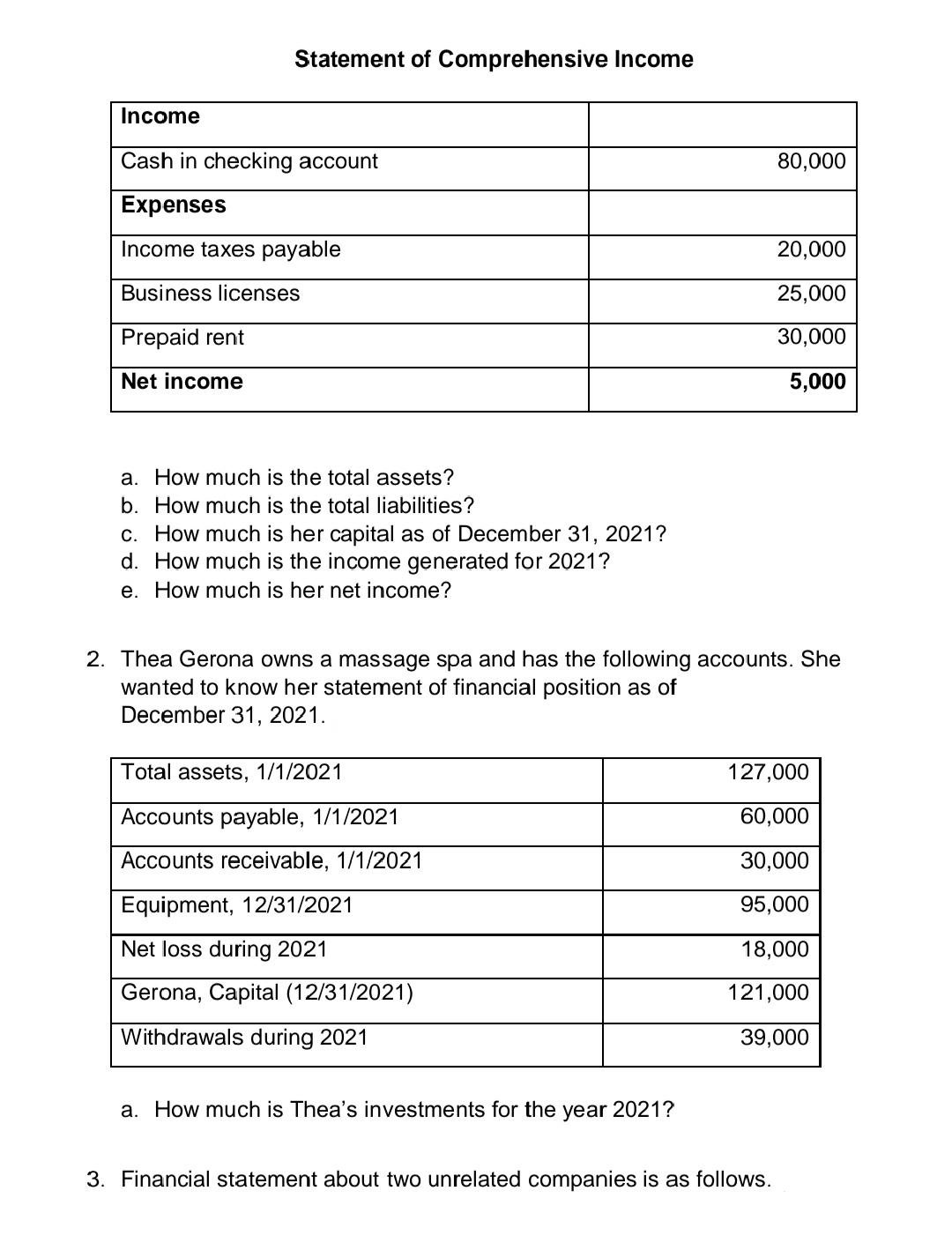

Compute for the total amount of the account being asked. Solutions are required. 1. Cath Maulion is a lawyer who doesn't think that she

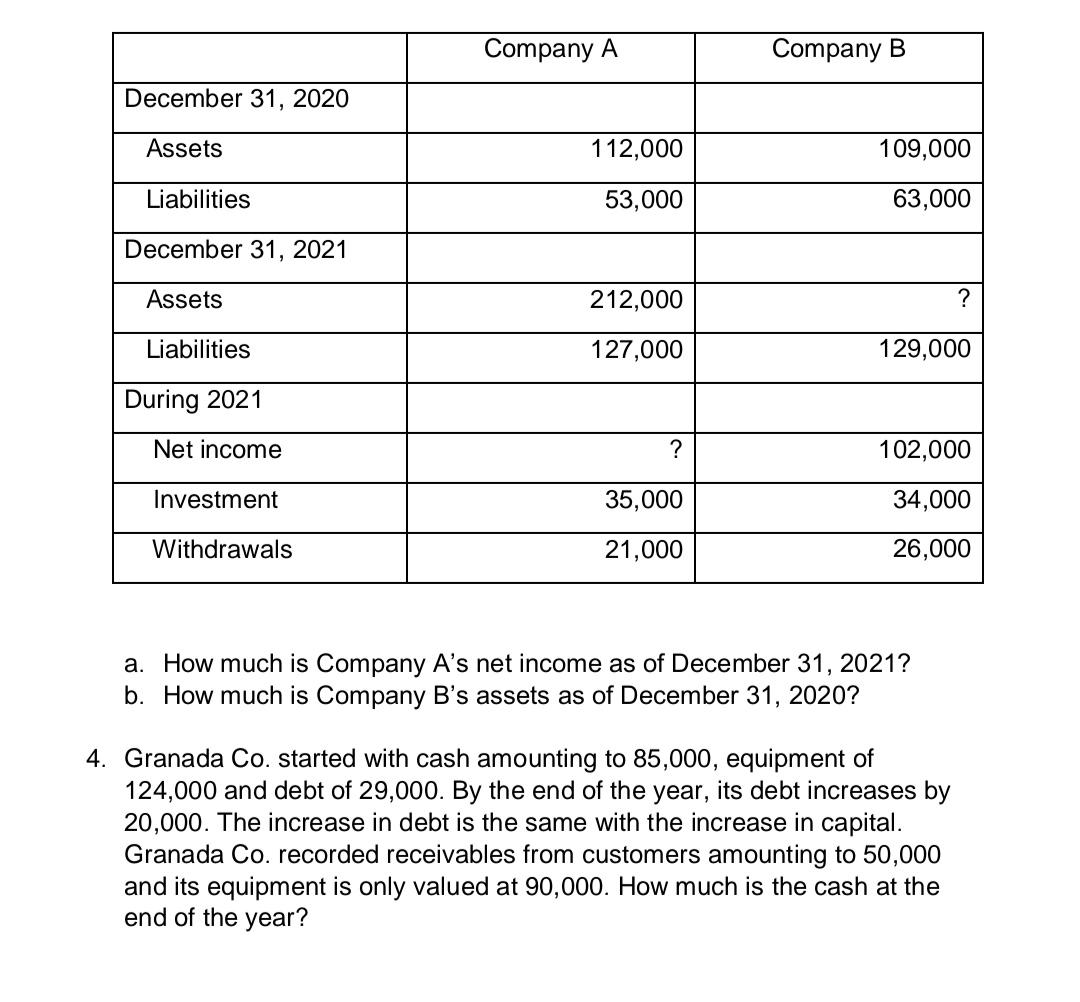

Compute for the total amount of the account being asked. Solutions are required. 1. Cath Maulion is a lawyer who doesn't think that she needs an accountant. She is the one who made the statement of financial position and statement of comprehensive income for the calendar year ended December 31, 2021. She does not know that she made mistakes classifying different accounts. Statement of Financial Position Assets Mortgage payable Notes receivable Transportation Maulion, Capital (12/31/2021) Equipment Total assets Liabilities Loans Accounts receivable Administrative expense Permits Total Liabilities Capital Professional fees Total Liabilities and Capital 40,000 25,000 5,000 125,000 50,000 245,000 30,000 30,000 80,000 10,000 150,000 95,000 245,000 Statement of Comprehensive Income Income Cash in checking account Expenses Income taxes payable Business licenses Prepaid rent Net income a. How much is the total assets? b. How much is the total liabilities? c. How much is her capital as of December 31, 2021? d. How much is the income generated for 2021? e. How much is her net income? Total assets, 1/1/2021 Accounts payable, 1/1/2021 Accounts receivable, 1/1/2021 Equipment, 12/31/2021 Net loss during 2021 Gerona, Capital (12/31/2021) Withdrawals during 2021 2. Thea Gerona owns a massage spa and has the following accounts. She wanted to know her statement of financial position as of December 31, 2021. a. How much is Thea's investments for the year 2021? 80,000 20,000 25,000 30,000 5,000 3. Financial statement about two unrelated companies is as follows. 127,000 60,000 30,000 95,000 18,000 121,000 39,000 December 31, 2020 Assets Liabilities December 31, 2021 Assets Liabilities During 2021 Net income Investment Withdrawals Company A 112,000 53,000 212,000 127,000 ? 35,000 21,000 Company B 109,000 63,000 129,000 ? 102,000 34,000 26,000 a. How much is Company A's net income as of December 31, 2021? b. How much is Company B's assets as of December 31, 2020? 4. Granada Co. started with cash amounting to 85,000, equipment of 124,000 and debt of 29,000. By the end of the year, its debt increases by 20,000. The increase in debt is the same with the increase in capital. Granada Co. recorded receivables from customers amounting to 50,000 and its equipment is only valued at 90,000. How much is the cash at the end of the year?

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the requested values for each scenario 1 Cath Mauions Financial Statements a Total As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started