Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute for the total cost per unit of each product using the VBC method 2) Compute for the total cost per unit of each product

Compute for the total cost per unit of each product using the VBC method 2) Compute for the total cost per unit of each product using the ABC method 2) Would you consider changing the current traditional costing method if the company wants to account all activities?

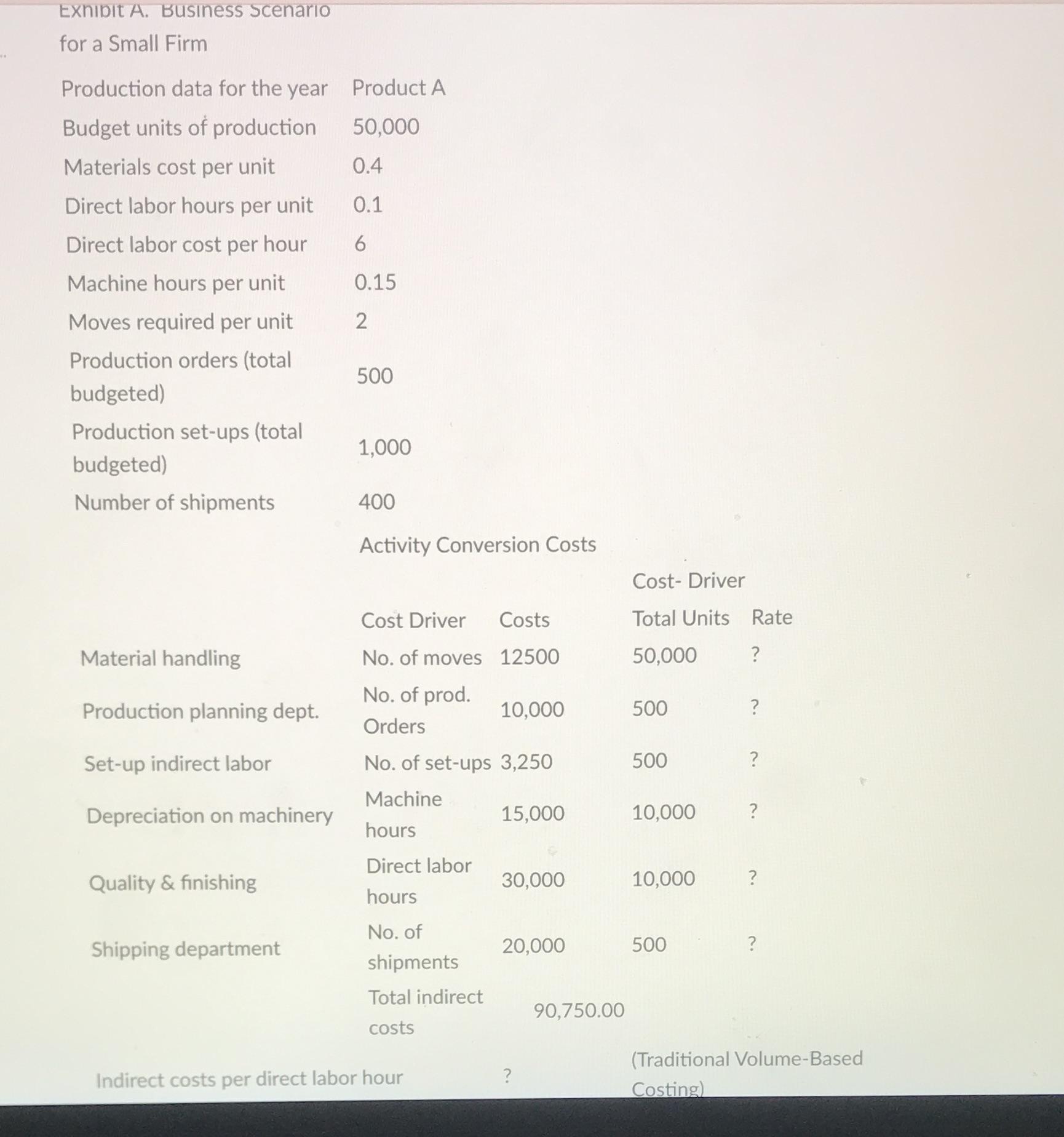

Exhibit A. Business Scenario for a Small Firm Production data for the year Budget units of production Materials cost per unit Direct labor hours per unit Direct labor cost per hour Machine hours per unit Moves required per unit Production orders (total budgeted) Production set-ups (total budgeted) Number of shipments Material handling Production planning dept. Set-up indirect labor Depreciation on machinery Quality & finishing Shipping department Product A 50,000 0.4 0.1 6 0.15 2 500 1,000 400 Activity Conversion Costs Cost Driver Costs No. of moves 12500 No. of prod. Orders No. of set-ups 3,250 Machine hours Direct labor hours No. of shipments Total indirect costs 10,000 Indirect costs per direct labor hour 15,000 30,000 20,000 ? 90,750.00 Cost- Driver Total Units Rate 50,000 ? 500 500 10,000 10,000 500 ? ? ? ? ? (Traditional Volume-Based Costing)

Step by Step Solution

★★★★★

3.34 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Calculating Total Cost per Unit using the VBC Method Under the Variable Costing VBC method the total cost of each product comprises both direct costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started