Answered step by step

Verified Expert Solution

Question

1 Approved Answer

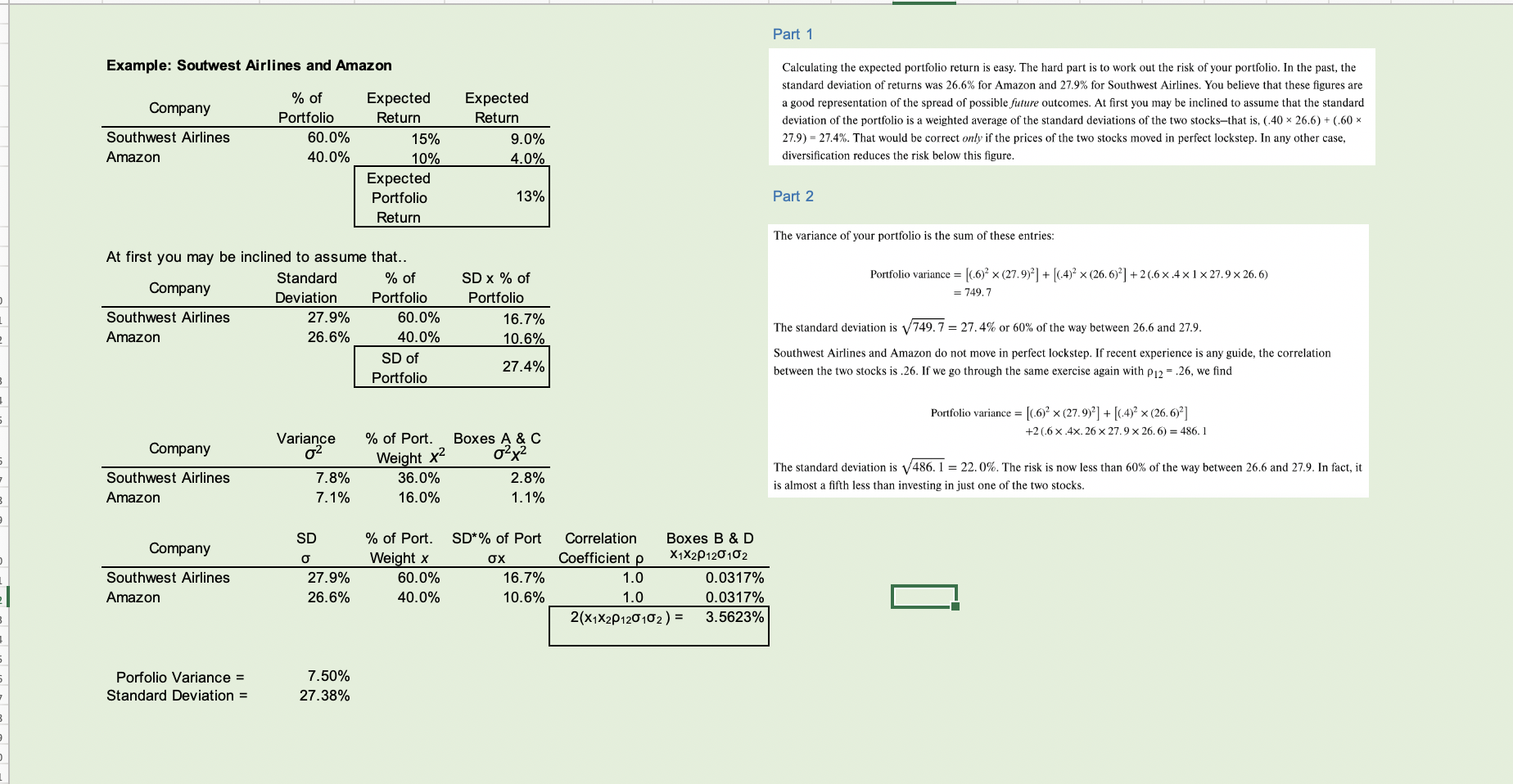

Compute for the variance and standard deviation of a portfolio of stocks containing Southwest Airlines and Amazon assuming: correlation ( 12 ) = 0.26; and

Compute for the variance and standard deviation of a portfolio of stocks containing Southwest Airlines and Amazon assuming:

- correlation (12) = 0.26; and

- correlation (12) = -1.

Replicate the calculations in the excel file attached.

Part 1 Example: Soutwest Airlines and Amazon Company % of Portfolio 60.0% 40.0% Expected Return 15% 10% Expected Portfolio Return Expected Return 9.0% 4.0% Calculating the expected portfolio return is easy. The hard part is to work out the risk of your portfolio. In the past, the standard deviation of returns was 26.6% for Amazon and 27.9% for Southwest Airlines. You believe that these figures are a good representation of the spread of possible future outcomes. At first you may be inclined to assume that the standard deviation of the portfolio is a weighted average of the standard deviations of the two stocks-that is, (.40 x 26.6) + (60 x 27.9) = 27.4%. That would be correct only if the prices of the two stocks moved in perfect lockstep. In any other case, diversification reduces the risk below this figure. Southwest Airlines Amazon 13% Part 2 The variance of your portfolio is the sum of these entries: Portfolio variance = [.692 (27.9)2] + [6.492 x (26.614] +26.6 x.4x 1 x 27.9 x 26.6) = 749.7 At first you may be inclined to assume that.. Standard % of Company Deviation Portfolio Southwest Airlines 27.9% 60.0% Amazon 26.6% 40.0% SD of Portfolio SD x % of Portfolio 16.7% 10.6% The standard deviation is 749.7 = 27.4% or 60% of the way between 26.6 and 27.9. 27.4% Southwest Airlines and Amazon do not move in perfect lockstep. If recent experience is any guide, the correlation between the two stocks is.26. If we go through the same exercise again with P12 = 26, we find Portfolio variance = (1.6) (27.9)2] + [(-4)2 x (26.6)] +2 0.6 x.4x. 26 x 27.9 x 26.6) = 486.1 Variance Company % of Port. Weight x2 36.0% 16.0% Boxes A&C 02x2 2.8% 1.1% Southwest Airlines Amazon 7.8% 7.1% The standard deviation is 486.1= 22.0%. The risk is now less than 60% of the way between 26.6 and 27.9. In fact, it is almost a fifth less than investing in just one of the two stocks. SD Company 0 % of Port. Weight x 60.0% 40.0% SD*% of Port X 16.7% 10.6% Southwest Airlines Amazon 27.9% 26.6% Correlation Boxes B & D Coefficient p X1X2P120102 1.0 0.0317% 1.0 0.0317% 2(X1X2P120102) = 3.5623% Porfolio Variance = Standard Deviation = 7.50% 27.38%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started