Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute for the VAT payable of Cebu Pacific, Inc. - a VAT registered common carrier based on the following information: Revenue from Domestic carriage

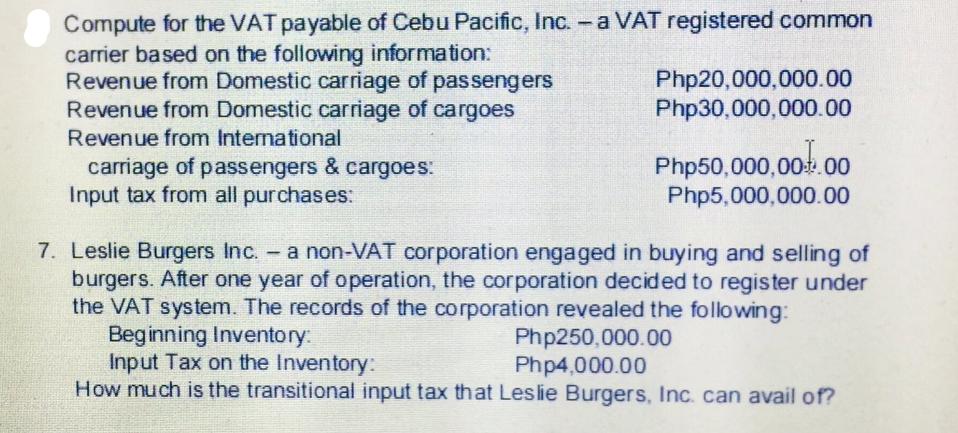

Compute for the VAT payable of Cebu Pacific, Inc. - a VAT registered common carrier based on the following information: Revenue from Domestic carriage of passengers Revenue from Domestic carriage of cargoes Revenue from International carriage of passengers & cargoes: Input tax from all purchases: Php20,000,000.00 Php30,000,000.00 Php50,000,00.00 00k.. Php5,000,000.00 7. Leslie Burgers Inc. - a non-VAT corporation engaged in buying and selling of burgers. After one year of operation, the corporation decided to register under the VAT system. The records of the corporation revealed the following: Beginning Inventory: Php250,000.00 Php4,000.00 Input Tax on the Inventory: How much is the transitional input tax that Leslie Burgers, Inc. can avail of?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

For Cebu Pacific Inc Total Revenue from Domestic carriage of passengers Php2000000000 Total Revenue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started