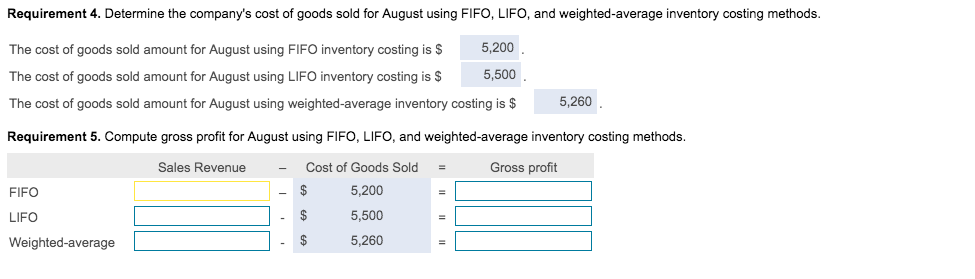

Compute gross profit for Requirement 5 using the previous data computed:

Compute gross profit for Requirement 5 using the previous data computed:

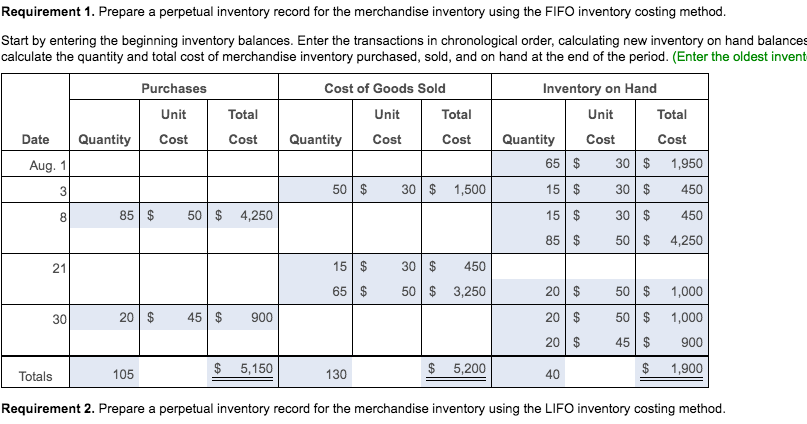

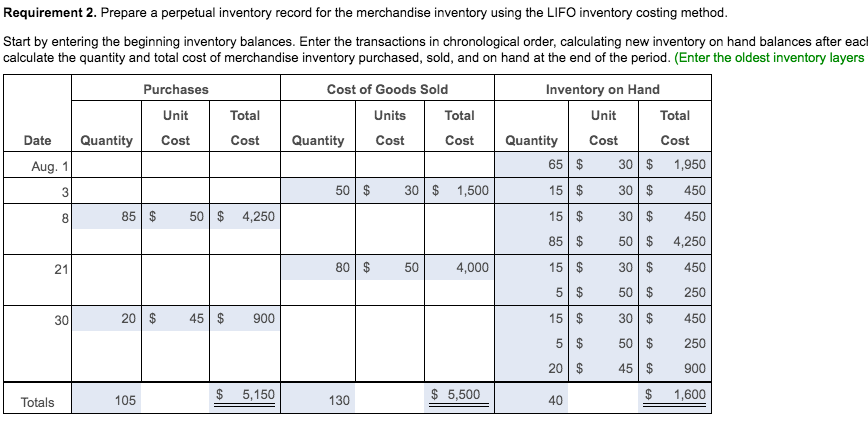

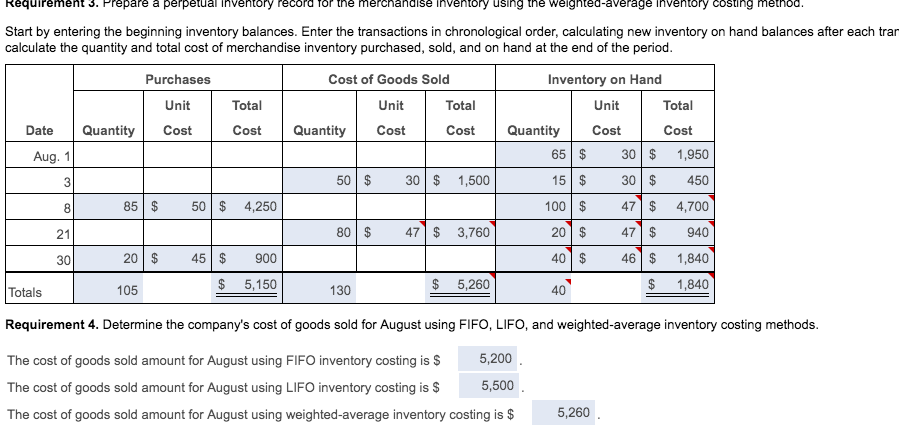

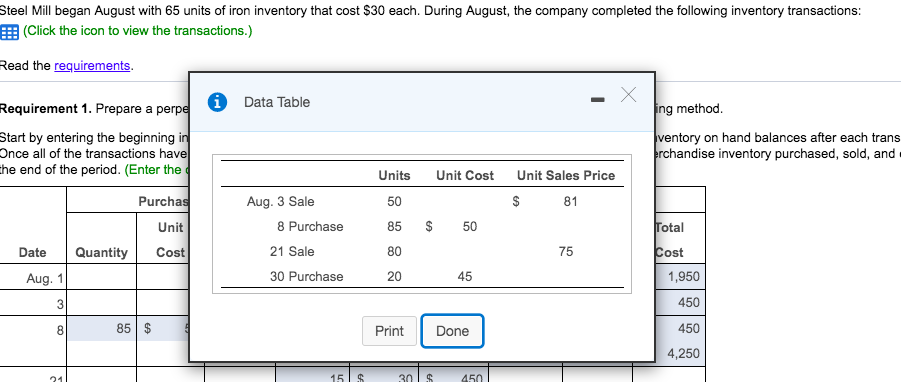

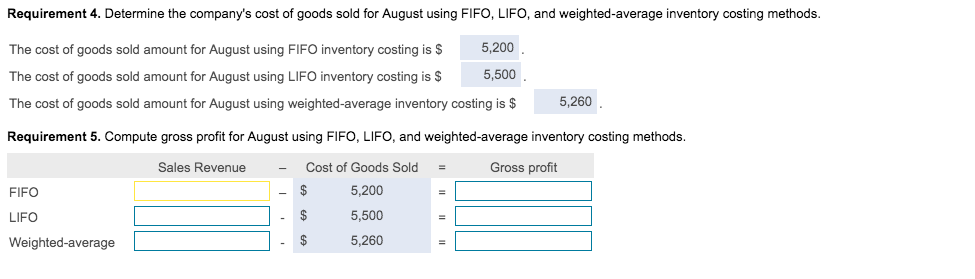

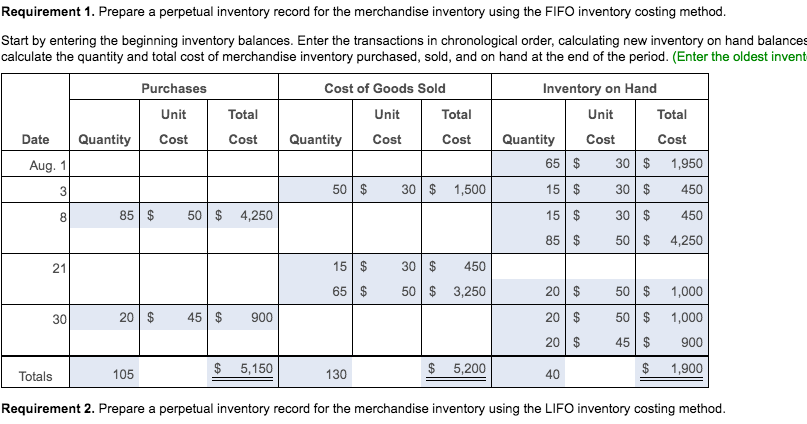

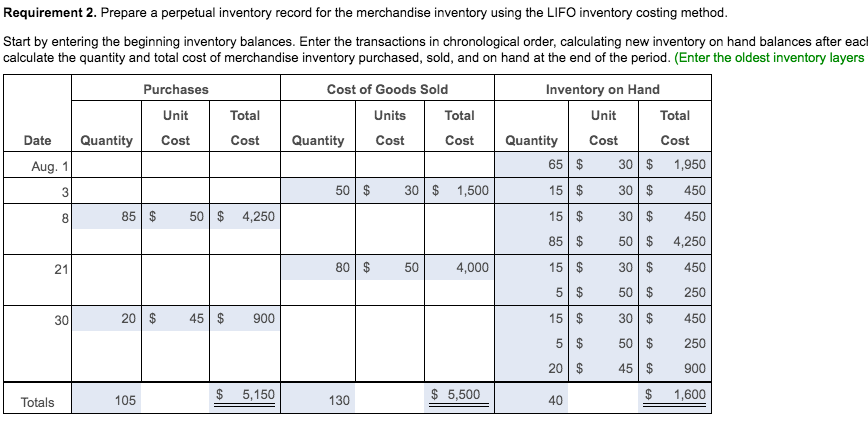

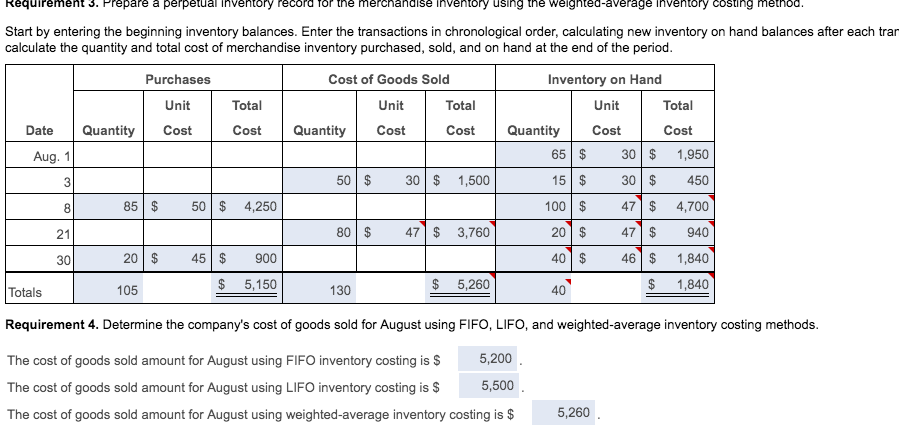

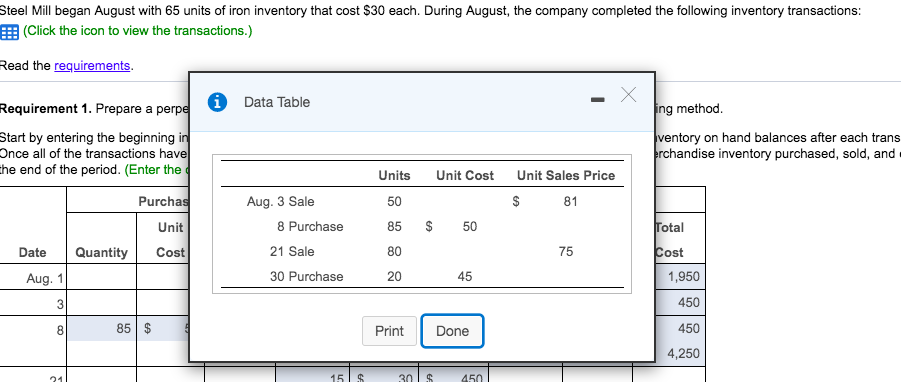

Steel Mill began August with 65 units of iron inventory that cost $30 each. During August, the company completed the following inventory transactions EEB (Click the icon to view the transactions.) Read the requirements Data Table Requirement 1. Prepare a per ng method tart by entering the beginning i Once all of the transactions hav ventory on hand balances after each trans rchandise inventory purchased, sold he end of the period. (Enter thee Units Unit Cost Unit Sales Price 81 Purcha Aug. 3 Sale 50 85 S 50 8 Purchase Unit otal 21 Sale Date QuantityCost 80 75 ost 1,950 30 Purchase 45 20 Aug. 1 450 85 $ 450 PrintDone 4,250 15 Requirement 4. Determine the company's cost of goods sold for August using FIFO, LIFO, and weighted-average inventory costing methods. 5,200 The cost of goods sold amount for August using FIFO inventory costing is $ 5,500 The cost of goods sold amount for August using LIFO inventory costing iss 5,260 The cost of goods sold amount for August using weighted-average inventory costing is $ Requirement 5. Compute gross profit for August using FIFO, LIFO, and weighted-average inventory costing methods Sales Revenue Cost of Goods Sold Gross profit 5,200 FIFO 5,500 LIFO 5,260 Weighted-average Requirement 1. Prepare a perpetual inventory record for the merchandise inventory using the FIFO inventory costing method Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest invent Purchases Inventory on Hand Cost of Goods Sold Unit Total Unit Total Unit Total Date QuantityCost Cost Quantity Cost Cost Quantity Cost Cost 65 $ 30 1,950 Aug. 1 50$ 30 $ 1,500 30 $450 15 $ 30 $450 85 $ 50 4,250 85$ 50 4,250 15$ 30 450 21 65 $ 50 3,250 20$50 1,000 20 45 900 20$50 1,000 30 20$ 45 900 $ 5,150 $ 5,200 $ 1,900 105 130 40 Totals Requirement 2. Prepare a perpetual inventory record for the merchandise inventory using the LIFO inventory costing method Requirement 2. Prepare a perpetual inventory record for the merchandise inventory using the LIFO inventory costing method Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after eaci calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers Purchases Cost of Goods Sold Inventory on Hand Unit Total Units Total Unit Total Cost Quantity Cost Date QuantityCost Cost Quantity Cost Cost 65 $ 30 1,950 Aug. 1 50 30 1,500 15$ 30 450 85 $ 50 4,250 15$ 30 450 85$ 50 4,250 80 $ 50 4,000 15$ 30 450 21 5 $ 50 250 20 45 900 15$ 30 450 30 5 $ 50 250 20 45$ 900 $ 5,150 $5,500 $ 1,600 105 130 40 Totals Requirement 3. Prepare a perpetual inventory record tor the merchandise inventory using the welghted-average inventory costing method. Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after each trar calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Quantity Date QuantityCost Cost Cost Cost Quantity Cost Cost 65 30 1,950 Aug. 1 50 $ 30 $ 1,500 30 $450 85 $ 50 4,250 100 47$ 4,700 8047$ 3,760 20$ 47$ 940 21 20 45 900 40 $ 46 1,840 30 $ 5,150 $ 5,260 $ 1,840 105 130 40 Totals Requirement 4. Determine the company's cost of goods sold for August using FIFO, LIFO, and weighted-average inventory costing methods 5,200 The cost of goods sold amount for August using FIFO inventory costing is $ 5,500 The cost of goods sold amount for August using LIFO inventory costing is S 5,260 The cost of goods sold amount for August using weighted-average inventory costing is $

Compute gross profit for Requirement 5 using the previous data computed:

Compute gross profit for Requirement 5 using the previous data computed: