Answered step by step

Verified Expert Solution

Question

1 Approved Answer

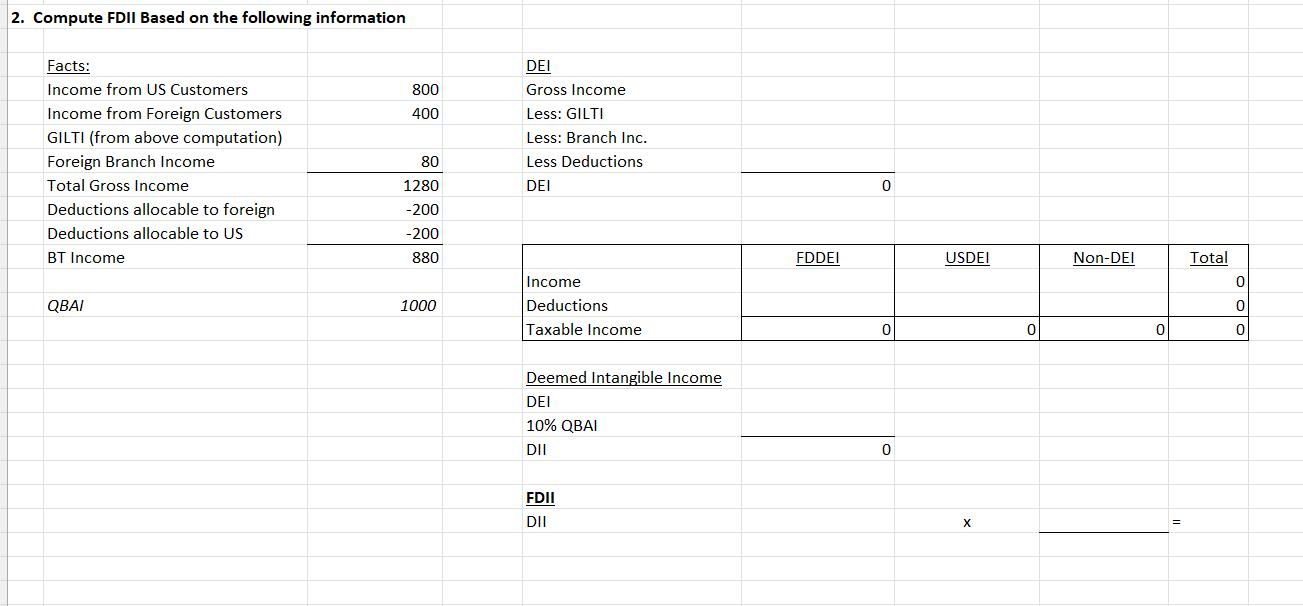

Compute items 1 and 2 baesd on the information provided 1. Compute tax from GILTI based on the following information Subpart F Income Non-Subpart

Compute items 1 and 2 baesd on the information provided 1. Compute tax from GILTI based on the following information Subpart F Income Non-Subpart F Income Total Gross Income Expenses Before Tax Income Tax @ 11% After Tax Income (E&P) QBAI 200 500 700 -500 200 (22) 178 150 Income Expenses Before Tax Income Tax After Tax Earnings Tested Income Less: QBAI x 10% Net DIR Gross-Up GILTI 50% Deduction (Sec 250) Taxable GILTI US Tax Rate Tax Before FTC Less: FTC Tax on GILTI Subpart F 0 0 Tested Income 0 0 Total 0 0 0 0 0 2. Compute FDII Based on the following information Facts: Income from US Customers Income from Foreign Customers GILTI (from above computation) Foreign Branch Income Total Gross Income Deductions allocable to foreign Deductions allocable to US BT Income QBAI 800 400 80 1280 -200 -200 880 1000 DEI Gross Income Less: GILTI Less: Branch Inc. Less Deductions DEI Income Deductions Taxable Income Deemed Intangible Income DEI 10% QBAI DII FDII DII FDDEI 0 0 0 USDEI X Non-DEI Total 0 0

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started