Answered step by step

Verified Expert Solution

Question

1 Approved Answer

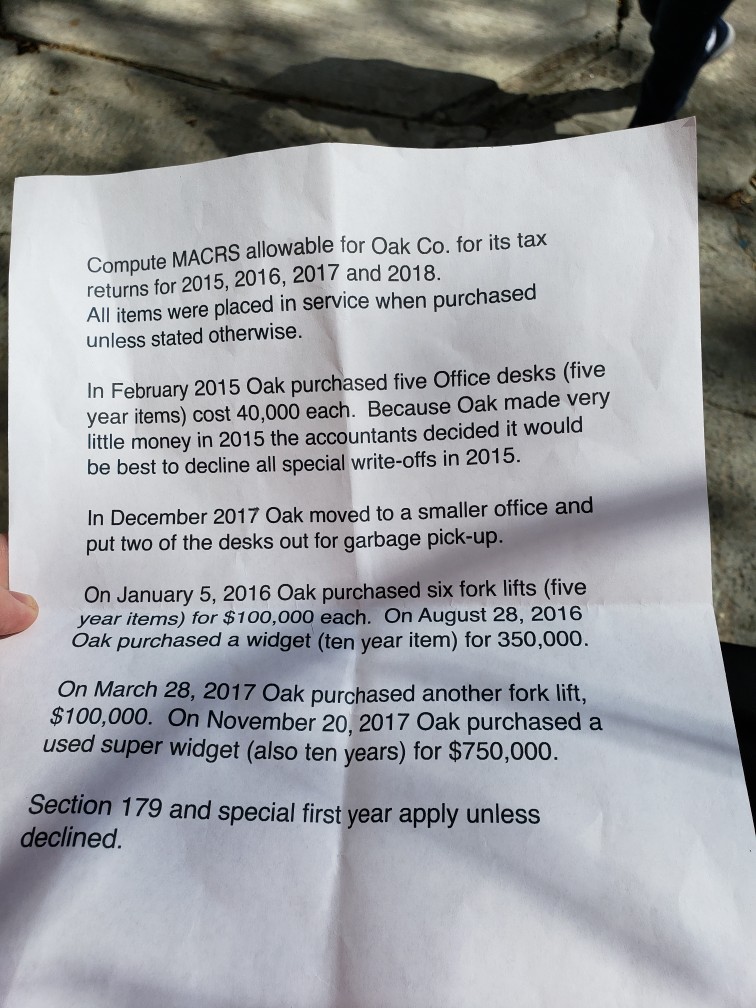

Compute MACRS allowable for Oak Co. for its tax returns for 2015, 2016, 2017 and 2018. All items were placed in service when purchased unless

Compute MACRS allowable for Oak Co. for its tax returns for 2015, 2016, 2017 and 2018. All items were placed in service when purchased unless stated otherwise. In February 2015 Oak purchased five Office desks (five year items) cost 40,000 each. Because Oak made very little money in 2015 the accountants decided it would be best to decline all special write-offs in 2015. In December 2017 Oak moved to a smaller office and put two of the desks out for garbage pick-up On January 5, 2016 Oak purchased six fork lifts (five year items) for $100,000 each. On August 28, 2016 Oak purchased a widget (ten year item) for 350,000. On March 28, 2017 Oak purchased another fork lift, $100,000. On November 20, 2017 Oak purchased a used super widget (also ten years) for $750,000. Section 179 and special first year apply unless declined

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started