Answered step by step

Verified Expert Solution

Question

1 Approved Answer

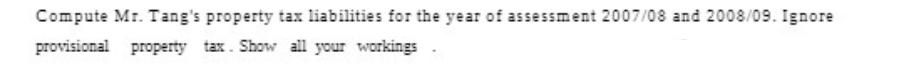

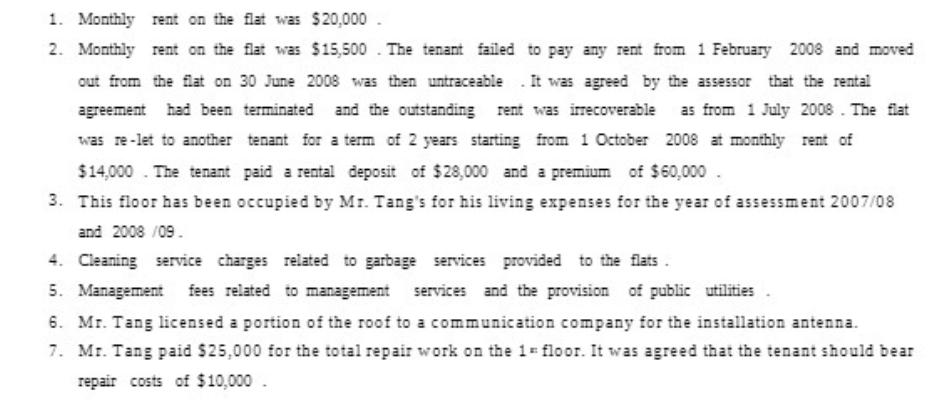

Compute Mr. Tang's property tax liabilities for the year of assessment 2007/08 and 2008/09. Ignore provisional property tax. Show all your workings. 1. Monthly

Compute Mr. Tang's property tax liabilities for the year of assessment 2007/08 and 2008/09. Ignore provisional property tax. Show all your workings. 1. Monthly rent on the flat was $20,000. 2. Monthly rent on the flat was $15,500. The tenant failed to pay any rent from 1 February 2008 and moved out from the flat on 30 June 2008 was then untraceable. It was agreed by the assessor that the rental agreement had been terminated and the outstanding rent was irrecoverable as from 1 July 2008. The flat was re-let to another tenant for a term of 2 years starting from 1 October 2008 at monthly rent of $14,000. The tenant paid a rental deposit of $28,000 and a premium of $60,000. 3. This floor has been occupied by Mr. Tang's for his living expenses for the year of assessment 2007/08 and 2008/09. 4. Cleaning service charges related to garbage services provided to the flats. 5. Management fees related to management services and the provision of public utilities 6. Mr. Tang licensed a portion of the roof to a communication company for the installation antenna. 7. Mr. Tang paid $25,000 for the total repair work on the 1 floor. It was agreed that the tenant should bear repair costs of $10,000. Mr. Tang owns a property with three-floors in Fanling and leases the flats to different tenants (including the provision of management services ). During the years ended 31 March 2008 and 31 March 2009, he received the following income from the property : Rent on 1 floor (Note 1) Rent on 2nd floor (Note 2) 3rd floor (Note3 ) Premium (Note 2) Rent deposit (Note 2) Cleaning service charges (Note 4) Management fee (Note 5) License fee (Note 6) 31 March 2008 240,000 155,000 12,000 38,400 36,000 96,000 reimbursement (Note 7) Mr. Tang paid the following expenditure during the two years if assessment: Rates Garbage fees Pet control & gardening Water pipe repairs (Note 7) 18,000 20,000 8,000 31 March 2000 240,000 84,000 12,000 60,000 28,000 35,200 39,600 99,000 10,000 18,000 20,000 8,500 25,000

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To compute Mr Tangs property tax liabilities for the years of assessment 200708 and 200809 we need t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started