Answered step by step

Verified Expert Solution

Question

1 Approved Answer

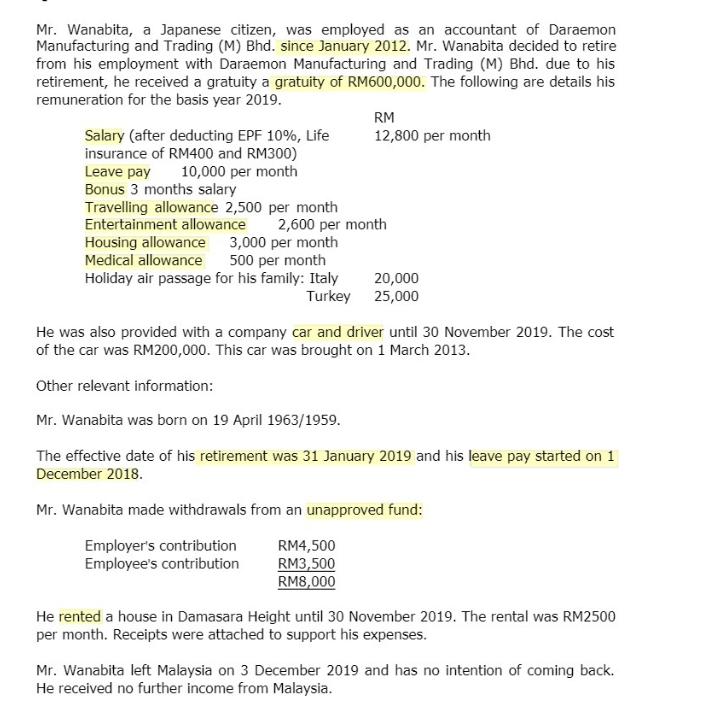

Compute Mr. Wanabita's Statutory Employment Income for the year of assessment 2019. Mr. Wanabita, a Japanese citizen, was employed as an accountant of Daraemon

Compute Mr. Wanabita's Statutory Employment Income for the year of assessment 2019. Mr. Wanabita, a Japanese citizen, was employed as an accountant of Daraemon Manufacturing and Trading (M) Bhd. since January 2012. Mr. Wanabita decided to retire from his employment with Daraemon Manufacturing and Trading (M) Bhd. due to his retirement, he received a gratuity a gratuity of RM600,000. The following are details his remuneration for the basis year 2019. Salary (after deducting EPF 10%, Life insurance of RM400 and RM300) Leave pay 10,000 per month Bonus 3 months salary Travelling allowance 2,500 per month Entertainment allowance 2,600 per month Housing allowance 3,000 per month Medical allowance 500 per month Holiday air passage for his family: Italy Turkey RM 12,800 per month 20,000 25,000 He was also provided with a company car and driver until 30 November 2019. The cost of the car was RM200,000. This car was brought on 1 March 2013. Other relevant information: Mr. Wanabita was born on 19 April 1963/1959. The effective date of his retirement was 31 January 2019 and his leave pay started on 1 December 2018. RM4,500 RM3,500 RM8,000 Mr. Wanabita made withdrawals from an unapproved fund: Employer's contribution Employee's contribution He rented a house in Damasara Height until 30 November 2019. The rental was RM2500 per month. Receipts were attached to support his expenses. Mr. Wanabita left Malaysia on 3 December 2019 and has no intention of coming back. He received no further income from Malaysia.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Given details Gross Sales 978000 Interest Income 140 Cash Dividend franked at 20 12000 70 in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started