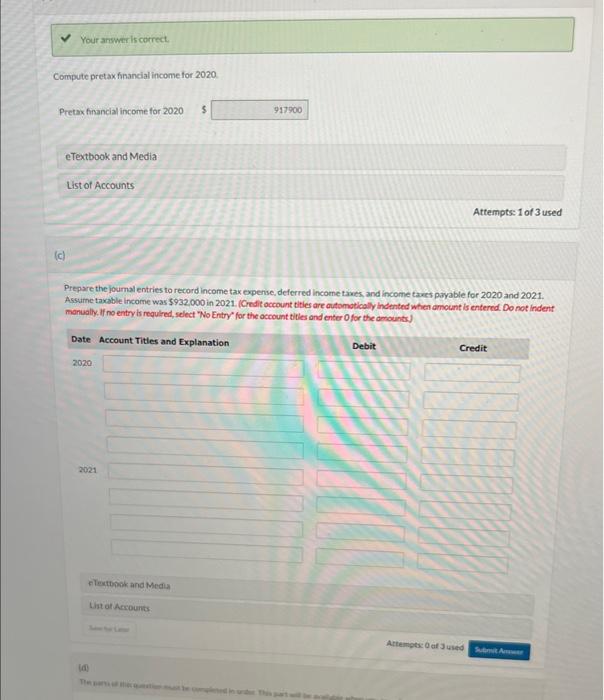

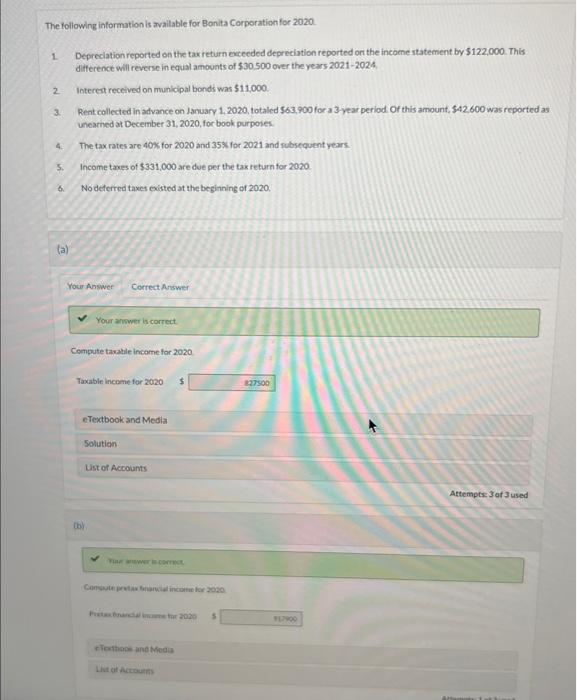

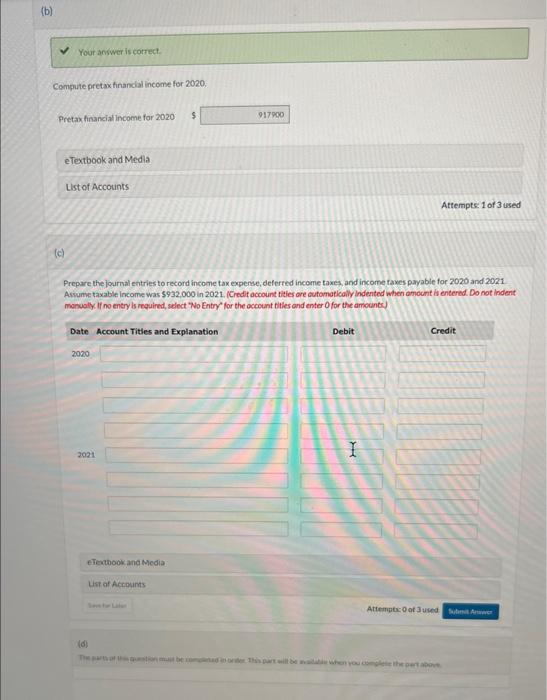

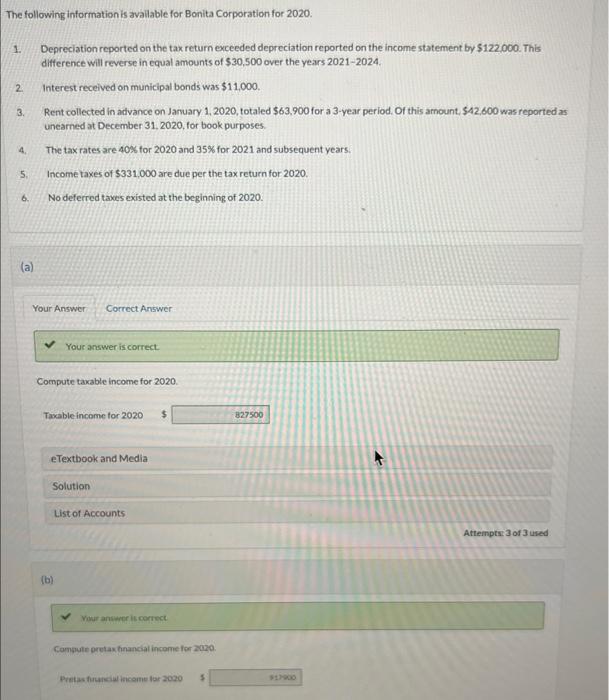

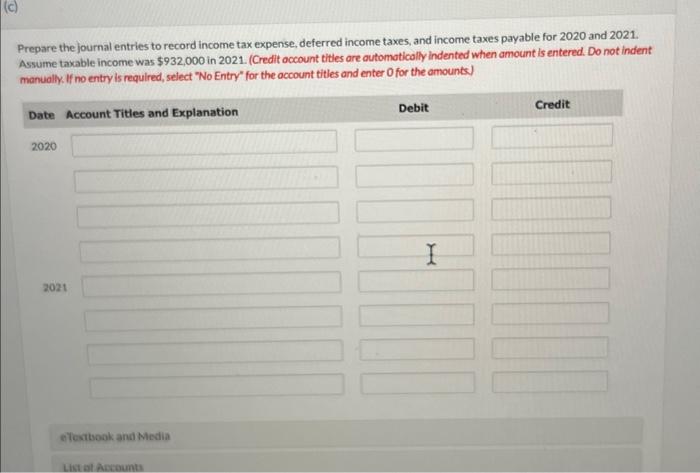

Compute pretax financial income for 2020 Pretax financial income for 2020 eTextbook and Media List of Accounts Attempts: 1 of 3 used (c) Prepare the journal entries to record income tax expense, deferred lincome taves, and income taves payable for 2020 and 2021. Assurne taxable income was $932.000 in 2021 . (Credit occount tities are automotically indented which omount is entered. Do not indent manually. If no entry is requled, select "No Entry" for the occount tities and enter O for the domount.). (19) The following information is available for Bonita Corporationfor 2020. 1. Depreciation reported on the tax return exceeded deprecistion reported on the income statement by $122,000. This ditference will reverse in equal amounts of $30,500 over the years 20212024. 2 interent received on municipal bonds was 511000 . 3. Rent collected in advance on January 1,2020, totaled 563,900 for a 3 - year period of this amount, 542,600 was reported as unearned at December 31, 2020, for book purposes. 4. The tax rates are 40k for 2020 and 35 for 2021 and subsequent years. 5. Income taxs of $331,000 are due per the tax return for 2020 . 6. No deferred taxes eisted at the beginning of 2020 . (a) Compute tawable income for 2020 Taxable income for 2020$ eTextbook and Media Attempts 3 af 3 used Compute pretax finanicial income for 2020 ; Pretax financial income for 2020 (c) Prepare the lournal entries to record income tax expense, deferred income taxes, and income faves payable for 3020 and 2021. Assums taxable income was $932,000 in 2021. (Credit account tities are cutomatically indented when omount is entered. Do not indent marnually. If no entry is reguired, select 'No Entry" for the occount titles and enter 0 for the arrounte). ETertbook and Media List af Accouints Attempte: of 3 used (d) The following information is avallable for Bonita Corporation for 2020. 1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $122.000. This difference will reverse in equal amounts of $30,500 over the years 20212024. 2. Interest received on municipal bonds was $11,000. 3. Rent collected in advance on January 1, 2020, totaled $63,900 for a 3-year period, Of this amount, $42,600 was reported as unearned at December 31, 2020, for book purposes. 4. The tax rates are 40s for 2020 and 35% for 2021 and subsequent years. 5. Income taxes of $331,000 are due per the tax return for 2020 . 6. No deferred taxes existed at the beginning of 2020 . (a) Your answer is correct. Compute taxable income for 2020. Taxable income tor 2020 eTextbook and Media Uist of Accounts Attempts: 3 of 3 used (b) Comsute oretax financiat income for 2020. Pretas frumeiul hicome for 2020 Prepare the journal entries to record income tax expense, deferred income taxes, and income taxes payable for 2020 and 2021. Assume taxable income was $932,000 in 2021. (Credit occount titles are outomotically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts)