Answered step by step

Verified Expert Solution

Question

1 Approved Answer

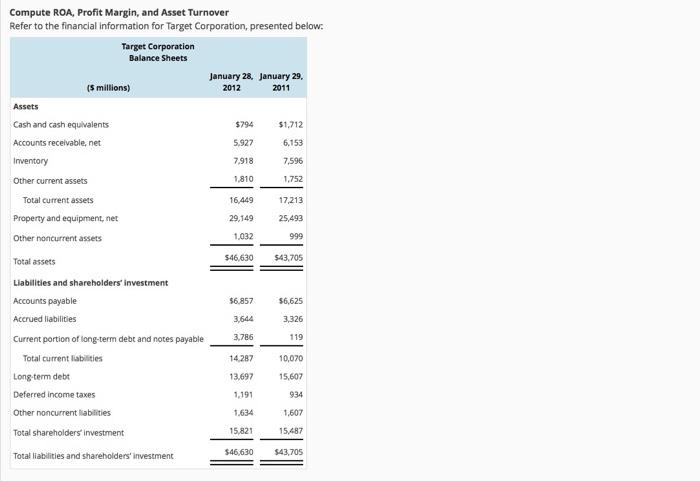

Compute ROA, Profit Margin, and Asset Turnover Refer to the financial information for Target Corporation, presented below: Target Corporation Balance Sheets January 28. January

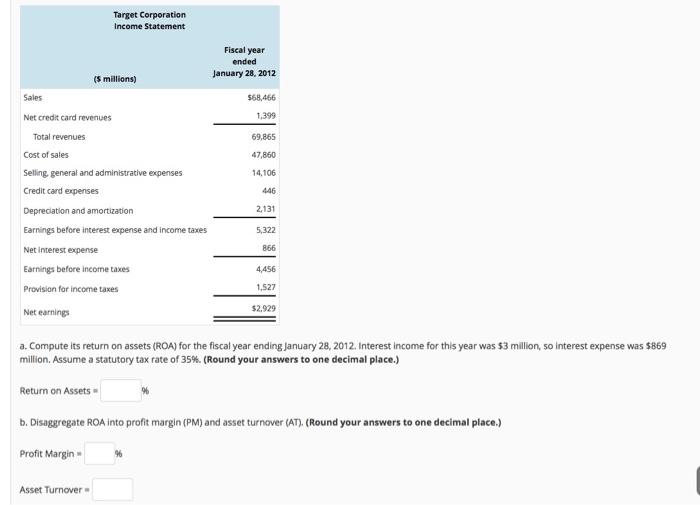

Compute ROA, Profit Margin, and Asset Turnover Refer to the financial information for Target Corporation, presented below: Target Corporation Balance Sheets January 28. January 29, 2011 (S millions) 2012 Assets Cash and cash equivalents $794 $1,712 Accounts receivable, net 5,927 6,153 Inventory 7,918 7,596 Other current assets 1,810 1,752 Total current assets 16,449 17,213 Property and equipment, net 29,149 25,493 Other noncurrent assets 1,032 999 $46,630 $43,705 Total assets Liabilities and shareholders' investment Accounts payable $6,857 $6,625 Accrued liabilities 3,644 3,326 Current portion of long-term debt and notes payable 3,786 119 Total current labilities 14.287 10,070 Long-term debt 13,697 15,607 Deferred income taxes 1,191 934 Other noncurrent labilities 1,634 1,607 Total shareholders' investment 15,821 15,487 $46,630 $43,705 Total liabilities and shareholders' investment Target Corporation Income Statement Fiscal year ended January 28, 2012 (S millions) Sales $68,466 Net credit card revenues 1,399 Total revenues 69,865 Cost of sales 47,860 Selling general and administrative expenses 14,106 Credit card expenses 446 Depreciation and amortization 2,131 Earnings before interest expense and income taxes 5,322 Net interest expense 866 Earnings before income taxes 4,456 Provision for income taxes 1,527 $2,929 Net earnings a. Compute its return on assets (ROA) for the fiscal year ending January 28, 2012. Interest income for this year was $3 million, so interest expense was $869 million. Assume a statutory tax rate of 35%. (Round your answers to one decimal place.) Return on Assets- b. Disaggregate ROA into profit margin (PM) and asset turnover (AT). (Round your answers to one decimal place.) Profit Margin Asset Turnover-

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

return On Assets Average assets beg assets Closin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

63647a998f01a_239246.pdf

180 KBs PDF File

63647a998f01a_239246.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started