Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Compute the accounting rate of return, rounded to 2 decimal places b. Compute the cash flow generated per year for years 1-5. c. Compute

a. Compute the accounting rate of return, rounded to 2 decimal places

a. Compute the accounting rate of return, rounded to 2 decimal places

b. Compute the cash flow generated per year for years 1-5.

c. Compute the weighted average cost of capital.

d. How many years will it take for the project to “pay for itself.” Round to 2 decimal places.

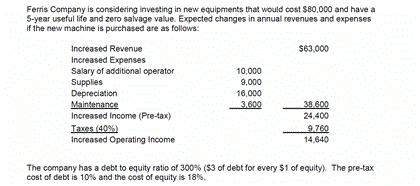

Ferris Company is considering investing in new equipments that would cost $80,000 and have a 5-year useful life and zero salvage value. Expected changes in annual revenues and expenses if the new machine is purchased are as follows: Increased Revenue Increased Expenses Salary of additional operator Supplies Depreciation Maintenance Increased Income (Pre-tax) Taxes (40%) Increased Operating Income 10,000 9,000 16,000 3.600 $63,000 38.600 24,400 9.760 14,640 The company has a debt to equity ratio of 300% ($3 of debt for every $1 of equity). The pre-tax cost of debt is 10% and the cost of equity is 18%,

Step by Step Solution

★★★★★

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

A Accounting rate of return Year 1 63000 38600 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started