Question

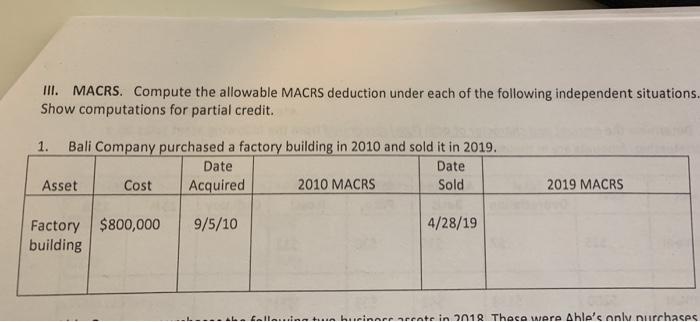

II. MACRS. Compute the allowable MACRS deduction under each of the following independent situations. Show computations for partial credit. 1. Bali Company purchased a

II. MACRS. Compute the allowable MACRS deduction under each of the following independent situations. Show computations for partial credit. 1. Bali Company purchased a factory building in 2010 and sold it in 2019. Date Sold Date Asset Cost Acquired 2010 MACRS 2019 MACRS Factory $800,000 building 9/5/10 4/28/19 tallaina...n hurinore arcete in 2018 Theca were Able's onlu nurchases

Step by Step Solution

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Answer As per the MACRS Method Building ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: J. David Spiceland, Wayne Thomas, Don Herrmann

2nd Edition

0078110823, 9780078110825

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App