Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the amount of acquired Goodwill, including contingent earnings and bargain purchase Assume that you are charged with assigning fair values related to a

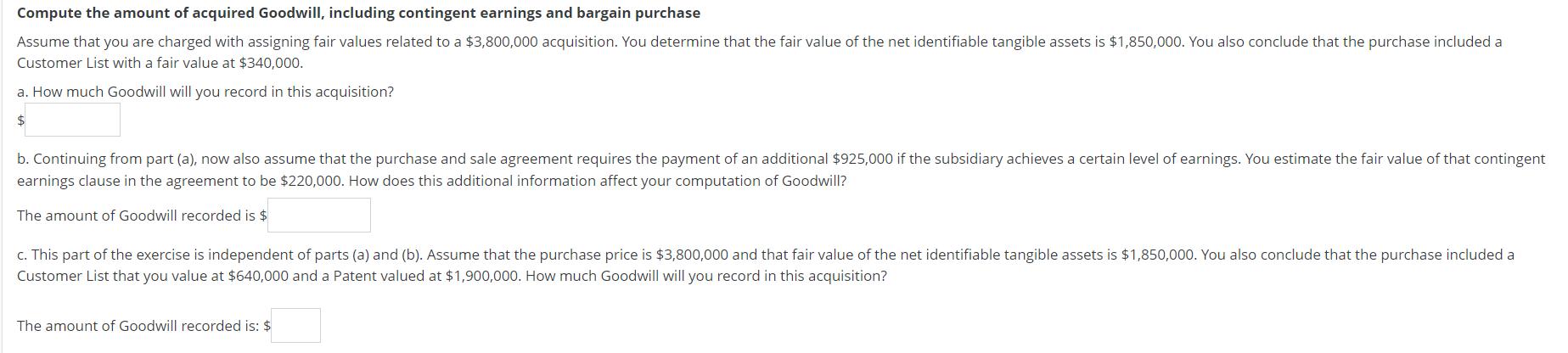

Compute the amount of acquired Goodwill, including contingent earnings and bargain purchase Assume that you are charged with assigning fair values related to a $3,800,000 acquisition. You determine that the fair value of the net identifiable tangible assets is $1,850,000. You also conclude that the purchase included a Customer List with a fair value at $340,000. a. How much Goodwill will you record in this acquisition? $ b. Continuing from part (a), now also assume that the purchase and sale agreement requires the payment of an additional $925,000 if the subsidiary achieves a certain level of earnings. You estimate the fair value of that contingent earnings clause in the agreement to be $220,000. How does this additional information affect your computation of Goodwill? The amount of Goodwill recorded is $ c. This part of the exercise is independent of parts (a) and (b). Assume that the purchase price is $3,800,000 and that fair value of the net identifiable tangible assets is $1,850,000. You also conclude that the purchase included a Customer List that you value at $640,000 and a Patent valued at $1,900,000. How much Goodwill will you record in this acquisition? The amount of Goodwill recorded is: $

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a The formula for calculating Goodwill is Purchase Price Fair Value of Net Id...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started