Answered step by step

Verified Expert Solution

Question

1 Approved Answer

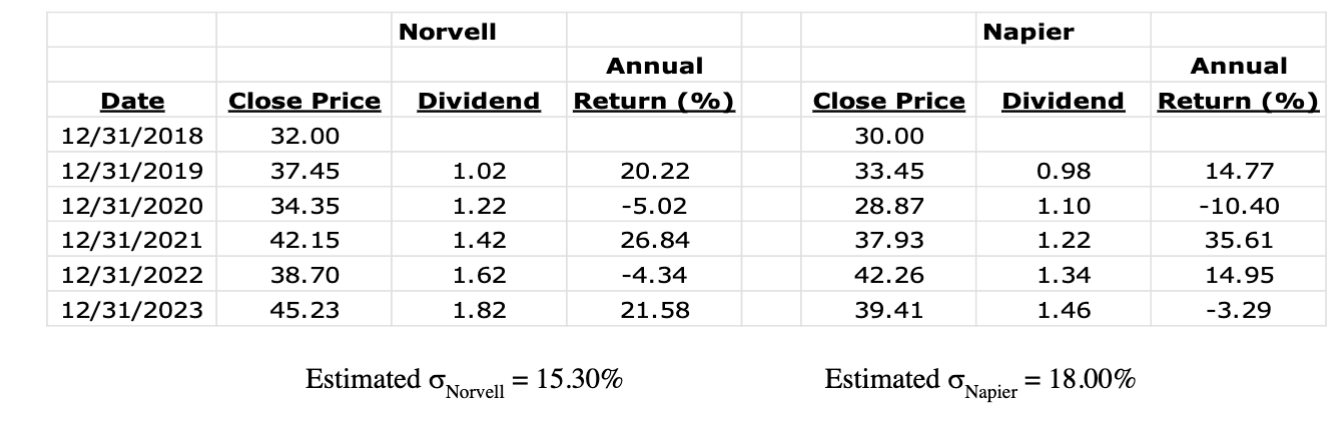

Compute the annual returns for 2 0 1 9 through 2 0 2 3 ( e . g . , each year's return ) of

Compute the annual returns for through eg each year's return of an equally

weighted portfolio of Norvell stock and Napier stock.

Provide an intuitive explanation of what the correlation coefficient between the returns of the two

securities measures. Comment on whether you would expect the typical correlation coefficient

between two stocks to be positive, negative, or around zero, and why in either case.

Compute the covariance between the returns of Norvell stock and Napier stock.

Now compute the correlation between the Norvell and Napier stocks and indicate how this relates

to the covariance in Question

You must now compute the standard deviation of the annual returns on the equally weighted

portfolio described in Question using two different methods.

For Question use the actual annual returns of the equally weighted portfolio calculated in

Question to calculate the portfolio return standard deviation.

For Question use the equation for the variance of a asset portfolio that includes the security

weights, the variances of each of the securities and the covariance between the returns of the two

securities How does your answer to Question compare to your answer to Question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started