Question

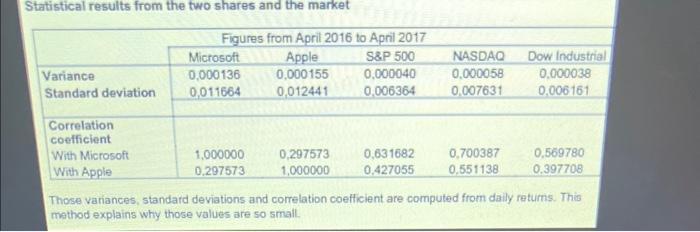

Compute the Beta for both Microsoft shares and Apple shares using the S&P 500. Statistical results from the two shares and the market Variance Standard

Statistical results from the two shares and the market Variance Standard deviation Correlation coefficient With Microsoft With Apple Figures from April 2016 to April 2017 Apple S&P 500 0,000155 0,012441 Microsoft 0,000136 0,011664 1,000000 0,297573 0,297573 1,000000 0.000040 0,006364 0,631682 0,427055 NASDAQ 0.000058 0.007631 0,700387 0.551138 Dow Industrial 0.000038 0.006161 0,569780 0.397708 Those variances, standard deviations and correlation coefficient are computed from daily returns. This method explains why those values are so small.

Step by Step Solution

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the beta for a stock the following formula is generally used Beta Correlation Coefficie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investments, Valuation and Management

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

8th edition

1259720697, 1259720691, 1260109437, 9781260109436, 978-1259720697

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App